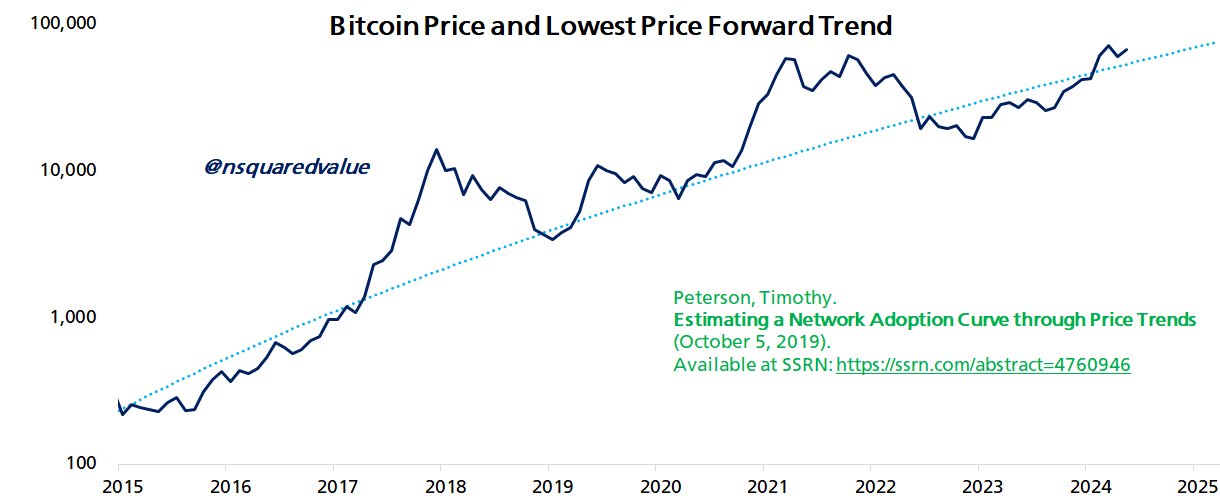

In a forecast issued by way of X on Friday, Timothy Peterson, a revered community economist and outstanding writer within the subject of crypto analytics, predicted a near-certain rise of the Bitcoin value within the upcoming 8 months. “There’s a 90% chance Bitcoin will reach a new ATH before March 2025,” Peterson proclaimed.

Peterson, identified for his works together with “Metcalfe’s Law as a Model for Bitcoin’s Value,” bases his forecast on the analytical framework detailed in his analysis paper titled “Lowest Price Forward: Why Bitcoin’s Price is Never Looking Back.” This paper, first revealed in 2019 and subsequently revised, introduces an revolutionary method to understanding the Bitcoin value trajectory by specializing in its historic lowest costs, known as the “Never Look Back Price” (NLB). This NLB marks the final occasion Bitcoin was traded at a selected value level, after which it by no means declined to that stage once more.

Related Reading

The methodology Peterson employs entails plotting these NLB information factors on a lognormal scale adjusted by what he calls a “square root time” scale. This unconventional metric facilitates a deeper perception into the long-term development patterns of Bitcoin, evaluating them successfully with the diffusion processes noticed in expertise adoption throughout different domains.

Bitcoin Adoption Is Key

Central to Peterson’s evaluation is Metcalfe’s Law, which he elaborates as “the value of the network is proportional to the square of the number of its users.” By making use of this precept to Bitcoin, Peterson posits that because the digital forex’s person base expands, its intrinsic worth is anticipated to extend exponentially. The paper particulars using a “square root time” mannequin to align conventional time-value cash ideas with the non-linear development charges typical in community economics, presenting a compelling case for Bitcoin’s future valuation trajectories.

Peterson’s method notably incorporates components of conservative monetary evaluation by emphasizing the bottom historic costs of Bitcoin. “By focusing on the lowest price, the analysis inherently adopts a conservative stance, underestimating rather than overestimating value,” Peterson notes, which helps in “minimizing the risk of overvaluation and ensures that predictions do not overly rely on optimistic scenarios which might not materialize.”

Related Reading

In his paper, Peterson additionally addresses potential anomalies and market manipulations, which might distort value perceptions. By specializing in the NLB, the evaluation filters out such distortions, providing a purer view of Bitcoin’s worth appreciation unaffected by short-term speculative pressures or exterior shocks such because the COVID-induced market anomalies of 2021.

The prediction of a new all-time high earlier than March 2025 displays a broader sentiment of confidence within the sustained development of the Bitcoin community by Peterson. As adoption curves proceed to rise and community results additional entrench the worth of Bitcoin, the forecast is just not merely speculative however grounded in quantifiable and noticed historic traits.

Peterson concludes, “As long as adoption continues, Bitcoin’s value — represented by its NLB price — will go up. If adoption is hindered, then the price will stagnate or drop.”

At press time, BTC traded at $58,192.

Featured picture created with DALL·E, chart from TradingView.com