Institutional traders are grabbing each dip in Bitcoin whereas retail traders panic amid BTC selloffs by the German Government. Investment adviser agency Fiduciary Alliance has bagged one of many largest holdings in BlackRock iShares Bitcoin ETF (IBIT), Grayscale Bitcoin Trust (GBTC), and a number of other crypto shares final quarter.

Fiduciary Alliance Bags BlackRock Bitcoin ETF

Investment advisory agency Fiduciary Alliance LLC turns into one of many largest patrons of BlackRock iShares Bitcoin ETF (IBIT) in Q2 2024, as per a 13-F submitting with the U.S. SEC on July 10. The firm added 188,668 items of IBIT valued at $6.64 million.

In addition, Fiduciary Alliance bought Grayscale Bitcoin Trust (GBTC) items price $3.48 million. Grayscale just lately noticed $25 million in influx because of 13-F filings by a number of institutional traders. CoinGape just lately reported that City State Bank revealed its publicity to Bitcoin (BTC) by way of IBIT and GBTC ETFs.

The firm additionally acquired shares in crypto-related corporations together with Coinbase, MicroStrategy, and Tesla. It added 8,332 COIN shares valued at $1.89 million, $1.70 million of MicroStrategy (MSTR) shares, and invested $744,426 in Tesla (TSLA).

$5 billion AUM Northwest Capital Management additionally disclosed its entry into the Bitcoin market by way of BlackRock’s iShares Bitcoin Trust (IBIT).

Also Read: Binance Vs SEC — Judge Sets Deadline For Discovery Phase Post Major Ruling

Bitcoin Bulls Becoming Strong Amid Selloff

Bitcoin bulls are progressively gaining dominance as institutional traders are shopping for the dip. With Mt. Gox compensation and German Government selloff pulling Bitcoin decrease.

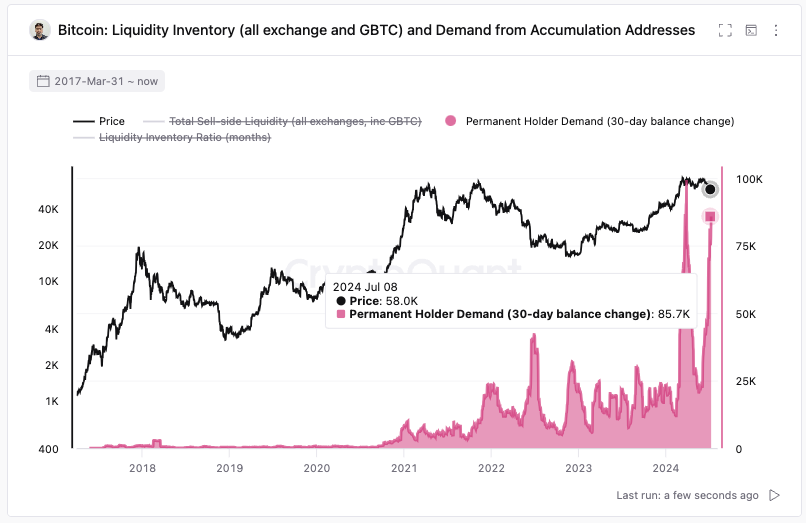

According to CryptoQuant CEO Ki Young Ju, everlasting holders which might be largely custodial wallets accrued 85K BTC in a month. “These wallets are neither ETFs, exchanges, nor miners. During the same period, 16K BTC flowed out of ETF holdings,” he mentioned.

BTC price jumped 0.50% previously 24 hours, with the worth at present buying and selling at $57,748. The 24-hour high and low are $57,014 and $59,416, respectively. Furthermore, the buying and selling quantity has decreased by 7% within the final 24 hours. The weak point is a results of CPI inflation knowledge due Thursday.

Meanwhile, derivatives merchants are shopping for as whole futures open curiosity surged 2% to surpass $28 billion. CME BTC futures open curiosity rose to $8.27, up greater than 2.50% within the final 24 hours. Also, whole BTC choices open curiosity continues to rebound, with at present valued at $16.5 billion.

Also Read: Elon Musk’s X Payments Gets Money Transmitter License In Washington DC

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.