Over the weekend, the Bitcoin price dropped below $60,000 amid speedy promoting by main holders such because the German and US governments. This led to one of many largest drops seen for the pioneer cryptocurrency within the final two years, costing the market billions of {dollars}. However, regardless of this, Bitcoin holders are nonetheless seeing main positive factors, with the overwhelming majority of traders at present in revenue regardless of the market crash.

Bitcoin Holders Enjoy Massive Gains

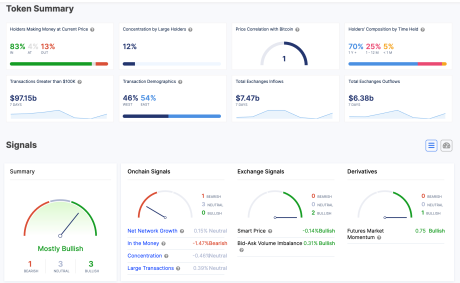

According to data from the on-chain tracker IntoTheBlock, there are round 53.57 million Bitcoin holders worldwide. Of these traders, a complete of 83% are nonetheless seeing revenue regardless of the BTC price drop under $60,000, because it at present sits simply above $56,000.

Related Reading

This determine leaves simply round 17% of the full BTC holders that aren’t at present seeing a revenue. Out of this determine, 13% are dropping cash, which means they purchased their BTC coins when the value was larger than the present worth, leaving 4% of holders at breakeven. This implies that this 4% purchased their cash across the present worth, so they’re neither making nor dropping cash on the present worth.

At these percentages, it implies that round 44.61 million Bitcoin traders are nonetheless having fun with earnings of their positions. 6.8 million BTC holders are struggling losses now, and round 2.16 million traders are at present sitting at breakeven.

Interestingly, nearly all of these traders sitting in revenue have their entry prices below $50,000, which means that even with one other 10% crash from right here, the overwhelming majority of Bitcoin traders would nonetheless be seeing their holdings in revenue.

BTC Long-Term Holders At Risk Of Losses

While the information reveals that the overwhelming majority of Bitcoin investors are nonetheless seeing earnings, there’s a rising pattern that’s notably affecting long-term holders. According to a Sentiment report, the common returns of Bitcoin long-term holders danger falling into losses for the primary time in a couple of yr.

Related Reading

However, this isn’t a unfavourable factor for the value, given how BTC has responded prior to now when the common long-term holder returns fell into the pink. As Santiment notes, that is normally a superb time to purchase, particularly when “Bitcoin’s 30-day and 365-day MVRV are in negative territory.” The tracker additional added, “This is when there is mathematical validation that you are buying relative to other traders’ pain.”

To put how a lot of a superb shopping for alternative that is, “If you had bought the last time both of these lines were in negative territory, your return on BTC would be at +132%,” Santiment notes. To put it in plain phrases, developments like these can typically be a superb indicator of the place the underside is and when to start out shopping for.

Featured picture created with Dall.E, chart from Tradingview.com