Spot Bitcoin ETFs noticed practically $295 million in web inflows on Monday, recording inflows for 2 consecutive days and beginning the week with huge shopping for. This signifies institutional traders are shopping for closely regardless of the German govt BTC selloff and key macroeconomic occasions this week.

Spot Bitcoin ETFs Inflow Hints At Upcoming Market Rally

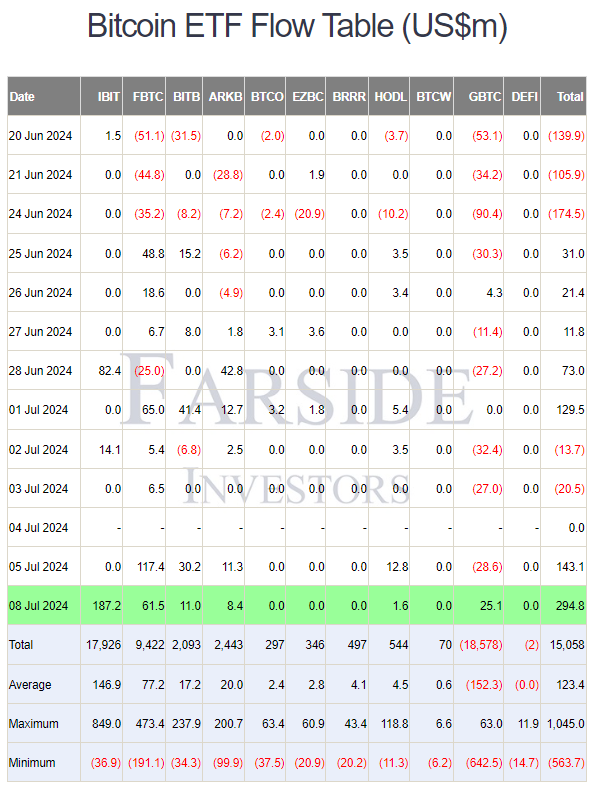

Spot Bitcoin ETFs within the U.S. recorded a complete web influx of $294.8 million, the best influx in 21 days. It follows as institutional traders proceed to purchase the dip. Crypto asset funding merchandise globally noticed a $441 million influx final week as crypto weak point by Mt Gox and the German Government promoting strain have been seen as a shopping for alternative, reported CoinShares.

According to Bloomberg and Farside Investors, BlackRock’s iShares Bitcoin ETF (IBIT) recorded $187.2 in influx, the best influx not seen in the previous couple of weeks. Following the newest influx, BlackRock’s web influx hit over $17.9 billion and BTC holding is valued at practically $18 billion.

Fidelity Bitcoin ETF (FBTC) noticed $61.5 in influx on Monday, with the full influx reaching $9.42 billion. Bitwise Bitcoin ETF (BITB), Ark 21Shares (ARKB) Bitcoin ETF, and VanEck Bitcoin ETF (HODL) additionally noticed inflows of $11 million, $8.4 million, and $1.6 million, respectively. Other spot Bitcoin ETFs noticed zero web inflows.

Notably, Grayscale Bitcoin Trust (GBTC) additionally recorded inflows of $25.1 million after consecutive outflows within the earlier days. GBTC buys 450 BTC, indicating sturdy demand from institutional traders.

Also Read: Matrixport Reveals Ethereum ETF Launch Timeline, Bernstein Targets ETH To $6,600

BTC Price To Rally Above $60k

Institutional shopping for indicators excessive probabilities of Bitcoin rally to above $60k. Experts are total bullish on BTC worth and imagine Mt. Gox collectors aren’t prone to promote their Bitcoin on this bull market.

In 6 months, US-listed Bitcoin ETFs introduced in over $14.7B in web inflows. Key takeaway? Interest in #Bitcoin and digital property stays excessive.

Token costs and market caps fluctuate, however the long-term fundamentals of our trade is robust.

Stay targeted and hold constructing! 🚀

— Richard Teng (@_RichardTeng) July 9, 2024

BTC price has jumped over 3% within the final 24 hours, with the value at present buying and selling at $57,603 as merchants adjusted positions primarily based on Wall Street’s bullish outlook on charge cuts. The 24-hour high and low are $55,240 and $58,131, respectively. Furthermore, the buying and selling quantity has elevated by 36% within the final 24 hours, indicating an increase in curiosity amongst merchants.

Derivatives market information reveals huge shopping for by futures and choices merchants. BTC futures open curiosity throughout exchanges soared 2.60% within the final 24 hours. Buying is recorded on CME and Kraken, which means increased demand within the US.

However, merchants should stay cautious as a result of Fed Chair Jerome Powell speech, CPI and PPI inflation information due this week.

Also Read: What Could be The Maximum Impact of Mt. Gox Creditors Selling Their Bitcoins?

The introduced content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.