Over the previous couple of months, altcoin costs have dropped 30% to 70%, main analysts to write down off the chance of an altcoin season. But when geared up with new data, BeInCrypto finds that issues could also be about to vary.

This evaluation sheds gentle on the rationale behind the thought whereas providing insights into the potential catalysts.

Early Days But the Signs Have Appeared

Altcoin season is in a market part the place non-Bitcoin (BTC) cryptocurrencies register a constant surge in worth whereas outperforming the primary coin.

One of the indicators validating this era is TOTAL2, which is the crypto whole market cap, excluding BTC. When this market cap will increase, it offers credence to the potential improve in the costs of altcoins.

However, a lower implies that Bitcoin is dominating the market. At press time, the whole altcoin market cap stands at $940.37 billion — a 4.87% improve in the final 24 hours. The similar market cap had initially dropped by 23.26% between June 6 and July 8.

Read More: Which Are the Best Altcoins to Invest in July 2024

If the indicator’s worth continues to extend, the altcoin season might be nearer. The final time such occurred was between February and March. At that point, the worth of TOTAL2 went from $753.83 billion to $1.24 trillion inside a month.

Following the current change, analysts on X appear to be altering their stance, favoring the dominance of altcoins. One of them is Michaël van de Poppe, founder of MN Trading.

“The Altcoin market capitalization has reached a crucial higher timeframe support level and finds support here. It’s still early in the week, but if this week continues this upward trend, then the signs will start to improve.” van de Poppe opined on X.

Bitcoin Dominance Steps Back, May Open Doors for Altcoins

Apart from opinions, one other issue that determines if altcoins’ time to shine is right here is Bitcoin’s dominance. For the cycle to be validated, the BTC.D has to lower.

Employing the weekly chart, we observe that the BTC.D fell from 62.69% in March 2021 to 40.89% in May of the similar yr. History exhibits that this was round the similar interval many altcoins hit their all-time highs in the final bull market.

This week, the dominance has fallen from 55.04% to 54.68%, indicating that some altcoins have begun to outperform BTC.

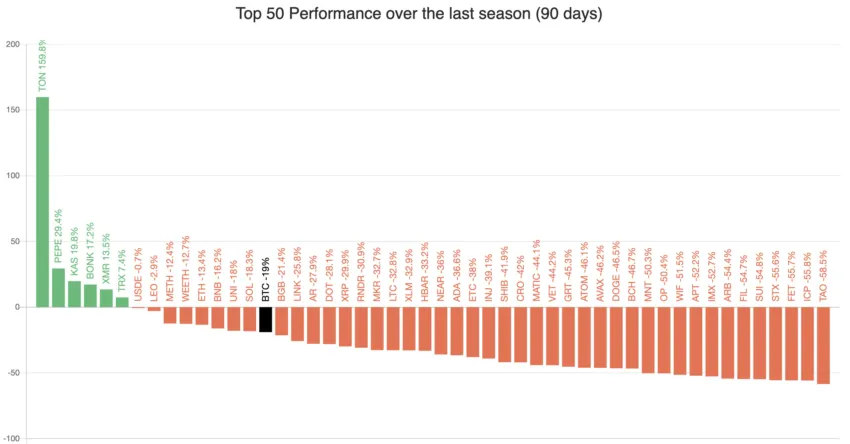

For this to mirror the efficiency proven in 2021, at the very least 75% of the prime 50 altcoins must carry out higher than Bitcoin.

According to information from Blockchaincenter, solely a few cryptocurrencies, including meme coins, have achieved that. Some of them embody Toncoin (TON), Pepe (PEPE), Kaspa (KAS) and Bonk (BONK).

As a end result, the Altcoin Season Index over the final 90 days stays at 29. However, that is an enchancment from the studying just a few days in the past when it was 25.

Should the index proceed to hit increased values, altcoins will get nearer to retesting their all-time highs, placing BTC on the again foot in the course of.

Read More: What Are Altcoins? A Guide to Alternative Cryptocurrencies

Ethereum, Solana’s Role Crucial

Additionally, you will need to point out that Ethereum (ETH) has at all times acted as a catalyst for fostering altcoin dominance.

Within the previous couple of months, ETH has underperformed in comparison with BTC. However, the impending approval of the spot Ethereum ETFs could spur a notable improve in ETH’s worth.

If that is the case, different altcoins could be part of the potential rally. In Capo of Crypto’s case, the replace on the ETH ETFs, in addition to the official functions for Solana ETFs by VanEck and 21Shares, is why the analyst is bullish on altcoins.

“Selling pressure from the German Government is being absorbed. All spot Ethereum ETF applicants have filed updated S-1s.VanEck & 21Shares have officially filed 19b-4s for spot Solana ETFs. I’m bullish for the next few weeks, especially on altcoins.” Capo of Crypto wrote.

Based on the evaluation above and market sentiment, altcoins appear like they’re set for a giant pump. However, merchants have to maintain an eye out.

If promoting strain hits the market once more, the hike could possibly be invalidated. Also, if Ethereum doesn’t obtain spectacular inflows into the ETFs, the cryptocurrencies could battle to leap.

Disclaimer

In line with the Trust Project pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. Always conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.