Recent information exhibits that the Bitcoin mining difficulty is on the decline and has hit its lowest since May. This is important contemplating what this might imply for the Bitcoin ecosystem, particularly Bitcoin’s price.

Bitcoin Mining Difficulty Drops To 79.5 T

Data from CoinWarz exhibits that Bitcoin mining difficulty has dropped to 79.5 T at block 851,204 and hasn’t modified within the final 24 hours. This mining problem has continued to fall for some time, with additional information from CoinWarz exhibiting that it’s down 5% within the final seven and 30 days.

Bitcoin mining problem refers to how exhausting it’s for miners to mine a brand new block on the Bitcoin network. The problem normally reduces when there’s much less computational energy on the facility and will increase when miners are mining quicker than the block common time of ten minutes. The current drop in mining problem means that extra miners are leaving the Bitcoin community.

This is probably because of the results of the Bitcoin halving, which lower miners’ rewards in half. This has lowered the income from their mining operations, with many miners struggling to remain afloat, particularly with elevated competitors. Bitcoin’s worth motion because the halving has additionally not helped, because the drop within the flagship crypto’s worth has additionally affected their earnings.

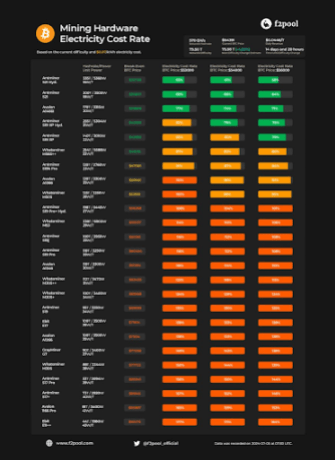

Bitcoin miner f2pool just lately highlighted the profitability of assorted classes of miners at Bitcoin’s present worth. The mining agency noted that solely ASICs with a Unit Power of 26 W/T or much less could make a revenue at Bitcoin’s present worth vary.

Crypto analyst James Van Straten additionally recently highlighted how “weak and inefficient miners” proceed to be purged from the Bitcoin community. He claimed that the current drop in mining problem exhibits that miner capitulation is nearer to ending. Due to the low profitability that miners have confronted because the halving, some have needed to offload a major quantity of their Bitcoin reserves to fulfill operational prices, and others have needed to exit the Bitcoin ecosystem fully.

What This Means For Bitcoin’s Price

The decline in mining problem means that miner capitulation may be ending quickly, which is a optimistic for Bitcoin’s worth contemplating the selling pressure these miners have placed on it. Bitcoinist reported that Bitcoin miners offered over 30,000 BTC ($2 billion) final month, which finally prompted the flagship crypto to expertise vital worth crashes.

Crypto skilled Willy Woo additionally (*3*) Bitcoin’s tepid worth motion to those miners and talked about that the flagship crypto will solely recuperate when the “weak miners die and hash rate recovers.” He acknowledged that Bitcoin must shed weak arms for this to occur, with inefficient miners going out of business whereas different mines are compelled to purchase extra environment friendly {hardware}.