The long-awaited Mt. Gox repayments have lastly commenced, making a stir within the cryptocurrency market. Notably, Bitcoin worth has dropped beneath $54,000 as Mt. Gox transfers one other 3,000 BTC, heightening fears of additional declines.

Notably, this transfer is a part of the trade’s effort to repay its collectors, who’ve been ready because the 2014 collapse. As the repayments begin, the market stays on edge, anticipating how recipients will deal with their newfound property.

Mt. Gox Starts Repaying Creditors Sparking Market Concerns

Mt. Gox’s latest Bitcoin transfers are substantial, with the most recent switch of roughly 2,702 BTC to new addresses. Precisely, 1,157.1 BTC, valued at $63.57 million, was moved to a brand new deal with “bc1qkj…ug68h” and 1,544.67 BTC, value $84.87 million, was moved to Bitbank.

Earlier at the moment, a good bigger sum of 47,229 BTC, valued at $2.7 billion, was transferred to a brand new pockets. These actions are according to Mt. Gox’s plan to start out creditor repayments in July.

Meanwhile, this newest spherical of transfers echoes comparable actions in May, the place giant sums have been despatched to new wallets, elevating questions on Mt. Gox’s intentions. However, Mt. Gox confirmed its compensation technique at the moment, calming some market fears but additionally resulting in heightened volatility.

With Bitcoin already struggling beneath the $54,000 mark, such substantial transfers are inflicting anxiousness amongst buyers. Besides, the timing of those actions coincides with the beginning of repayments to collectors, as confirmed by a discover from Mt. Gox.

The trade’s rehabilitation trustee, Nobuaki Kobayashi, acknowledged that repayments are being made in Bitcoin and Bitcoin Cash. The course of entails a number of situations, together with validation of accounts and agreements with cryptocurrency exchanges. Kobayashi assured that repayments would proceed so long as they might be made safely and securely.

Also Read: Labour Party Wins UK Election, What It Means For Crypto?

What’s Next For BTC Amid Market FUD?

The initiation of Mt. Gox repayments has led to a blended response out there. Some buyers worry a possible sell-off, which might exacerbate the present worth dip. In different phrases, the broader crypto market crash, compounded by the anticipation of additional Bitcoin gross sales, has dampened sentiment.

However, some business consultants stay optimistic about Bitcoin’s long-term prospects. Nischal Shetty, CEO of WazirX, cleared market FUD, suggesting that the affect won’t be as extreme as feared. He identified that the repayments are being made in BTC and BCH, which implies there received’t be a mass sell-off by a single entity.

Shetty famous, “People receiving these assets are Bitcoin OGs who may sell a portion for liquidity but likely won’t flood the market. Think of it as a massive Bitcoin airdrop campaign.”

The compensation of roughly 142,000 BTC and 143,000 BCH, value about $9 billion, to round 127,000 collectors is critical. Given the worth of those property, many recipients may select to carry reasonably than promote instantly. Besides, the Bitcoin held by collectors has elevated in worth because the Mt. Gox hack in 2014, making them probably extra inclined to maintain their property long-term, Shetty added.

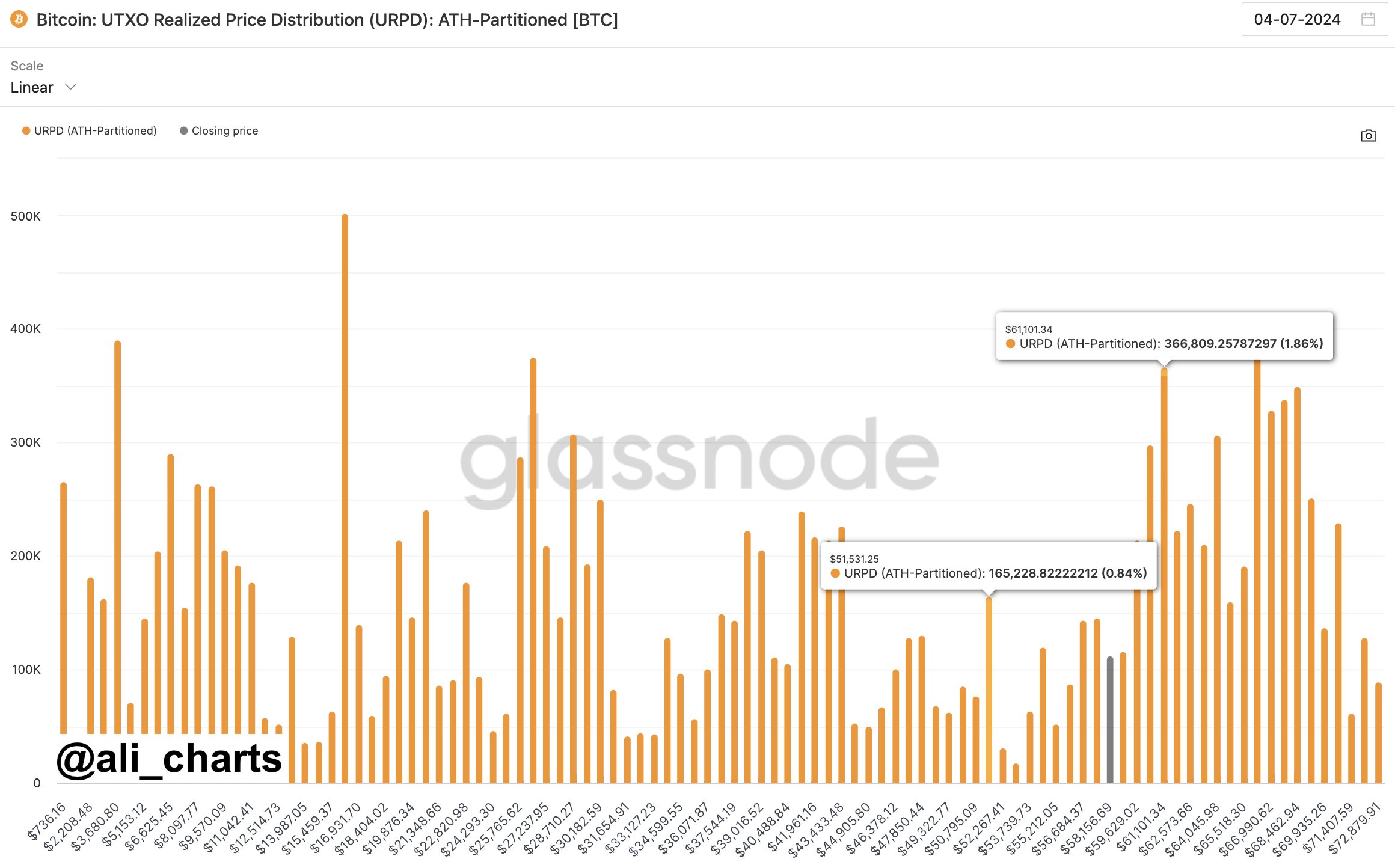

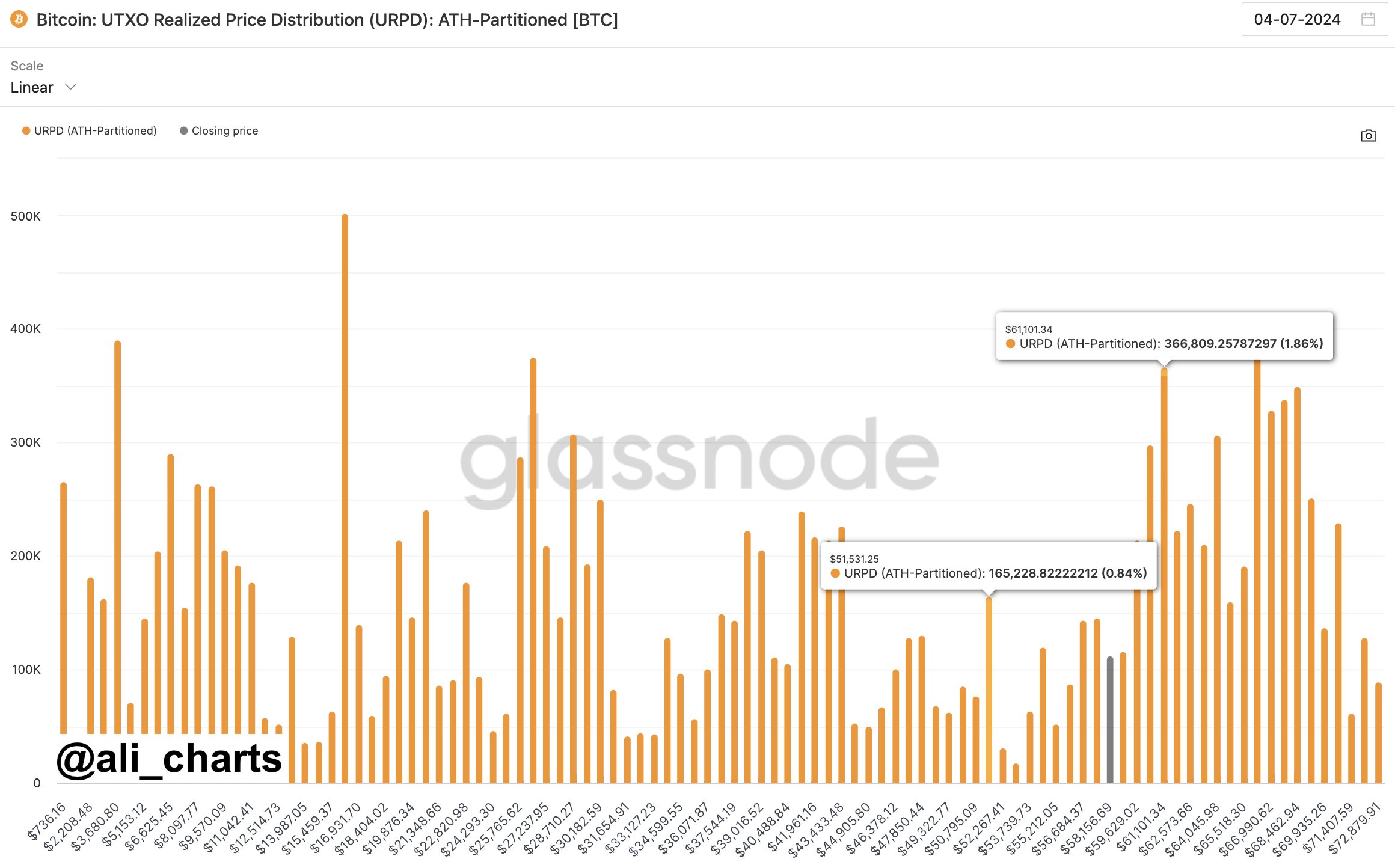

However, the latest market evaluation alerts an additional dip within the BTC worth. According to Ali Martinez, Bitcoin’s drop beneath $57,000 confirms its subsequent help at $51,000. Previously, 10X Research additionally stated that Bitcoin dangers falling to $50K, and even decrease, sparking market considerations.

As of writing, Bitcoin price was down about 8% however stayed above the $54,300 stage. Over the final 24 hours, the crypto has touched a low of $53,717.38. Furthermore, its buying and selling quantity rose 52% during the last 24 hours to $52.18 billion.

Also Read: Ethereum Suffers Most Liquidations In Panic Selling

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.