Crypto Market Selloff: The digital asset sector has famous a pointy decline right now, with the general market retreating almost 3% right now within the final 24 hours. Meanwhile, the current hunch within the main cryptos like Bitcoin, Ethereum, DOGE, BNB, LINK, and others, has sparked discussions out there over the potential causes.

So, let’s check out the potential causes which have fueled the current crypto market selloff.

Potential Reasons Behind The Recent Crypto Market Selloff

A collection of things might have triggered the current crypto market selloff right now. Here we discover the highest causes that may have impacted the sentiment of the broader crypto market.

Bitcoin ETF Outflow Fuels Concern

The U.S. Spot Bitcoin ETF has reversed its observe after noting inflows for 5 straight days by way of July 1. Over the final 5 days, the U.S. Bitcoin ETF has recorded the best inflow of $129.5 million on July 1. This transfer has fueled the market sentiment over regaining the arrogance of the institutional pursuits in the direction of the flagship crypto.

However, the general state of affairs took a distinct activate July 2, with U.S. Spot Bitcoin ETFs recording an outflow of $13.7 million. Despite inflows of $14.1 million and $5.4 million from BlackRock IBIT and Fidelity’s FBTC, the outflux of $32.4 million from GrayScale has allayed the positive factors.

This transfer might need as soon as once more weighed on the buyers’ sentiment, who’re nonetheless in search of readability available on the market momentum. The current outflux after a five-day profitable streak additionally signifies that the establishments are taking a pause earlier than making additional bets within the sector.

Friday Options Expiry

The Bitcoin ETF outflow has triggered volatility in BTC, doubtlessly impacting the broader crypto market. Apart from that, the large upcoming choices expiry additionally appears to have impacted the risk-bet urge for food of the buyers.

Notably, the current crypto market selloff could possibly be primarily attributed to the upcoming expiration of great BTC and ETH choices. Data from Deribit reveals that BTC choices with a notional worth exceeding $1.04 billion and a put/name ratio of 0.80 are set to run out on Friday, July 5, with a most ache value of $63,000.

Similarly, ETH choices price $479.30 million, with a put/name ratio of 0.38 and a max ache value of $3,450, may even expire. The impending expiries are creating uncertainty and influencing market habits, as merchants modify their positions forward of the deadline.

Also Read: Ripple and Coinbase Use Binance Win to Contest SEC Claims

Ethereum ETF Launch Delay

The crypto market was extremely anticipating the Spot Ethereum ETF approval by the U.S. SEC this week. However, a possible delay might need sparked considerations among the many buyers.

Meanwhile, trying on the newest market tendencies, ETF Store president Nate Geraci mentioned that the U.S. Spot Ethereum ETF would possibly launch on July 15. Besides, Bloomberg additionally hinted at a mid-July launch for the Ether ETF to go stay within the U.S.

Crypto Market Faces Over $120M Liquidation

The current selloff within the crypto market has precipitated a liquidation of $123.62 million during the last 24 hours, CoinGlass information confirmed. In the identical timeframe, round 45,000 merchants have been liquidated with the biggest single liquidation going down on OKX – ETH-USDT-SWAP price $3.36 million.

Bitcoin faces liquidation of $34.74 million, whereas Ethereum’s liquidation stood at $32.87 million. However, regardless of the current crypto market selloff, some analysts are nonetheless optimistic concerning the future efficiency of the market. Given the declining worth and anticipation over Ethereum ETF approval this month, the crypto market would possibly witness strong positive factors within the coming days.

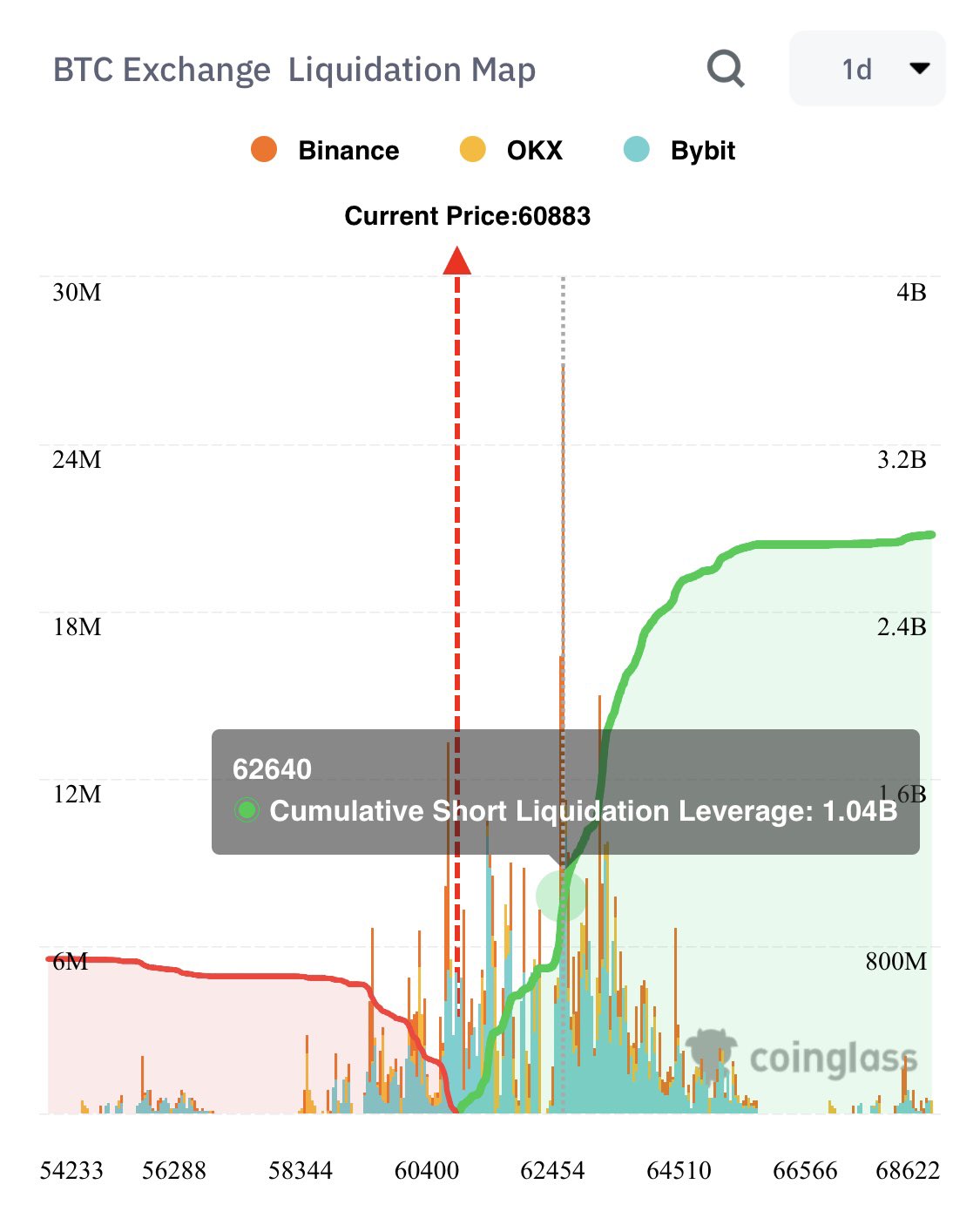

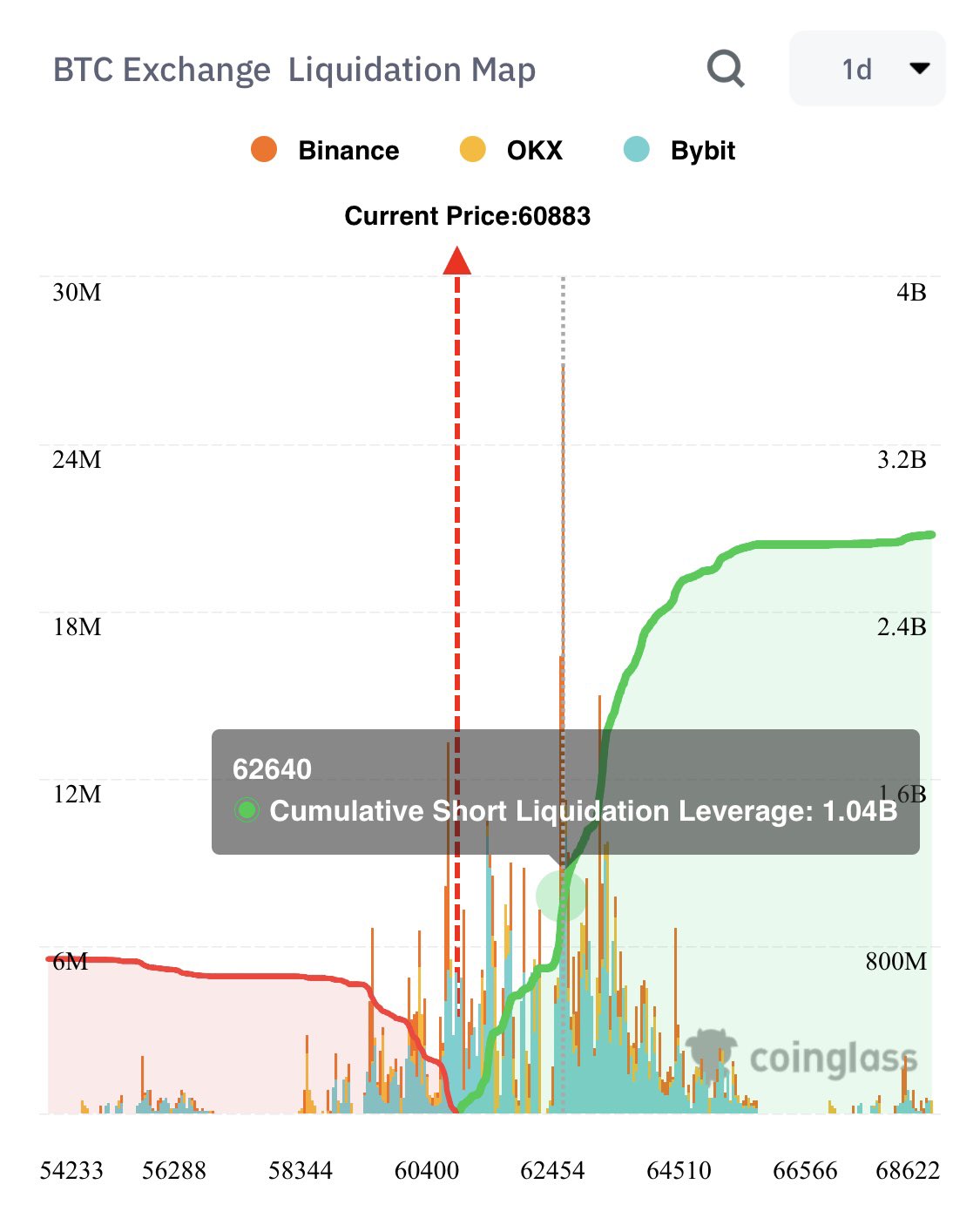

However, with Bitcoin price at the moment crossing the temporary $61,000 mark, the chance nonetheless prevails out there. In a current evaluation, in style crypto market knowledgeable Ali Martinez warned of over $1 billion liquidation if BTC hits the $62,600 mark.

As of writing, Ethereum price dropped almost 3% within the final 24 hours, whereas Dogecoin price fell 1.3%. Simultaneously, the BNB price famous a hunch of two.5% to $566.23, and Shiba Inu price slipped 1.34% to $0.00001695.

Also, CoinGlass information confirmed that Bitcoin Futures Open Interest (OI) fell about 4% from yesterday, whereas Ethereum OI slipped about 1.4%. This information additionally highlights the gloomy sentiment dominating the crypto market.

Also Read: Genesis Digital Is Considering Going Public Via IPO In US

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.