Bitcoin worth slips to $60,000 at present, sparking considerations within the broader crypto market. Following the downturn development in BTC worth, a number of different main cryptos additionally witnessed a decline at present.

However, what has piqued the market curiosity is the potential cause behind the current dip. Besides, the discussions additional intensify, particularly after the current pump in Bitcoin over the weekend.

Why Bitcoin Slips To $60K Today?

The current decline in Bitcoin worth to $60,000 raised eyebrows throughout the cryptocurrency panorama. However, amid this, a brand new report by 10X Research sheds gentle on the important thing elements driving this sluggish efficiency within the flagship crypto.

Their report outlines that the weekend pump was seemingly a technical reset, assuaging oversold situations within the brief time period. This reset paved the best way for the downtrend to renew as longer-term technical indicators level to a possible topping formation.

In addition, the report means that regardless of short-term bullish sentiments pushed by elements reminiscent of U.S. Presidential Election tailwinds and anticipated rate of interest cuts, these had been overshadowed by deeper technical and structural considerations. Analysts from 10X Research spotlight the numerous function of on-chain indicators, market flows- notably from Bitcoin miners’ inventory, and market construction information on this downturn.

These elements collectively contributed to a bearish outlook for Bitcoin, outweighing non permanent bullish influences. Besides, one essential facet famous was the affect of low buying and selling volumes over the weekend.

During these durations, even modest shopping for exercise can set off cease orders, resulting in liquidations and amplifying worth actions. This phenomenon was evident within the current weekend’s upward surge, which swiftly became a correction because the upside threat from brief overlaying diminished and draw back pressures took maintain.

Also Read: Fidelity & Sygnum Taps Chainlink For Tokenized Asset Data

What’s More?

Another vital driver of Bitcoin’s worth decline is the approaching expiration of considerable Bitcoin and Ethereum choices. Data from Deribit signifies that Bitcoin choices with a notional worth exceeding $1.04 billion are set to run out on July 5, with a put/name ratio of 0.80 and a most ache worth of $63,000.

On the opposite hand, Ethereum choices value $479.30 million, that includes a put/name ratio of 0.38 and a max ache worth of $3,450, are additionally attributable to expire on the identical date. These expiries are producing uncertainty, prompting merchants to regulate their positions forward of the deadline. The approaching expiry date will increase market volatility, as individuals hedge their bets and recalibrate methods in response to the numerous choices contracts which might be about to mature.

In addition, the July 2 outflow within the U.S. Spot Bitcoin ETF following a 5-day successful streak additionally weighed on the traders’ sentiment. According to current information, the U.S. Spot Bitcoin ETFs recorded an outflow of almost $14 million on Tuesday, following an inflow of about $130 million within the prior day.

Further Liquidation Ahead?

Several market consultants seem to have remained bullish regardless of at present’s hunch. However, it’s value noting that the liquidation warning from 10X Research in addition to from different outstanding analysts have weighed on the sentiment.

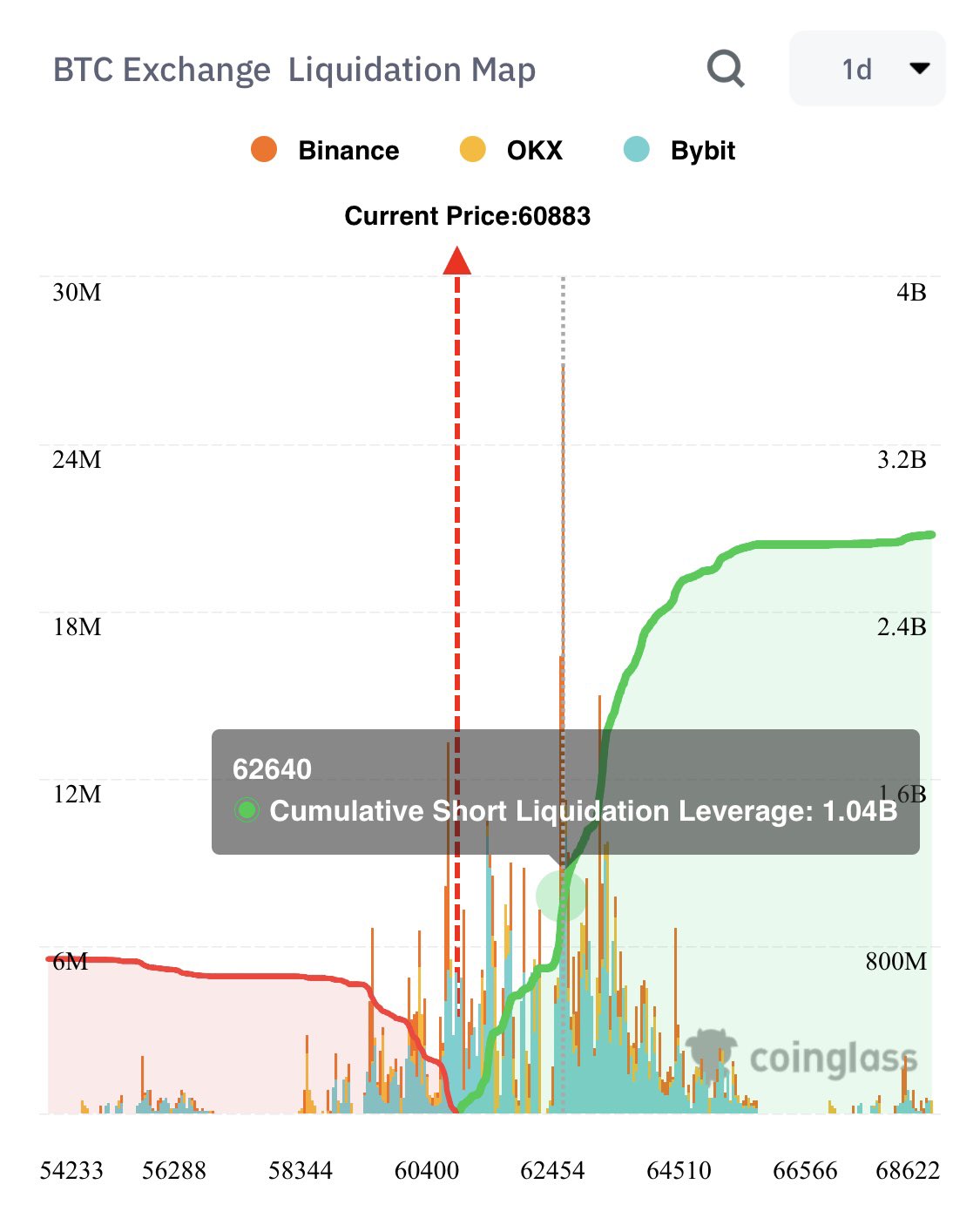

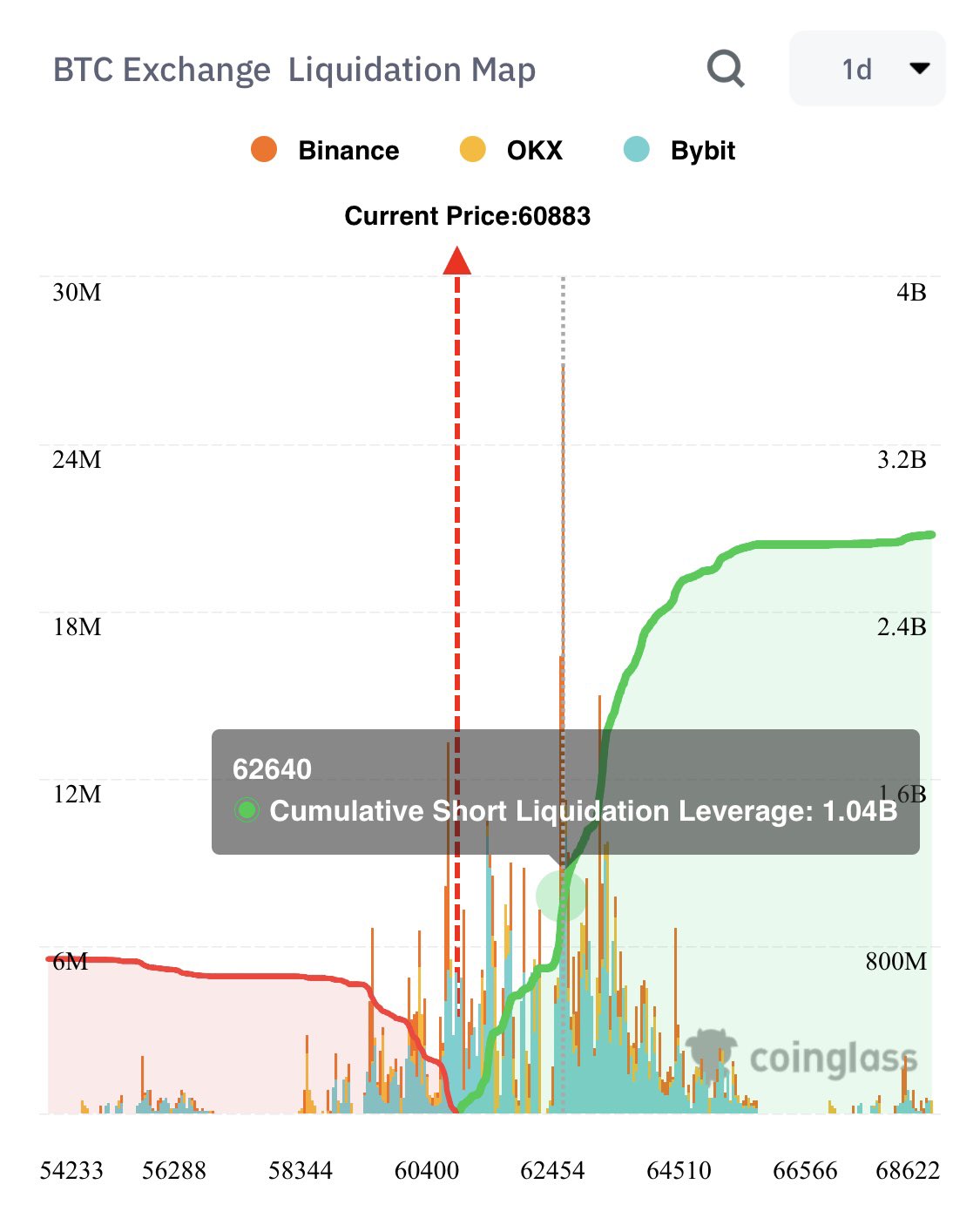

For context, Ali Martinez mentioned that Bitcoin might get well from its present part whereas revealing a warning. Martinez, whereas analyzing the Bitcoin Exchange Liquidation Map, mentioned that BTC dangers witnessing over $1 billion in liquidation if it reaches the $62,600 degree.

As of writing, Bitcoin price was down greater than 3% and hovers close to the $60,500 vary. Its one-day buying and selling quantity rose 7% to $23.54 billion, whereas the crypto has touched a 24-hour excessive of $63,015.03. Furthermore, CoinGlass information confirmed a hunch of greater than 4% in Bitcoin Futures Open Interest from yesterday.

Also Read: Binance Announces Delisting Of Key Crypto Pairs, Brace For Market Impact

The introduced content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.