The spot Ethereum ETFs that consultants equivalent to Bloomberg ETF analysts Eric Balchunas and James Seyffart estimated to launch subsequent week have been additional delayed by the U.S. Securities and Exchange Commission (SEC). The SEC issued just a few feedback on the S-1 type submitted by spot Ethereum ETF issuers, with refiling anticipated within the coming weeks.

SEC Comments Postpones Spot Ether ETF Launch

The U.S. SEC within the newest feedback has requested the spot Ethereum ETF issuers to submit the S-1 types by July 8, based on individuals aware of the matter. This means the spot Ethereum ETFs launch is delayed to mid-July or July-end.

SEC Chair Gary Gensler not too long ago confirmed that the approval course of for spot Ethereum ETF goes easily after issuers together with BlackRock, Fidelity, 21Shares, Grayscale, Franklin Templeton, VanEck, iShares, and Invesco. The Ether ETF issuers equivalent to VanEck have additionally filed Form 8-A in preparation for itemizing on exchanges by July 8.

The delay places Ethereum holders in limbo. ETFstore President Nate Geraci earlier famous that the final spherical of S-1 revisions was fairly “light” and the regulator will seemingly clear issuers for buying and selling inside the subsequent 14-21 days. While the precise timeline is unclear, the SEC hinted at a possible launch this summer time.

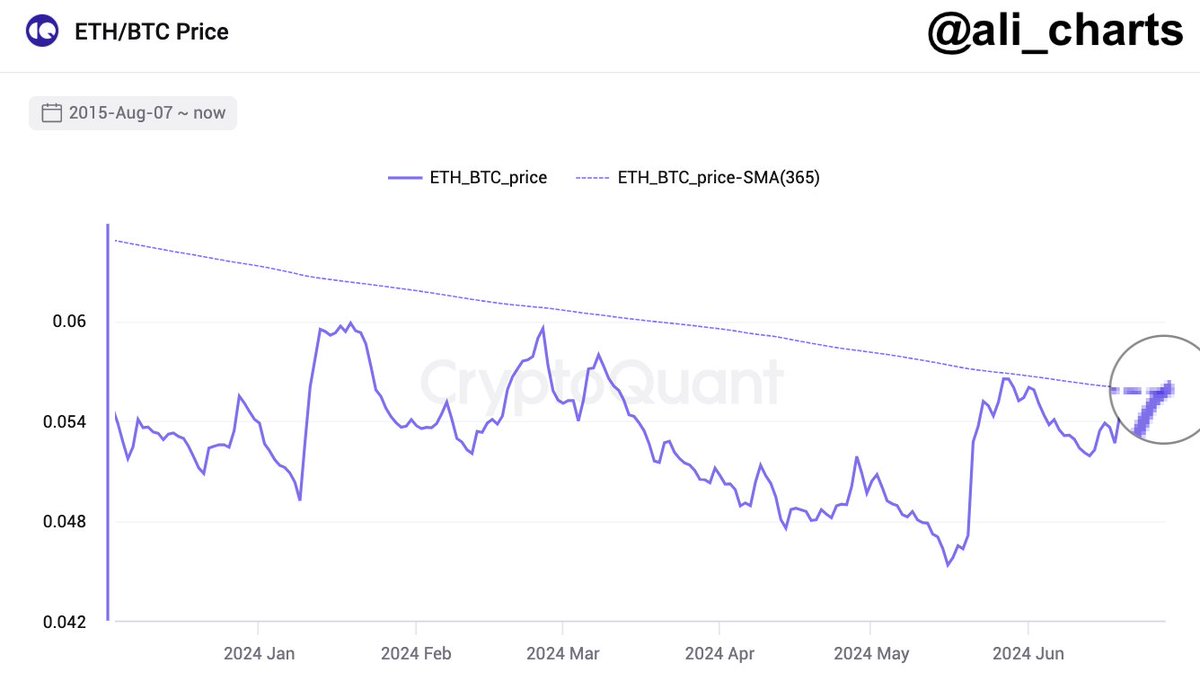

Also Read: ETH/BTC Pair Eyes Major Breakout With Ethereum ETF on Horizon, What’s Next?

ETH Price to Drop Due to Delay?

Market individuals have criticized the transfer by the SEC as Ethereum and the broader crypto market are already buying and selling underneath selloff strain. The odds of Ethereum ETF launch subsequent week ignited hopes of altseason as ETH/BTC worth was lastly transferring above the 365 easy transferring common.

ETH price fell over 1% previously 24 hours, with the value at present buying and selling at $3,384. The 24-hour high and low are $3,363 and $3,467, respectively. Furthermore, the buying and selling quantity has decreased additional by 8% within the final 24 hours, indicating a decline in curiosity amongst merchants.

Also Read: Ripple Vs SEC – Judge Torres Doctrine Stands, XRP Secondary Sales Are Not Securities

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.