The latest hunch in Bitcoin worth beneath the $61K vary has sparked discussions within the crypto market over the potential actions within the coming days. Meanwhile, a number of traders seem like staying on the sideline given the latest risky state of affairs famous within the broader crypto market, not to mention Bitcoin worth.

However, amid this, a famend cryptocurrency agency QCP Capital has shared insights on the potential future strikes of the BTC worth. It’s price noting that QCP Capital has highlighted potential elements that might pull down Bitcoin to as little as $50,000.

Bitcoin Price To Hit $50K, QCP Capital Predicts

Bitcoin’s slip beneath the $61,000 mark has reignited fears of a deeper decline, with market evaluation pointing to a number of elements that might drive the worth right down to $50,000. QCP Capital, a outstanding cryptocurrency agency, has highlighted a sequence of developments contributing to the present bearish sentiment in its latest weekend temporary.

QCP Capital notes that Bitcoin’s $60,000 help stage, traditionally resilient within the second quarter, faces new pressures. According to QCP, the market goes to witness a heightened risky state of affairs with strong provide inflow from the Mt. Gox payouts. In addition, the hefty Bitcoin gross sales by authorities our bodies additionally weighed on the emotions.

Notably, the defunct Mt. Gox exchange, set to start repaying collectors in Bitcoin and Bitcoin Cash beginning July 2, introduces a possible inflow of Bitcoin into the market, which may amplify volatility. In addition to the Mt. Gox state of affairs, important Bitcoin transfers by the U.S. government to crypto exchanges have weighed closely on investor sentiment.

Meanwhile, the identical sample was seen with the German government’s large-scale Bitcoin offload. These developments have led to apprehensions about additional downward stress on Bitcoin’s worth. In different phrases, the market contributors are bracing for the potential impression of those transactions on liquidity and market stability.

Also Read: Bitcoin ETF Records 4-Day Streak As BlackRock Boosts With $82M Influx

What’s Next?

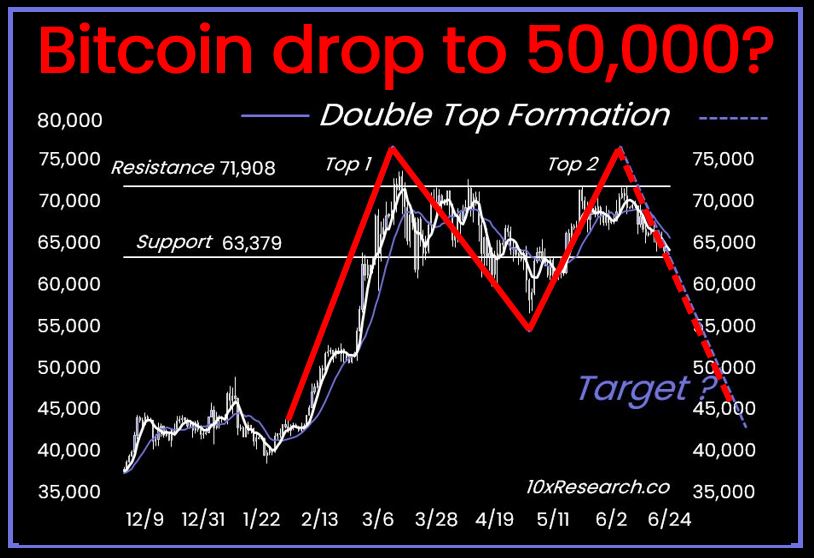

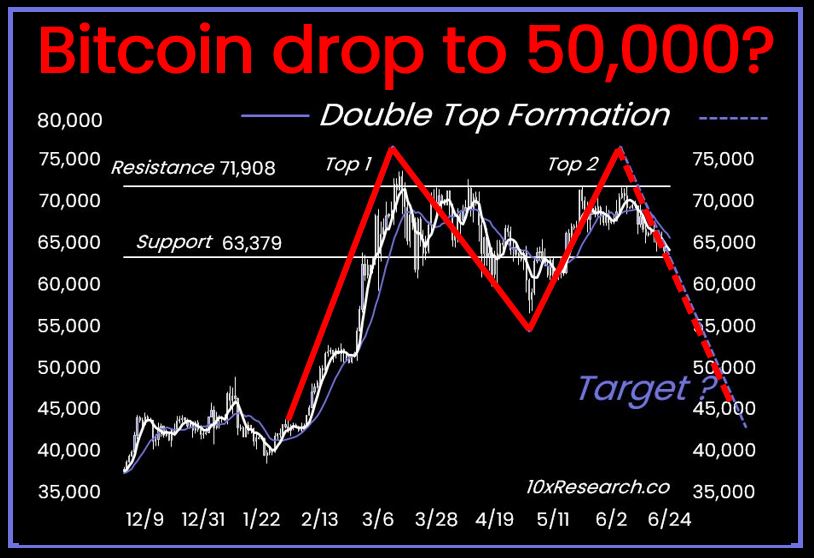

Another issue contributing to the cautious outlook is the present liquidity state of affairs. 10X Research, a well-liked on-chain analytics agency, has issued a warning relating to Bitcoin’s precarious place. They spotlight the growing market nervousness over a possible “double top” formation, a chart sample that usually indicators an impending important worth drop.

Meanwhile, their latest evaluation on X means that Bitcoin may take a look at decrease ranges, probably BTC reaching $50,000 and even dropping additional to $45,000. Besides, the continuing uncertainty and liquidity challenges add to the bearish sentiment surrounding Bitcoin, making it extra prone to downward stress.

However, it’s not all doom and gloom. QCP Capital believes that whereas the potential BTC drop to $50,000 is believable, the market will doubtless discover strong help at this stage. They argue that conventional finance curiosity stays robust, supported by basic regulatory easing worldwide, which may present a stabilizing impact.

On the opposite hand, the anticipated buying and selling of the U.S. Spot Ethereum ETF within the subsequent week may inject some pleasure and optimistic momentum again into the market. Besides, the hype over the Solana ETF additionally fueled discussions available in the market.

As of writing, Bitcoin price traded close to the flatline and crossed the temporary $61,000 mark. Its buying and selling quantity rose 9% from yesterday to $23.62 billion, and its worth noticed a low of $59,985.40. According to CoinGlass, the Bitcoin Futures Open Interest rose 0.13% during the last 4 hours, whereas dropping about 2% from yesterday.

Also Read: Binance’s BNB Sales Don’t Qualify As Securities, Judge Dismisses SEC’s Claims

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.