Bitcoin’s (BTC) worth is falling sharply under the $61K stage after failing to keep up its help above $60,000. This decline has raised issues amongst analysts a few potential main correction if Bitcoin can not maintain its final help stage of $56,000.

Bitcoin Struggles Amid Cooling PCE Data

Bitcoin’s price motion has not displayed a lot of a response to the current U.S. macroeconomic figures. The core Personal Consumption Expenditures (PCE) worth index, the Federal Reserve’s most popular inflation measure, rose at an annual price of two.6% in May, the bottom since March 2021.

On a month-to-month foundation, the core PCE elevated at a relatively gradual tempo of solely 0.1%, the slowest rise since November 2023. However, even with these considerably low inflation numbers, Bitcoin has not been impacted a lot and continues to commerce within the $60,000 vary.

Econ Friday

PCE information expectedly got here in coolerPersonal revenue barely increased than anticipated however cooling private spending

Pretty good studies tbh https://t.co/7erMdACddr pic.twitter.com/4GhTcxmtOd

— Skew Δ (@52kskew) June 28, 2024

Concurrently, current actions by the U.S. government have additionally added to market uncertainties. A U.S. government-associated handle shifted 11.84 BTC, valued at roughly $726,000, to a brand new handle. Although comparatively small, this transaction is imagined to be a precursor to bigger strikes. Such authorities actions could cause unease amongst traders, contributing to speculative fears about potential large-scale sell-offs, which might exert downward strain on Bitcoin costs.

Analysts Warn of Thin Support Below $60,000

Market analysts are frightened that help for Bitcoin is weakening under the $60,000 mark. If the value fails to carry this stage, an enormous bearish momentum could observe, and the value could drop to $54,000.

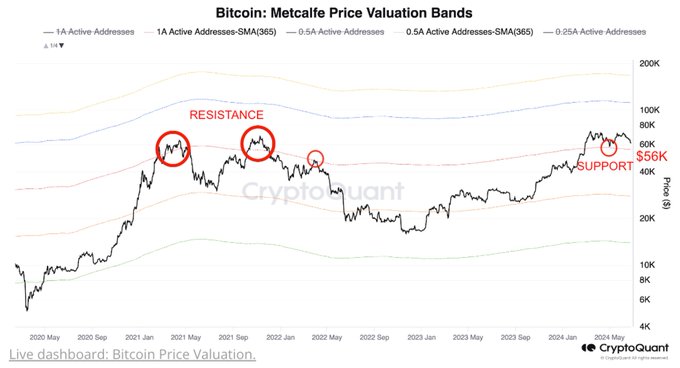

CryptoQuant reveals that the important stage of help that Bitcoin has is at $56k. If this help stage shouldn’t be sustained sooner or later, then there’s a threat of a pointy worth decline.

Analyst Willy Woo has described the current worth retests at $58,000 to be as a consequence of liquidations of leveraged positions in addition to promoting strain from miners, which signifies that the market has not absolutely recovered from the downtrend with out liquidating these positions.

Decreasing Demand, Trading Volume, and Open Interest

Another issue contributing to Bitcoin’s worth decline is the lowering demand from long-term holders and U.S. traders. Long-term BTC holders have been decreasing their holdings all through 2024, with important sell-offs noticed in May and June. According to IntoTheBlock information, May noticed roughly 160,000 BTC bought, price round $10 billion, whereas June witnessed an extra 40,000 BTC leaving long-term holders’ wallets. This regular lower in holdings has correlated with fluctuations in Bitcoin’s market worth.

Furthermore, buying and selling quantity has seen a big lower of 12.84%, settling at $39.92 billion. This drop could point out low market turnover and merchants’ curiosity which can lead to low liquidity and excessive volatility.

Open curiosity, which is the whole variety of by-product contracts excellent, additionally declined by 1. 94% to $31. 74 billion, which suggests that there are fewer contracts being held or opened. However, choices open curiosity has gone up by 2. 18% to $10. 24 billion, this would possibly imply that though there are fewer new choices being traded, extra merchants are holding on to their choices, presumably as a consequence of uncertainty out there.

Read Also: Bitcoin ETF, Nvidia, & AI Hype Usher $400 Billion Investment in ETFs

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.