The Bitcoin (BTC) value has skilled important volatility lately, amid rising considerations over waning danger urge for food amongst traders and the latest authorities sell-offs. For context, the German and U.S. governments have offloaded substantial quantities of BTC to crypto exchanges, contributing to the market’s present uncertainty.

However, regardless of this bearish development, market analysts stay optimistic a few potential value reversal.

Analyst Predicts Reversal After BTC Dips To Key Level

Renowned crypto market analyst Michael van de Poppe has shared a bullish outlook for BTC, regardless of its latest value struggles. In a latest X publish, the analyst instructed that Bitcoin might expertise an additional decline earlier than staging a major restoration.

He emphasised {that a} reversal might happen after Bitcoin reaches the $60,000 degree, a value level he believes will set off a bullish divergence. For the reversal, he has targeted on the potential approval of the U.S. Spot Ethereum ETF by the SEC subsequent week.

Meanwhile, Van de Poppe’s forecast aligns with rising hypothesis about probably the most awaited U.S. SEC’s potential approval of Spot Ethereum ETF on July 2. If granted, the approval is predicted to boost market sentiment, presumably driving Bitcoin’s value greater alongside Ethereum’s potential beneficial properties.

Analysts consider that the introduction of an Ethereum ETF might bolster institutional curiosity and general investor confidence within the cryptocurrency market, thereby benefiting BTC value as properly.

Also Read: Japanese Yen Collapse May See More Firms Adopt Bitcoin (BTC) Very Soon

Analyst Believes Miner Selling Concerns Overstated

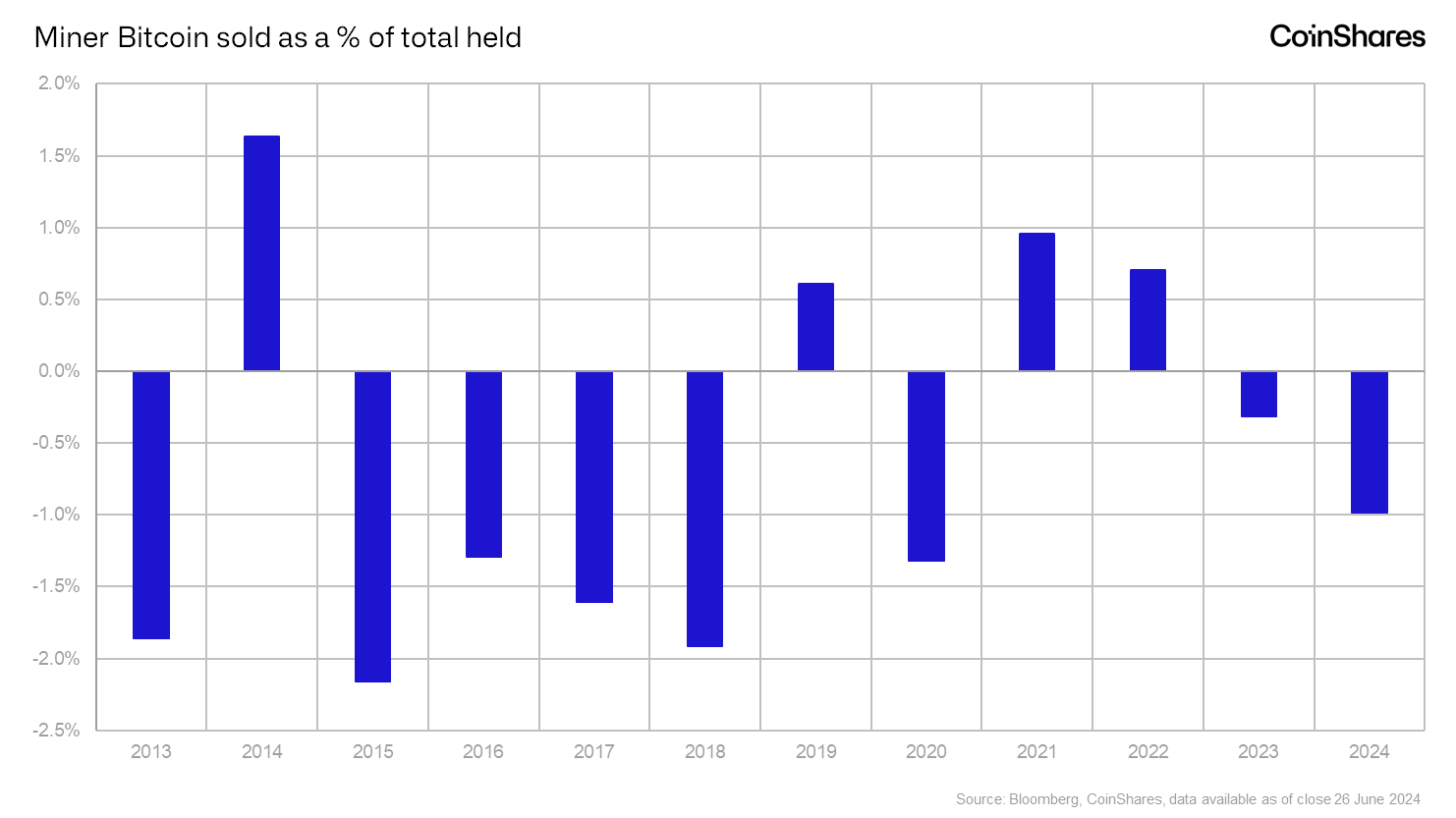

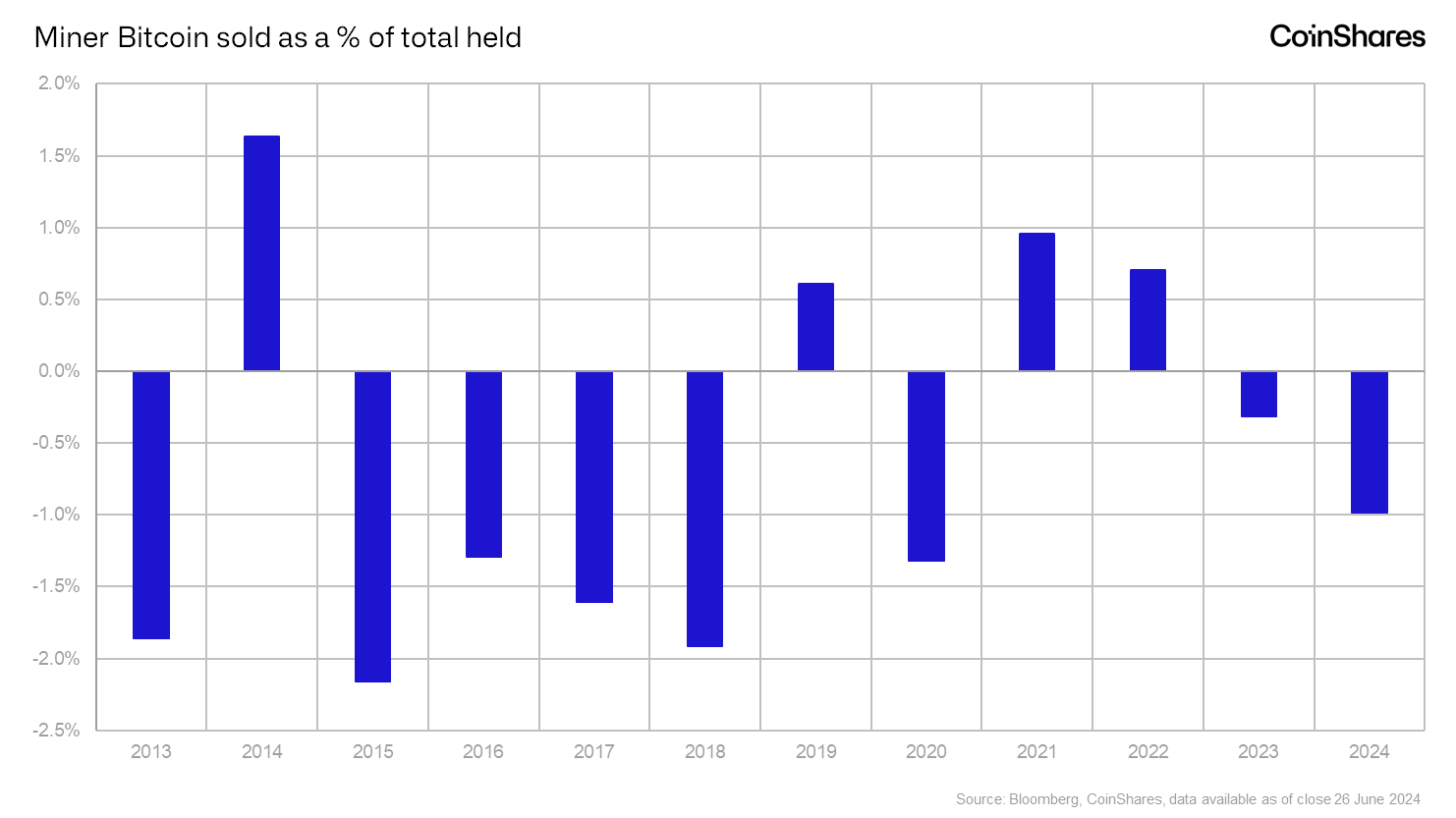

Some market members have expressed considerations about Bitcoin miners promoting off their holdings, resulting in extra market strain. However, James Butterfill, Head of Research at CoinShares, argues that these fears could also be overblown.

In a latest X publish, Butterfill clarified that miners have offered a report quantity of Bitcoin this yr— “over $1 billion worth”. However, Butterfill identified that when contemplating the proportion of complete Bitcoin held, miners’ gross sales are usually not as important as they seem. James Butterfill mentioned:

“When looking at things proportionally you find that miners selling as a proportion of total Bitcoin held isn’t all that significant at 1% this year so far compared to 2% in 2018 and 2015.”

Butterfill’s evaluation means that whereas miners are promoting extra Bitcoin, the general affect in the marketplace is comparatively minor in comparison with historic precedents. This perception gives a extra nuanced perspective on the present market dynamics and means that the considerations over miner sell-offs won’t be as detrimental to Bitcoin’s value as initially feared.

Meanwhile, throughout writing, Bitcoin price traded at $61,565.45, up about 0.05%, with its buying and selling quantity slipping 12.6% to $22.48 billion. Over the final 24 hours, the flagship crypto has touched a low of $60,580.78, with BTC Futures Open Interest rising 0.82% within the four-hour timeframe.

Also Read: Pro-XRP Lawyer Deaton Highlights US Govt and SEC’s Contradictory Stance On Coinbase

The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.