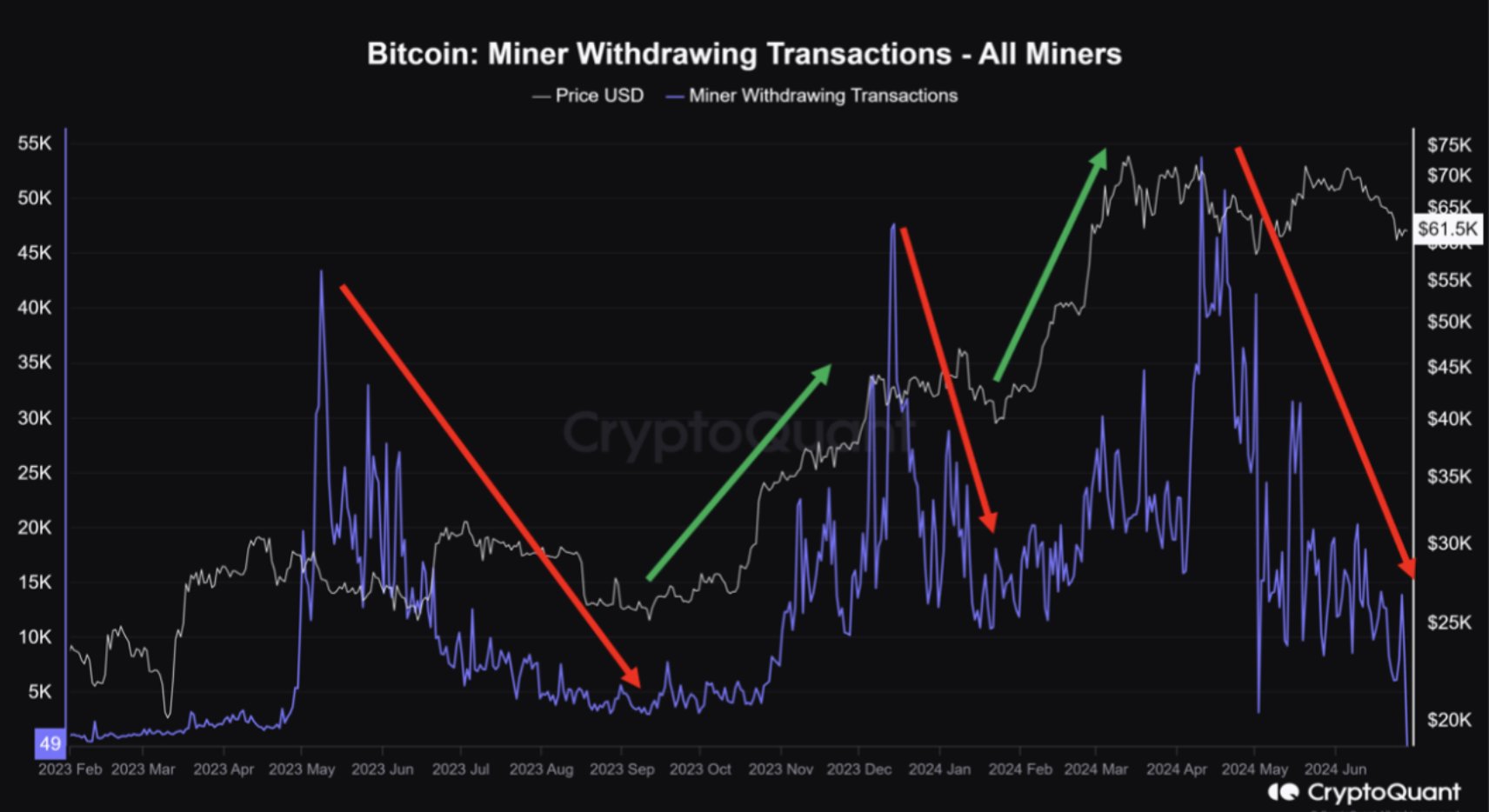

In an analysis supplied by CryptoQuant, a big change in Bitcoin miner conduct has been famous, probably indicating a turning level. CryptoQuant analyst, often known as Crypto Dan, outlined a discount in miners’ promoting strain, which has traditionally been a pivotal issue affecting Bitcoin’s value trajectory.

Bitcoin Mining Selling Pressure Decreases

According to Crypto Dan, “Miners’ selling pressure decreases. One of the whales that have caused the cryptocurrency market to fall recently have been miners.” He defined that the BTC halving, which halved mining rewards, led to a lower in using older, much less environment friendly mining rigs, subsequently lowering total mining exercise. This change pressured miners to promote Bitcoin in over-the-counter (OTC) transactions to maintain their operations.

The evaluation means that the market is at present absorbing the sell-off, with a notable decline within the quantity and frequency of Bitcoin being transferred out of miners’ wallets. “The current market can be seen as being in the process of digesting this sell-off, and fortunately, the quantity and number of Bitcoins miners are sending out of their wallets has been rapidly decreasing recently,” Crypto Dan acknowledged.

Related Reading

The implications of this shift are vital. Crypto Dan added, “In other words, the selling pressure of miners is weakening, and if all of their selling volume is absorbed, a situation may be created where the upward rally can continue again.” He projected optimism for the market, predicting optimistic actions within the third quarter of 2024.

Historical information from CryptoQuant corroborates the evaluation. BTC has beforehand proven an analogous sample the place miner promoting exercise exerted a robust affect on market costs, notably famous from May to September 2023 and from December 2023 to January 2024. During these intervals, extended sideways motion in BTC costs was noticed, aligning with peaks in miner promoting. Notably, when these promoting actions diminished, Bitcoin costs resumed an upward development.

This sample means that the latest lower in miner promoting might be the precursor to a different vital bullish phase for Bitcoin, as market circumstances seem ripe for the same reversal of fortunes.

Key Price Level For A Bullish Breakout

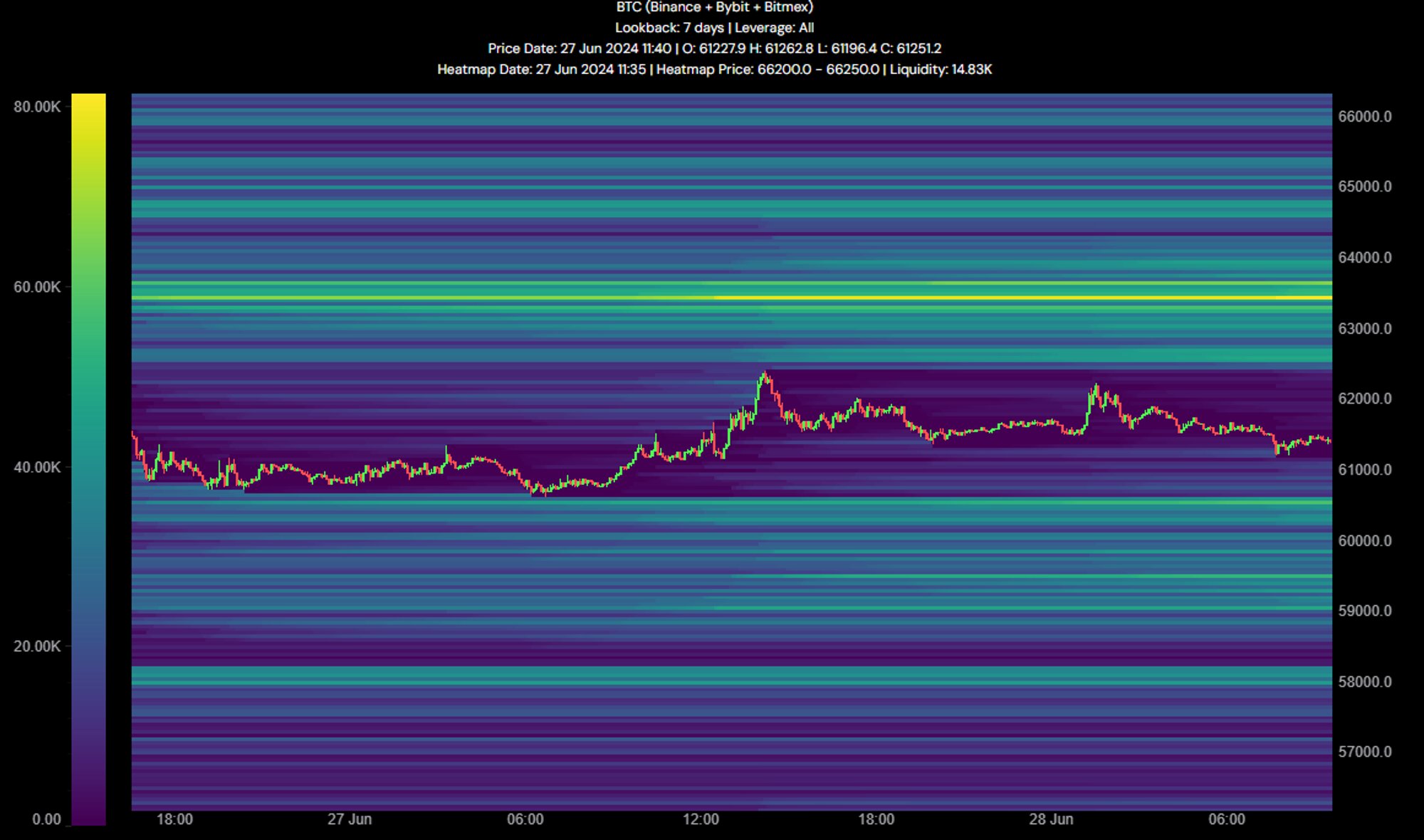

Further insights from technical analysts at alpha dōjō present a granular view of the market circumstances. Their every day replace on Bitcoin by way of X underscores the present market indecision, characterised by Bitcoin “chopping around” with out clear directional motion. However, the analysts have recognized essential value ranges which may point out future market actions: “If BTC reclaims the $63.5k area, it would be bullish; if it loses the $60k level, it would be bearish.”

Related Reading

The technical evaluation additionally reveals that the liquidity within the Bitcoin market is at present dispersed, with few substantial clusters of orders. The most notable focus of orders is across the $63.5k stage, suggesting that this value level is pivotal for market sentiment and potential bullish momentum.

The order ebook information supplied by alpha dōjō highlights a present dominance of promote orders, indicating a bearish sentiment amongst merchants. Conversely, the bid aspect is described as weak, with fewer purchase orders supporting upward value actions. This imbalance means that the market is at present cautious, probably awaiting extra definitive indicators earlier than committing to extra substantial positions.

At press time, BTC traded at $61,704.

Featured picture created with DALL·E, chart from TradingView.com