Amidst waves of concern surrounding the sale of Bitcoin by the US and German governments, trade specialists have come ahead to dispel fears, suggesting that these strikes might be bullish for the market.

Yesterday, the Bitcoin sector skilled heightened volatility following actions by two main governments. The German Federal Criminal Police (BKA) continued with its sales of Bitcoin, decreasing its holdings from 50,000 BTC to 45,264 BTC. Concurrently, the US authorities transferred 4,000 BTC to Coinbase, seemingly aiming for liquidation, retaining a considerable 213,546 BTC in its reserves.

Why This Is Bullish For Bitcoin (Long-Term)

Travis Kling, founding father of Ikigai Asset Management, remarked on the synchronicity of those occasions. “All at the same time—US Govt selling seized Silk Road Bitcoin, US Govt selling seized Banmeet Singh BTC, German Govt selling seized Movie2k BTC, Mt Gox distributing BTC after a decade. Interesting… I can’t help but look at all these actions and wonder about some kind of coordination/underlying intention,” Kling stated through X.

Related Reading

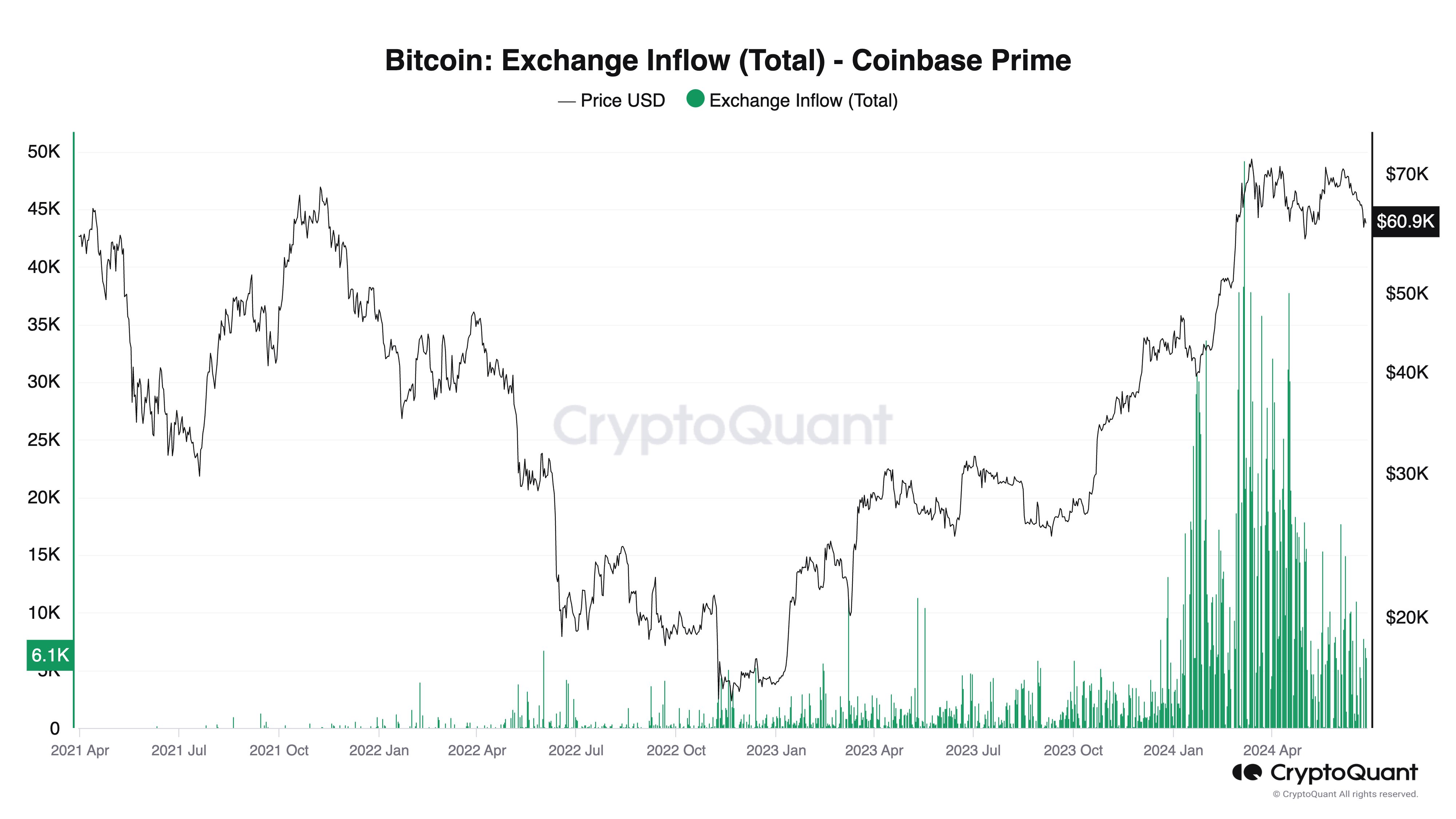

Despite considerations that these gross sales may stress Bitcoin costs, specialists argue that the impression in the marketplace is probably going minimal. Ki Young Ju, CEO of CryptoQuant, countered the prevalent concern, uncertainty, and doubt (FUD). He famous, “US gov’t sold 4K Bitcoin today, but it’s less likely to impact the market. Coinbase Prime handled 20-49K BTC in sell-side liquidity daily during high spot ETF inflows and 6-15K daily during low spot ETF inflows. Posting this because I’m tired of ‘gov’t selling’ FUDs,” as shared through X.

Crypto analyst Skew (@52kskew) provided insights into how these transactions sometimes happen, “US Gov sent 3.94K BTC to Coinbase Prime to be handled by Coinbase Institutional. There’s typically two options here: OTC desks can auction off the BTC to clients (off-market buyers), or an open market auction (sold over time on the market).” Skew’s rationalization makes it clear that the impression on the value is more likely to be fairly small.

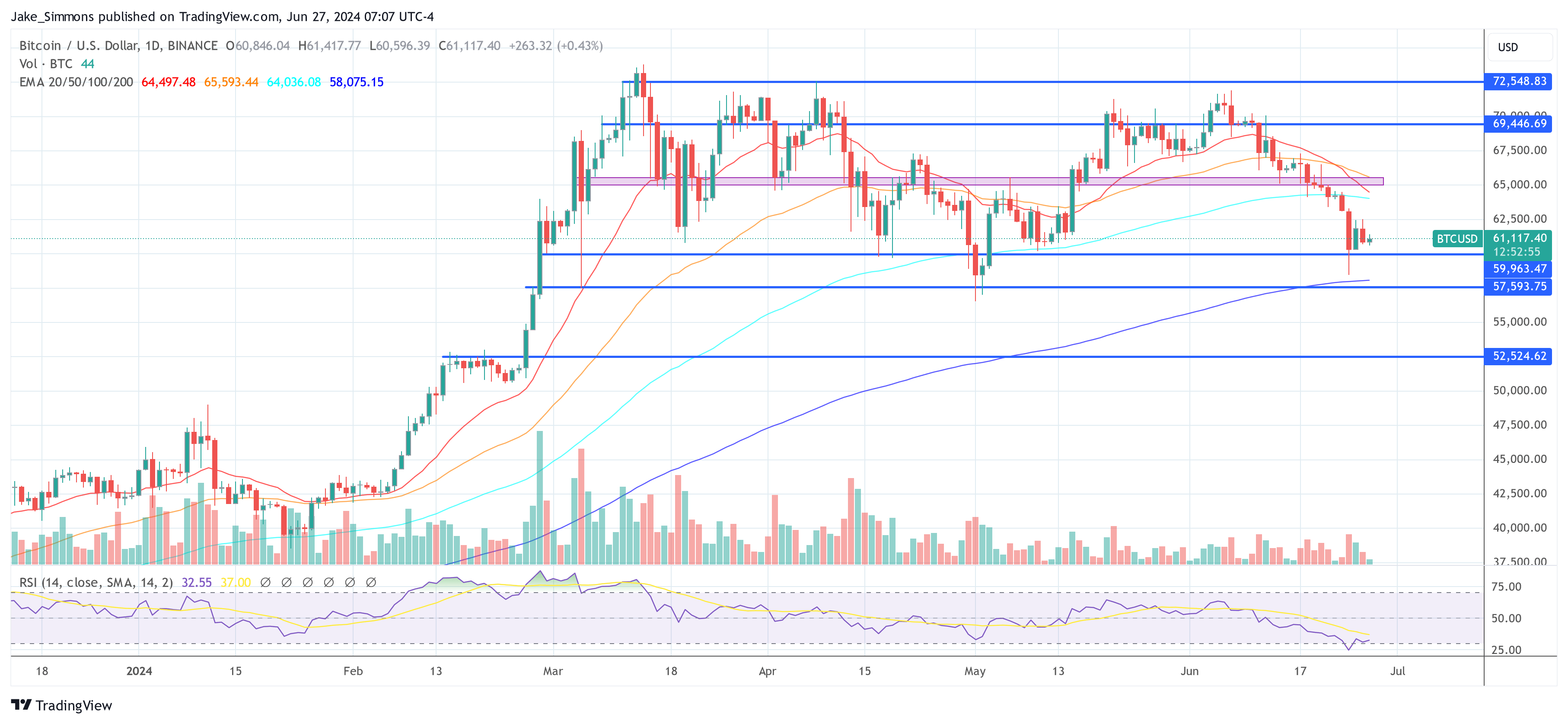

Adam Cochran, managing companion at CEHV, highlighted the resilience of Bitcoin in mild of a number of bearish catalysts, “Also with US Gov FUD, Mt Gox FUD, most major airdrops finished, markets down, Nvidia off highs, BTC has had every reason to go lower, and it’s still mostly held $60k. Negative news struggling to make a dent.”

Will Gold’s History Repeat Itself For BTC?

Echoing a traditionally bullish sentiment, Alistar Milne, CIO of Altana Digital, drew parallels to previous authorities gross sales of property, “Government selling is bullish. Gordon Brown famously sold the UK’s Gold reserves for less than $300/ounce. One of the worst decisions made by a Chancellor of the Exchequer, ever. Germany & America are making far worse mistakes by selling seized BTC now. They can only sell once.”

Government promoting is bullish

Gordon Brown famously offered the UK’s Gold reserves for lower than $300/ounce. One of the worst selections made by a Chancellor of the Exchequer, ever

Germany & America are making far worse errors by promoting seized BTC now. They can solely promote as soon as pic.twitter.com/i0rZMpuiS0

— Alistair Milne (@alistairmilne) June 26, 2024

For context, throughout his tenure as Chancellor of the Exchequer from 1997 to 2007, Gordon Brown made the choice to promote roughly 60% of the UK’s gold reserves between 1999 and 2002, a interval generally known as the “Brown Bottom.”

Related Reading

The gross sales have been carried out in a sequence of auctions at costs that ranged between $256 and $296 per ounce—considerably beneath the gold value in subsequent years, which noticed a considerable rise. This motion is extensively thought to be a monetary misstep that price the UK treasury billions in potential income, as gold costs surged to over $1,500 per ounce within the following a long time.

Moreover, there’s one other bullish facet to this. The finalization of those BTC gross sales may take away a big overhang in the marketplace as these gross sales are hanging above the market like a Damocles sword; as soon as finished, there’s a serious draw back threat for the market ceaselessly eradicated, higher early than late.

At press time, BTC traded at $61,117.

Featured picture created with DALL·E, chart from TradingView.com