The current retreat in Bitcoin worth has taken the market by storm, whereas some specialists stay optimistic about its future. Latest on-chain information and technical indicators counsel a major bullish reversal could also be on the horizon, probably driving Bitcoin to $88,000.

Notably, this optimistic forecast is fueled by a mix of historic traits and a notable flag sample, igniting investor confidence amid the broader market volatility.

On-Chain Data Indicates Bitcoin Price Rally To $88K Soon

Prominent crypto market analyst Crypto Faibik has predicted a bullish flip for Bitcoin, citing a “Bullish Flag Pattern” on the weekly chart. In a submit on the X platform, Faibik asserted that Bitcoin might surge to $88,000 by July or August.

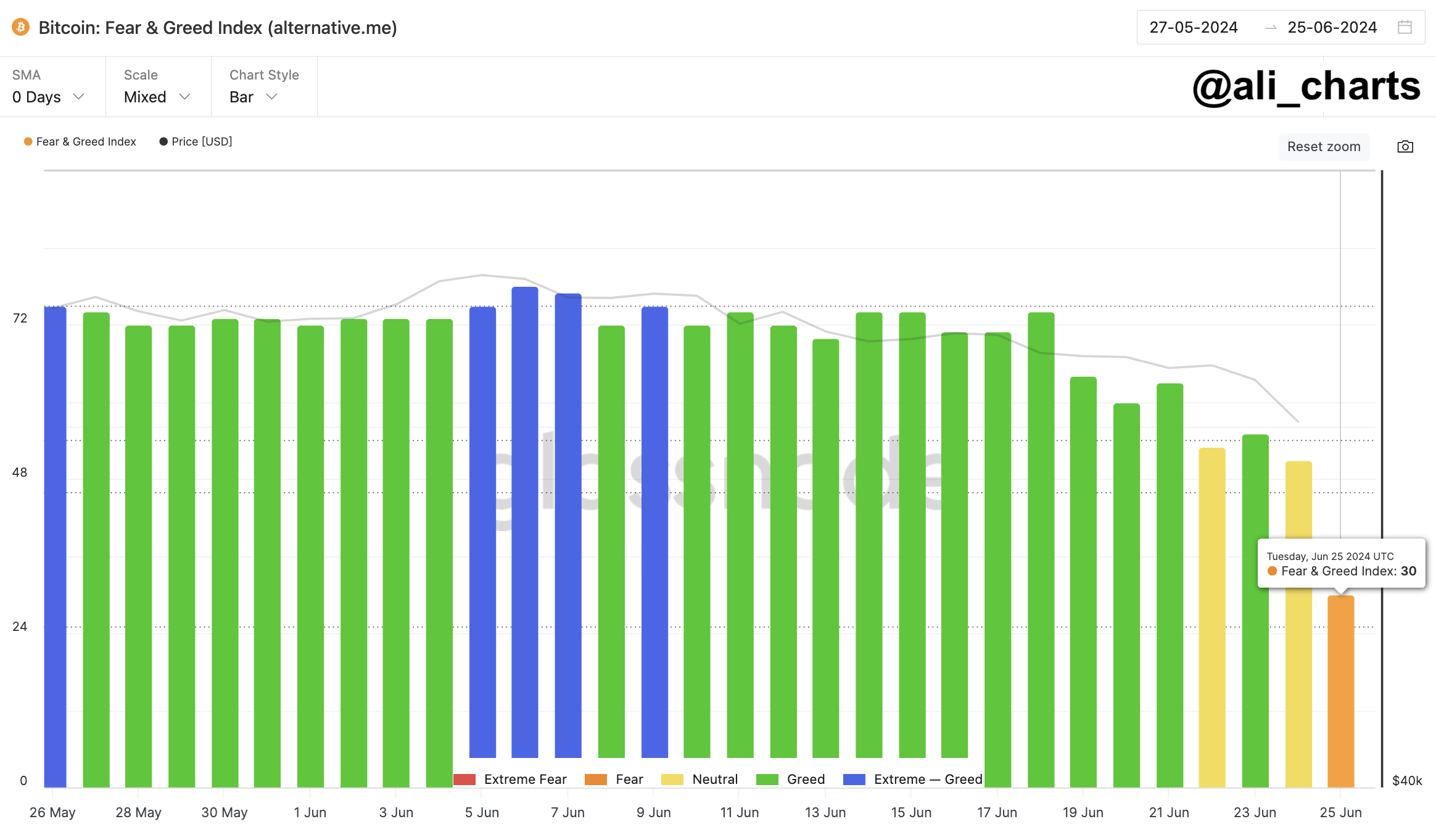

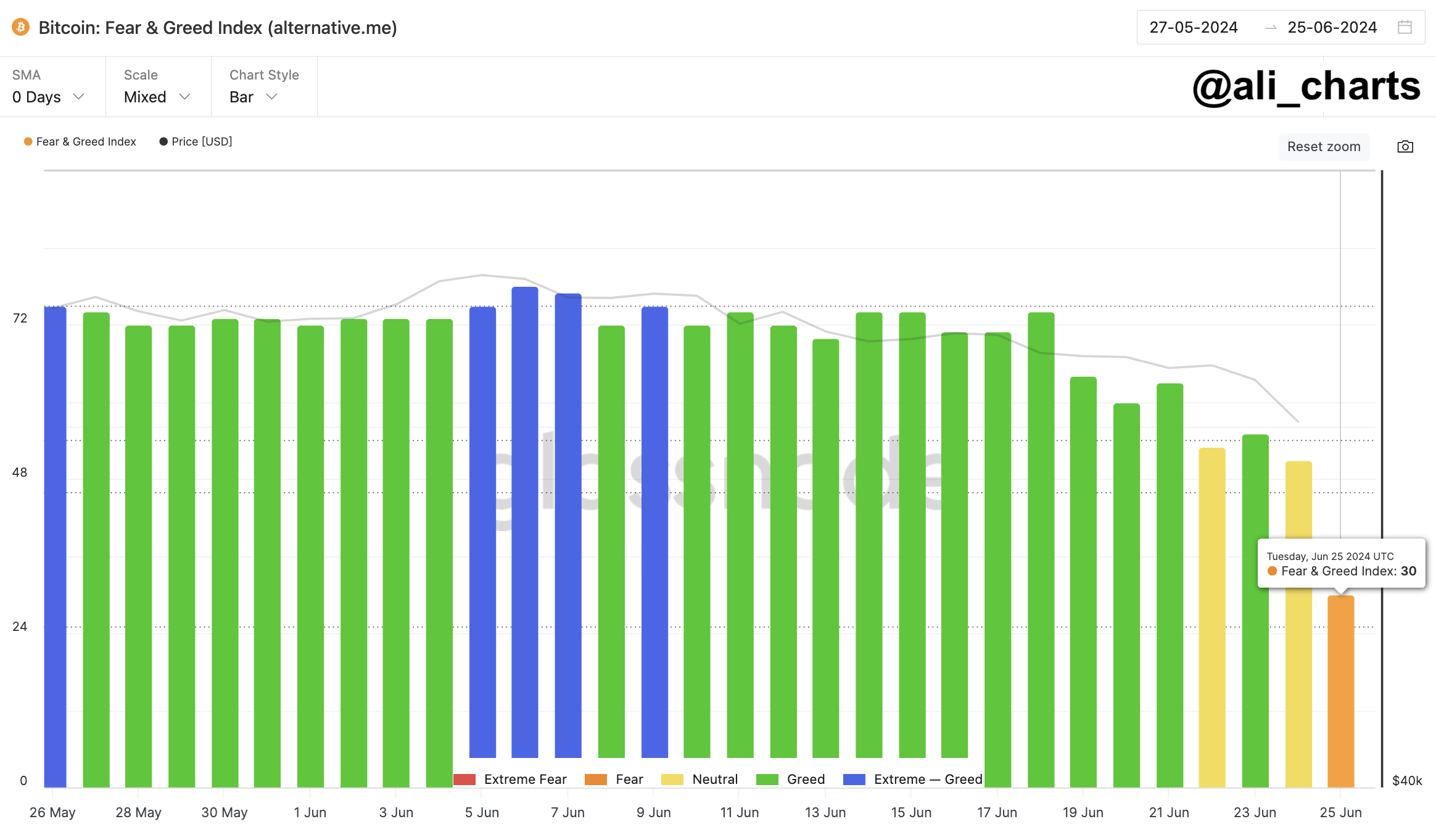

Notably, the flag sample, typically seen as a continuation sign, means that Bitcoin is perhaps getting ready for one more upward transfer after its current consolidation. Supporting this outlook, one other well-known analyst, Ali Martinez, emphasised the present “Fear” sentiment out there, as mirrored by the Bitcoin Fear and Greed Index, which has fallen to 30.

Meanwhile, Martinez famous that this drop in sentiment sometimes presents shopping for alternatives. Besides, he identified that the Relative Strength Index (RSI) hitting oversold ranges has traditionally preceded substantial worth rebounds.

Martinez highlighted that in earlier cases over the previous two years, comparable RSI situations led to Bitcoin worth will increase of 60%, 63%, and 198%. In addition, Martinez additionally pointed to the Market Value to Realized Value (MVRV) Ratio, which is presently beneath -8.40%.

Looking on the historic traits, such ranges have led to notable worth surges. He noticed that the MVRV ratio dipping to those ranges beforehand triggered worth jumps starting from 28% to 100%. With Bitcoin presently underneath $60,000 and the MVRV ratio at -8.96%, Martinez suggests this could possibly be a perfect time for buyers to purchase the dip.

Also Read: Jack Mallers’ Strike Launches In UK, Will It Boost Bitcoin Adoption?

Institutional Accumulation and Market Dynamics In-Play

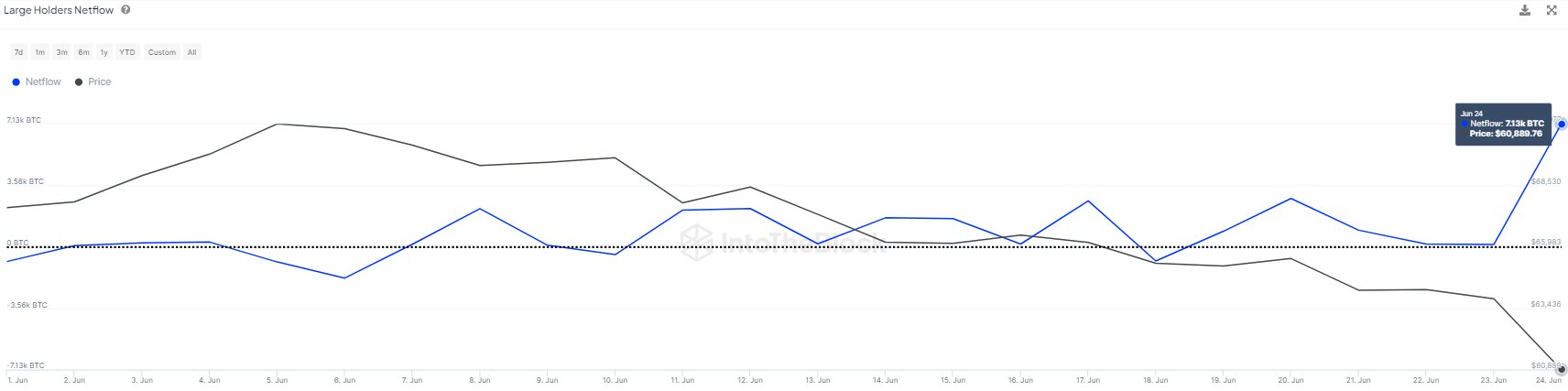

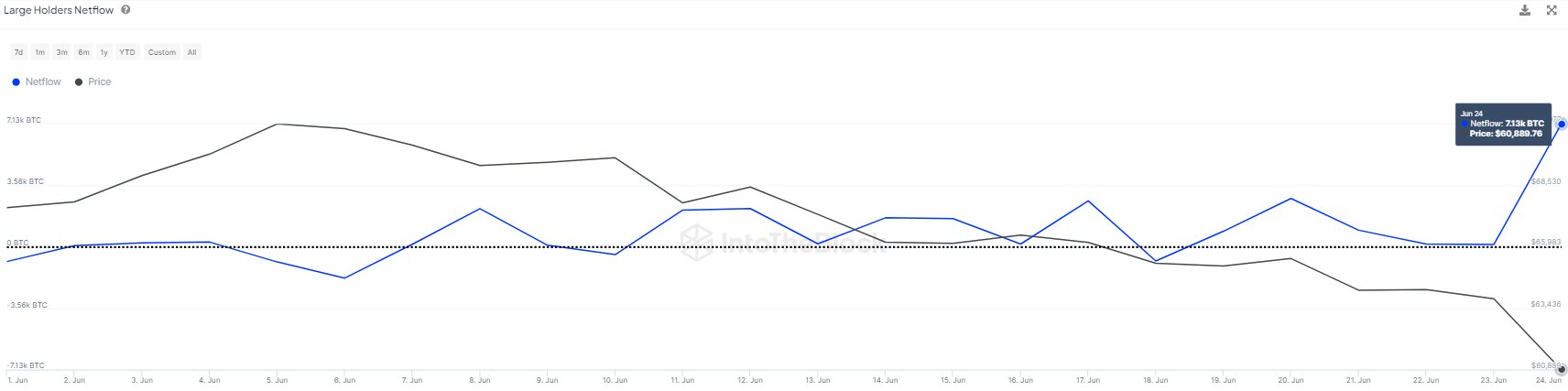

Complementing these technical analyses, information from on-chain analytics agency IntoTheBlock signifies substantial accumulation by giant Bitcoin holders. According to their report, wallets controlling at the least 0.1% of the whole Bitcoin provide added 7,130 BTC, valued at roughly $436 million, in a single day.

This important web influx marks the very best stage since late May, suggesting that regardless of market fears, uncertainty, and doubts (FUD) institutional buyers are capitalizing on the current worth dip to build up extra Bitcoin.

The mixed insights from Crypto Faibik, Ali Martinez, and IntoTheBlock spotlight a rising sentiment amongst market individuals that Bitcoin’s recent decline is perhaps a precursor to a powerful restoration. The flag sample and on-chain accumulation align with the historic resilience of Bitcoin during times of market worry, suggesting a attainable rally towards $88,000.

On the opposite hand, current stories point out that Morgan Stanley is more likely to approve Bitcoin ETFs on its platform for patrons by August 2024 finish. The report, citing a “very senior source”, has additional fueled optimism over rising institutional curiosity within the flagship crypto.

As of writing, Bitcoin price exchanged arms at $61,254.19, noting a flat change from yesterday. Furthermore, the crypto has touched a low of $58,601.70 within the final 24 hours, with its buying and selling quantity hovering over 32% to $37.15 billion.

Also Read: Metaplanet Creates Offshore Arm for Enhanced Bitcoin Strategy

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.