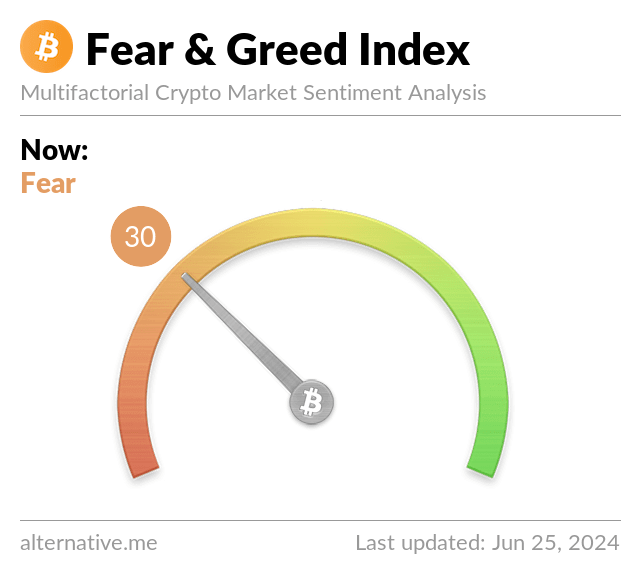

- Crypto Fear and Greed Index is presently in the “fear” zone with a rating of 30.

- This is the lowest sentiment measure for Bitcoin (BTC) in almost 18 months.

The Crypto Fear and Greed Index, a measure of market sentiment for Bitcoin (BTC) and the broader crypto market, has dropped to 30, the lowest rating it has reached in over one and half years.

While BTC has traded decrease in the course of the present market cycle and the Crypto Fear & Greed Index has fallen into the “fear” zone, that is the primary time it has executed so since January final yr.

Crypto Fear & Greed Index drop to 30

As Bitcoin price slipped below $60,000 on Monday, June 24, the index rating nosedived greater than 20 factors to drop into the “fear” zone.

The decline means the Bitcoin Fear & Greed Index is presently trending at ranges final seen in January 2023. At the time, Bitcoin value was buying and selling round $17,000 after the market response to the trade’s most surprising collapse to this point – the implosion of the FTX crypto alternate.

In May this yr, Bitcoin value fell to lows of $56,500 and the index’s rating dipped from impartial to worry.

A bounce in value noticed sentiment enhance considerably to push the Fear & Greed Index to 74. “Greed” dominated then as Bitcoin broke above $71k, however that rating flipped impartial and inside hours on June 24, reached the 30 mark.

Mt. Gox repayments and German authorities promoting

Catalysts for the most recent declines embody the Mt.Gox repayments information.

A discover on Monday indicated that the alternate will start repaying prospects who’ve waited for the reason that 2014 hack. Mt.Gox prospects will obtain Bitcoin and Bitcoin Cash.

Over $8.5 billion price of BTC is with the alternate’s trustee. In April, analysts at K33 Research warned that Mt.Gox’ Bitcoin repayments might influence costs.

Also attracting detrimental sentiment is the promoting of Bitcoin by the German authorities. After sending 1,700 BTC to exchanges final week, together with Coinbase and Kraken, Germany is at it once more.

On Tuesday, Lookonchain shared on-chain knowledge monitoring wallets linked to the 50,000 BTC seizure the German authorities made early this yr. The particulars present one other 400 BTC deposited in CEXs.