The once-sizzling crypto market continues to sputter, with Bitcoin, the undisputed king of the digital realm, main the retreat.

After a euphoric climb that noticed it breach the $73,000 degree earlier this 12 months, Bitcoin has shed its royal cloak, plummeting to new lows and dragging the complete crypto ecosystem right into a interval of frosty uncertainty.

Related Reading

Exodus From The Empire: Investors Pull Billions

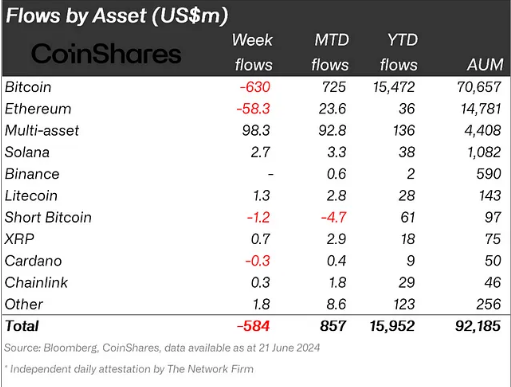

The previous weeks have been marked by a mass exodus from Bitcoin. Investors, spooked by the extended value droop, have been fleeing the flagship cryptocurrency in droves. A current report by CoinShares paints a bleak image, revealing a staggering $630 million outflow from Bitcoin simply final week.

This follows a equally hefty outflow of $631 million the week prior, marking a brutal two-week stretch for Bitcoin. The hemorrhaging extends past Bitcoin, with different outstanding cryptocurrencies like Ethereum experiencing their very own investor flight.

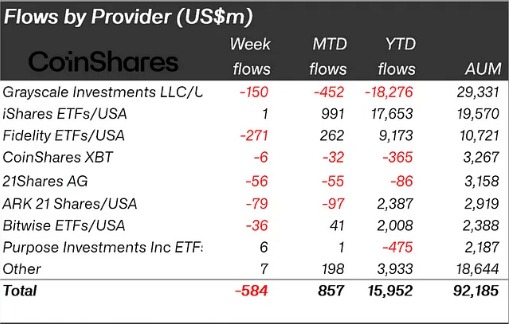

The sell-off isn’t confined to particular person holdings. Bitcoin exchange-traded funds (ETFs), which permit conventional traders to dabble in crypto with out immediately proudly owning it, have additionally been hit arduous.

Major issuers like Fidelity and Grayscale have witnessed a six-day consecutive outflow, with tons of of tens of millions of {dollars} vanishing from their coffers. This mass exodus from each Bitcoin and Bitcoin ETFs paints a transparent image: traders are shedding religion, searching for shelter from the crypto storm.

A Chink In The Armor? Not Quite

While the general sentiment is undeniably bearish, there are just a few glimmers of hope amidst the gloom. Short positions, which basically guess on a value lower, have seen a shocking decline of $1.2 million.

This could possibly be interpreted as a lower in bearish bets, hinting at a possible shift in investor sentiment. Additionally, some altcoins like Solana, Litecoin, and Polygon have defied the downward pattern, registering wholesome beneficial properties. This means that not all bets are off the desk, and a few traders is likely to be searching for alternatives in different corners of the crypto market.

A Crypto Winter Thaw Or Avalanche?

The crypto market is not any stranger to dramatic fluctuations. Bitcoin itself has a historical past of epic boom-and-bust cycles. However, the present downturn raises considerations a few extended “crypto winter” – a interval of sustained decline.

Related Reading

Meanwhile, the much-anticipated approval of an Ethereum ETF, initially seen as a possible market catalyst, appears to be doing little to dispel the present chill.

Will traders regain their urge for food for digital belongings, resulting in a Bitcoin-fueled thaw? Or will the present outflow snowball right into a full-blown avalanche, burying the crypto market beneath a blanket of crimson? The unfolding of this crypto winter stays to be seen.

Featured picture from Silktide, chart from TradingView