Crypto market noticed bears progressively taking up bulls, with the market cap tumbling from $2.35 trillion to $2.26 trillion within the final 24 hours. Crypto buyers misplaced $160 billion in internet wealth in per week as market sentiment slips to “Neutral” in the present day. The crypto market concern and greed index continues to slip from 76 (excessive greed) final month to 51 (impartial) on June 24.

Bitcoin value plunges greater than 3% to a 24-hour low of $62,258 amid continued promoting stress and uncertainty. Traders eye BTC price to slide beneath $61,000, the help stage it hit in April and May as properly. BTC spot and derivatives merchants look extraordinarily bearish resulting from a give attention to U.S. PCE inflation information and month-to-month choices expiry.

Ethereum value additionally tumbled 4% within the final 24 hours, making the month-to-month drop to over 10%. ETH price is at present buying and selling at $3,366 with a buying and selling quantity rising 73% as buyers liquidated their holdings.

Altcoins akin to Solana, XRP, Toncoin, Dogecoin, Cardano, and Shiba Inu tumbled 3-6% within the final 24 hours. Meme cash and AI cash are witnessing huge selloff, resulting in correction within the crypto market. dogwifhat (WIF) leads with a 14% fall up to now 24 hours.

Crypto Market Nears Crash As Traders Brace For Macro Events

Coinglass information signifies the favored cryptocurrencies recorded a liquidation of $170 million in the present day, with $127 million liquidated within the final 12 hours. Over 70k merchants had been liquidated, with the biggest single liquidation order occurred on crypto trade BitMEX after a whale offered XBTUSD valued at $10 million.

Over $80 million in lengthy positions in BTC, ETH, SOL, DOGE, NOT, ORDI, PEOPLE, WIF, PEPE within the final 4 hours resulting from uncertainty available in the market. This has triggered the crypto market to bleed in the present day.

Per week in the past, CoinGape warned about BTC price crash doubtlessly to the $57k stage close to the month’s finish resulting from key macro occasions and choices expiry. Investors are bracing for each US PCE and month-to-month choices expiry on Friday, anticipating a pointy correction earlier than the date because the Fed eyes solely single price cuts this yr. Moreover, key macro occasions akin to ISM manufacturing information, Fed Chair Powell speech, the FOMC assembly launch, and jobs and unemployment price information are due within the first week of July.

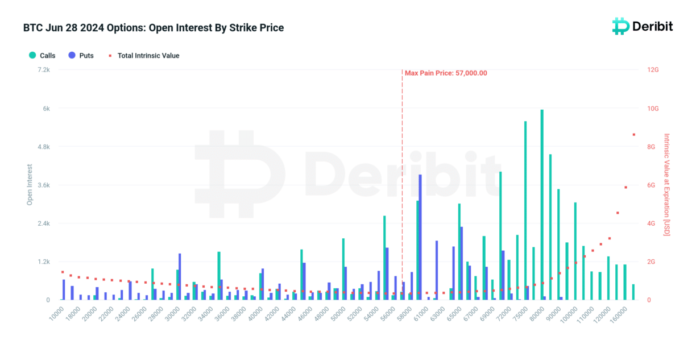

Over 105K BTC options of notional worth $6.72 billion are about to run out on June 28, per the biggest derivatives trade Deribit. With a put-call ratio of 0.52 and the max ache level at $57,000, Bitcoin value is extra more likely to stay underneath promoting stress.

Also Read: Big Capital Rotation Into Altcoins to Begin In Two Weeks, Predicts Analyst

Analyst Predicts Bitcoin Price Drop To $50K

Markus Thielen, founding father of crypto analysis firm 10x Research, mentioned it’s the time to make robust choices as BTC value motion appears to be like weak amid steady outflows from spot Bitcoin ETFs. He predicts Bitcoin may crash to $50,000 resulting from double prime sample formation. The key help stage is at $60,000.

#Bitcoin Double Top? Is It Time to Panic? How Low Prices Could Plunge? https://t.co/UOr9cWTisg pic.twitter.com/rtoTDf14E7

— 10x Research (@10x_Research) June 24, 2024

BTC on-chain information and different analysts have additionally pointed to weaker BTC value motion within the coming weeks. The considerations round huge selloffs by dumb cash have risen, which may push BTC a lot decrease.

Also Read: ETH Price Reversal Soon As Ethereum ETF Coming In Two Weeks

The offered content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.