The Chainlink value has dropped greater than 3% at present, sparking speculations over the potential causes behind the latest dip. Although the broader market has declined at present, together with main cryptos like Bitcoin, Ethereum, Cardano, and others, it seems another components in play have triggered volatility in LINK value.

So, right here we discover the potential causes past market traits that will have induced the latest volatility in LINK value.

Chainlink Price Slips Amid Massive Token Unlock

Chainlink’s value dip at present follows a major token unlock occasion. Notably, a latest report confirmed that Chainlink has unlocked 21 million LINK tokens, price roughly $295 million, from non-circulating provide contracts.

According to Spot On Chain, the unlock has launched a considerable variety of tokens into the market, elevating considerations about elevated provide and its potential affect on costs. This growth may sign additional declines in LINK’s value within the close to future.

Meanwhile, token unlocks typically enhance the circulating provide of a cryptocurrency, which might put downward strain on its value. This inflow of latest tokens can dilute present holdings, making every token much less helpful.

On the opposite hand, token burns, which scale back the general provide, are likely to have the alternative impact by doubtlessly growing the worth of the remaining tokens.

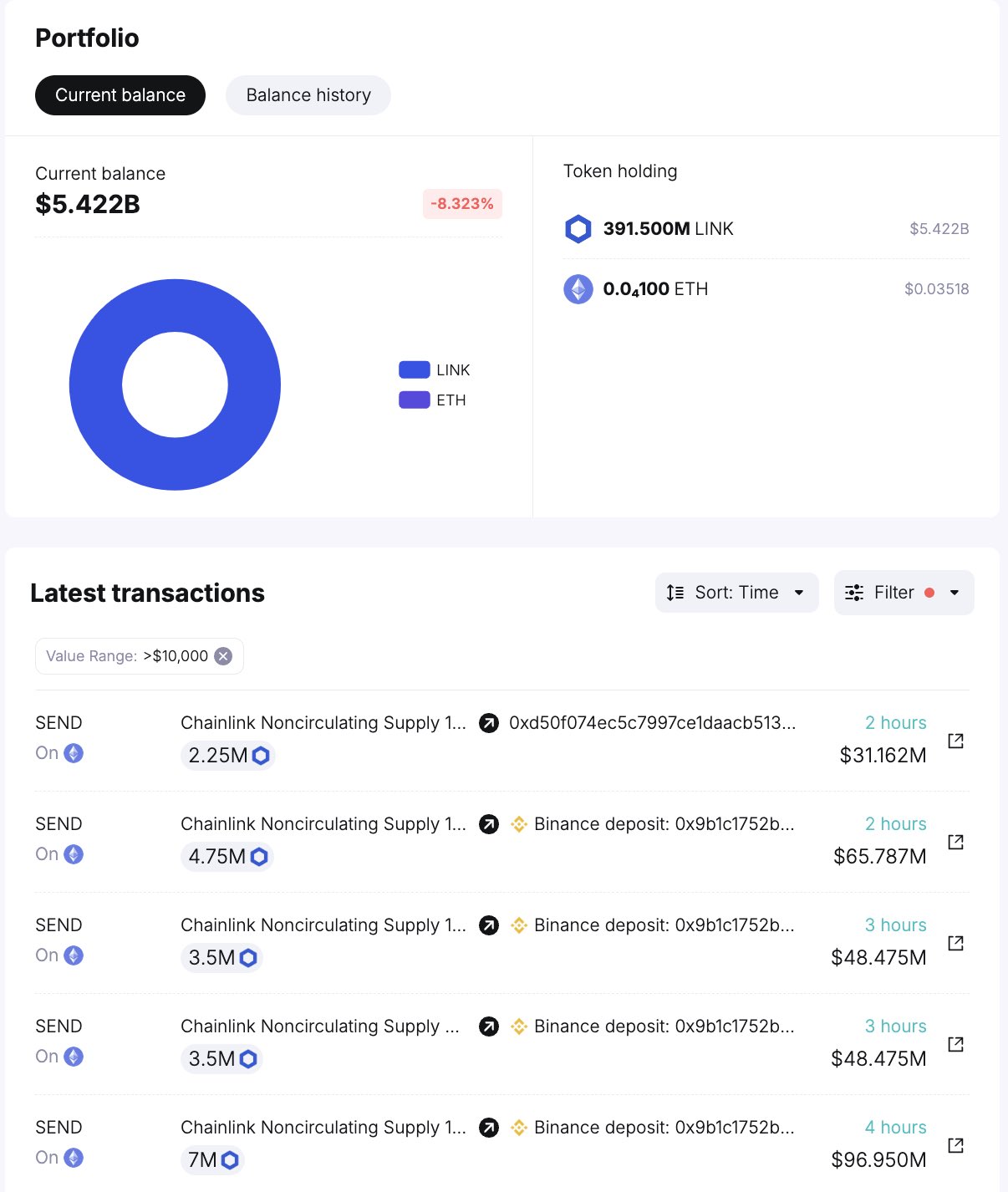

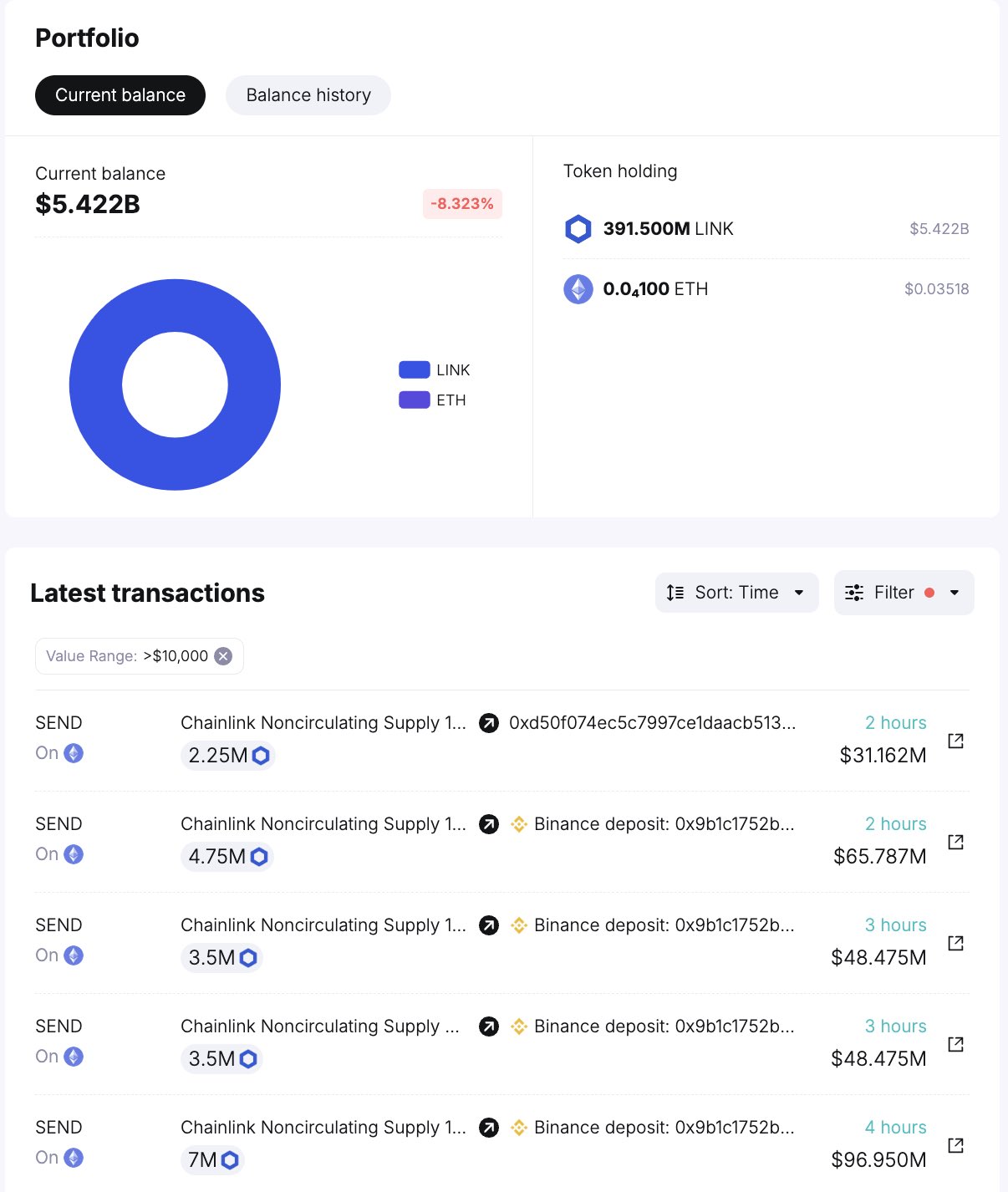

Notably, at present’s unlock concerned the switch of 18.25 million LINK, price $264 million, to Binance, and one other 2.25 million LINK, valued at $31.3 million, to a Multisig pockets recognized as 0xD50f. This large-scale motion of tokens has doubtless contributed to the promoting strain on LINK.

In addition, Spot On Chain’s report highlights that Chainlink has unlocked a complete of 127 million LINKs since August 2022. Besides, 107.7 million of these tokens have been despatched to Binance at a median value of round $9.89 per LINK.

Currently, 391.5 million LINK, price $5.4 billion, stays locked throughout 24 contracts. However, regardless of these unlocks, LINK’s value has typically remained steady post-unlock, however at present’s market response suggests renewed considerations.

Also Read: US Bitcoin ETF Records $545M Outflow, BTC Dip To $60K Imminent?

What’s Next?

The latest unlock of LINK tokens has not solely added to the circulating supply but in addition sparked a wave of hypothesis amongst buyers and analysts in regards to the future value trajectory of Chainlink. The substantial enhance in obtainable tokens usually results in heightened promoting strain as buyers anticipate a possible decline in worth.

Although at present’s decline in LINK’s value aligns with broader market traits, the particular timing of the token unlock exacerbates its affect. The added provide from the unlock may overshadow any optimistic market sentiments or technical developments within the quick time period, retaining downward strain on the value.

While Chainlink’s value has sometimes managed to stabilize following earlier token unlocks, the market’s present response underscores the significance of monitoring such occasions. As of writing, LINK price was down 3.23% and exchanged fingers at $13.80.

In addition, its buying and selling quantity soared 22% to $320.884 million, whereas the crypto touched a excessive of $14.58 within the final 24 hours. However, regardless of the latest value dip, Chainlink Open Interest (OI) soared 1.74% to $179.02 million.

Also Read: PEPE Coin (PEPE) Price Bounces From Crucial Support Levels, A Do or Die Ahead

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.