Bitcoin value has confronted immense promoting stress these days, as witnessed by its current dip. As of writing, the BTC value has slipped under the $64,000 degree, sparking considerations over a possible crash to $60K, and even under that.

Meanwhile, amid this, traders are searching for potential causes behind the sluggish buying and selling and the dip in BTC value. So, let’s take a fast tour of the highest three causes which might be seemingly driving the Bitcoin value dip right now.

Why Is Bitcoin Price Falling?

The current market sentiment signifies that the traders are staying on the sideline. A flurry of causes seems to have weighed on the risk-bet urge for food of the traders, doubtlessly impacting the BTC value in addition to the broader crypto market.

Here are the highest three causes behind the current Bitcoin value dip:

Bitcoin Options Expiry

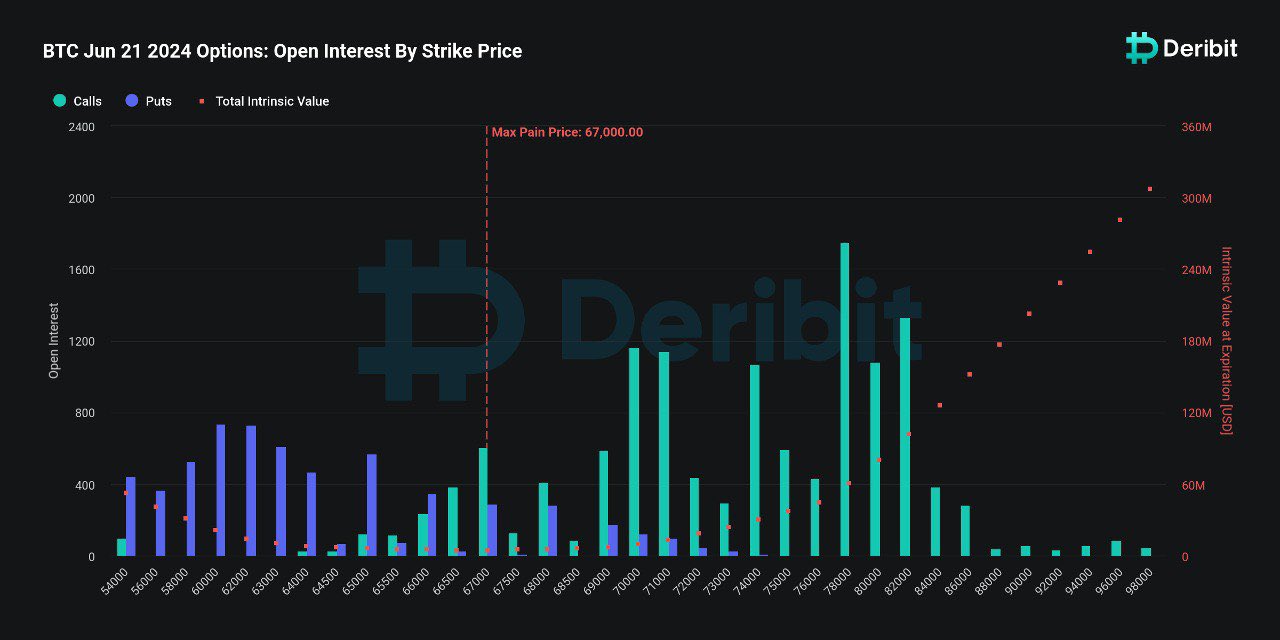

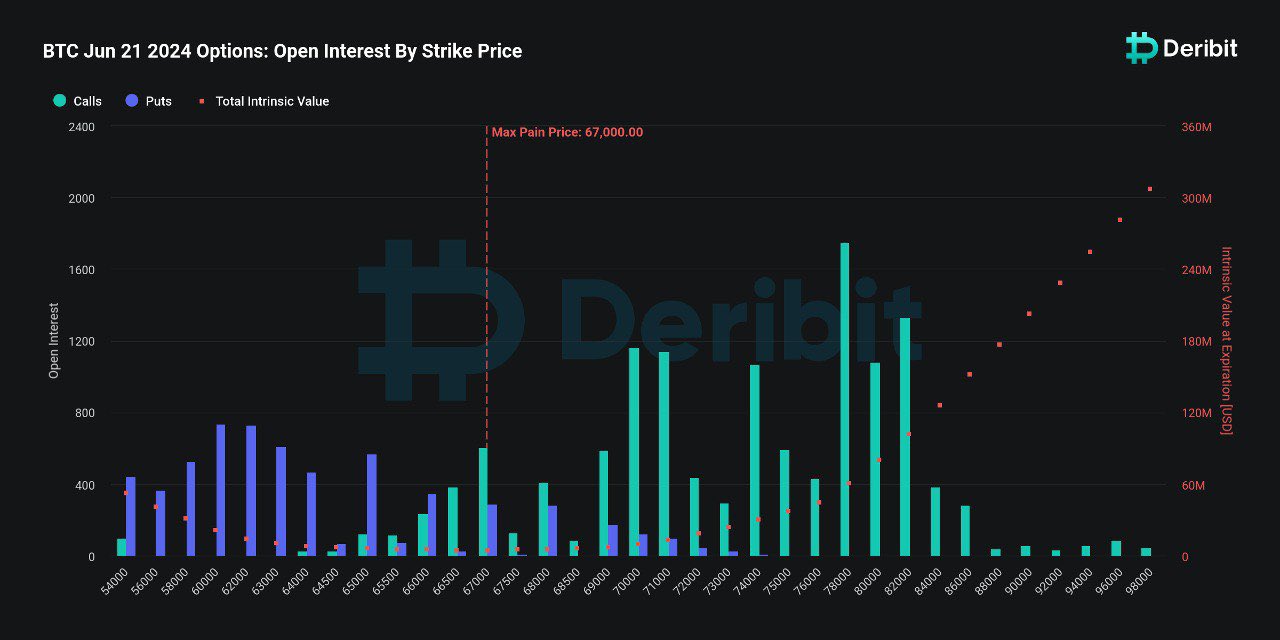

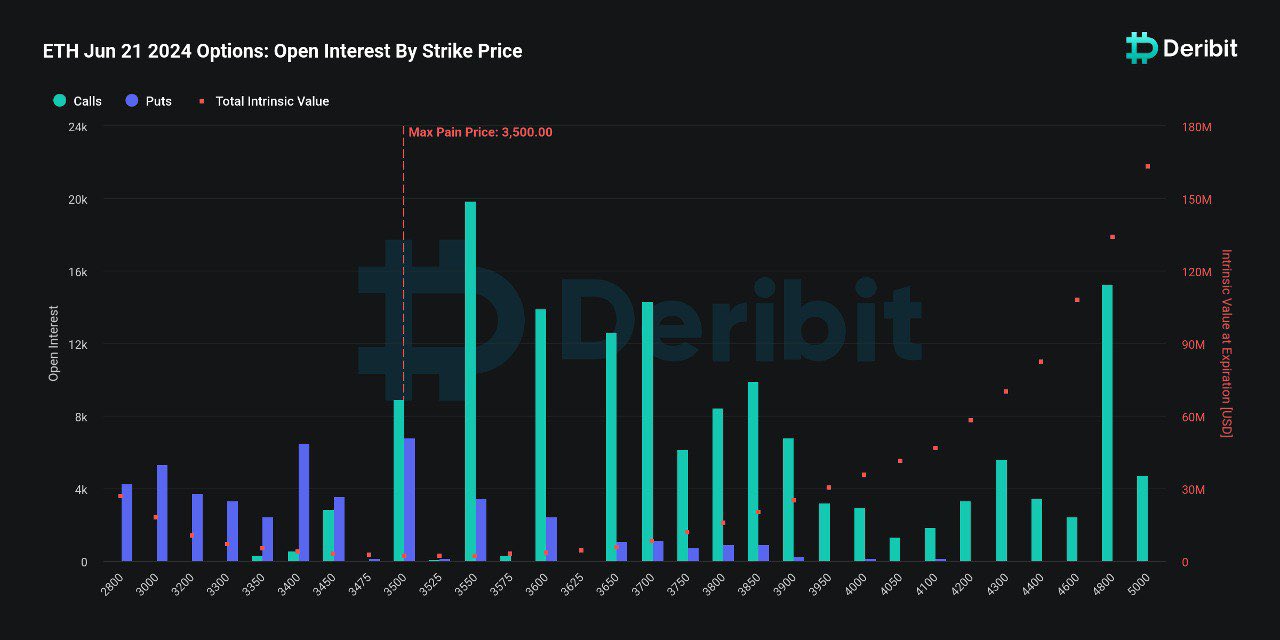

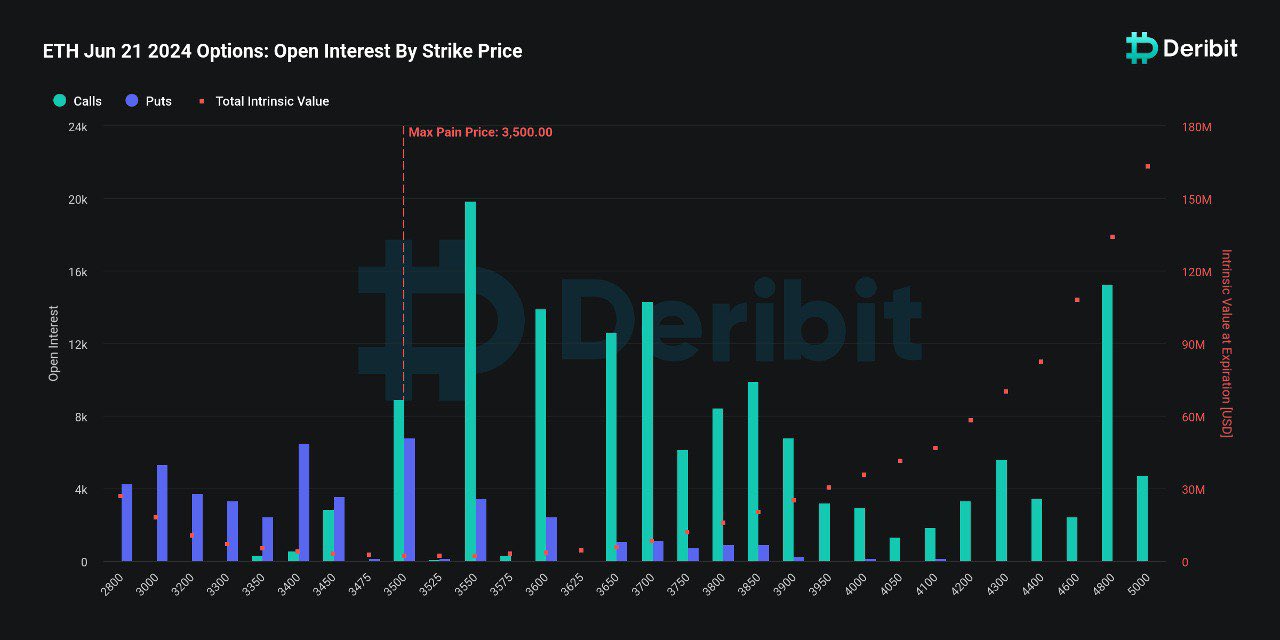

Bitcoin’s value dipped right now amid the looming expiration of $1.96 billion value of Bitcoin (BTC) and Ethereum (ETH) choices. This substantial expiry, involving $1.26 billion in Bitcoin choices with a put-to-call ratio of 0.46 and a max ache level of $67,000, has heightened market volatility.

On the opposite hand, Ethereum’s expiring choices, valued at $693.37 million with a put-to-call ratio of 0.32 and a max ache level of $3,500, additional contribute to the uncertainty. The anticipated market actions surrounding these expirations are influencing merchants and traders, prompting nearer scrutiny of value developments.

Usually, the market faces heightened volatility through the choices expiry. However, regardless of the anticipated short-term volatility, the choices expiry usually supplies stability out there in the long term.

US PMI Impact

The U.S. PMI by S&P Global, a month-to-month survey of enterprise actions that tracks the manufacturing and companies sector, is scheduled to be launched later right now. The traders will preserve an in depth monitor of the information for readability on the U.S. financial well being. Notably, this knowledge may form the long run trajectory of the broader monetary market, not to mention the Bitcoin value.

Notably, in May, the S&P Global Composite PMI elevated at a speedy tempo to 54.5 from 51.3 within the prior month. Besides, the U.S. Manufacturing PMI elevated to 51.3 final month from 50 in April.

However, the upcoming S&P Global U.S. Services PMI knowledge for June is predicted to indicate a slower enlargement of 54 from 54.8 in April. In addition, the manufacturing PMI can be anticipated to edge decrease to 51 in June. It’s value noting {that a} studying over 50 signifies an enlargement within the sector’s business-related actions.

Meanwhile, with the current macroeconomic pressures and the U.S. Fed sticking to their coverage fee plans, the Bitcoin value has famous gloomy buying and selling. Having stated that, right now’s S&P Global PMI knowledge would play an important function in shaping the way forward for Bitcoin.

Also Read: Bitcoin Whale Activity, Germany’s $3 Billion BTC Holdings on Radar

Bitcoin ETF Outflow

The U.S. Spot Bitcoin ETF has continued to witness important outflows over the previous few days. After a sturdy influx famous over the previous couple of weeks, the momentum appears to have pale in current days.

On June 20, the U.S. Spot Bitcoin ETF famous an outflow of practically $140 million, led by GrayScale’s GBTC with $53.1 million outflux. This week, the overall outflow totaled about $440 million by Thursday.

Bottom line

Bitcoin’s value faces continued stress, as famous by outstanding crypto analyst Rekt Capital. Despite current makes an attempt to get better, Bitcoin encountered a powerful rejection from the Lower High resistance, suggesting the cryptocurrency isn’t prepared to interrupt its June downtrend. In different phrases, Rekt Capital anticipates extra decline in Bitcoin value, indicating a dip in direction of $60,000, earlier than an additional reversal.

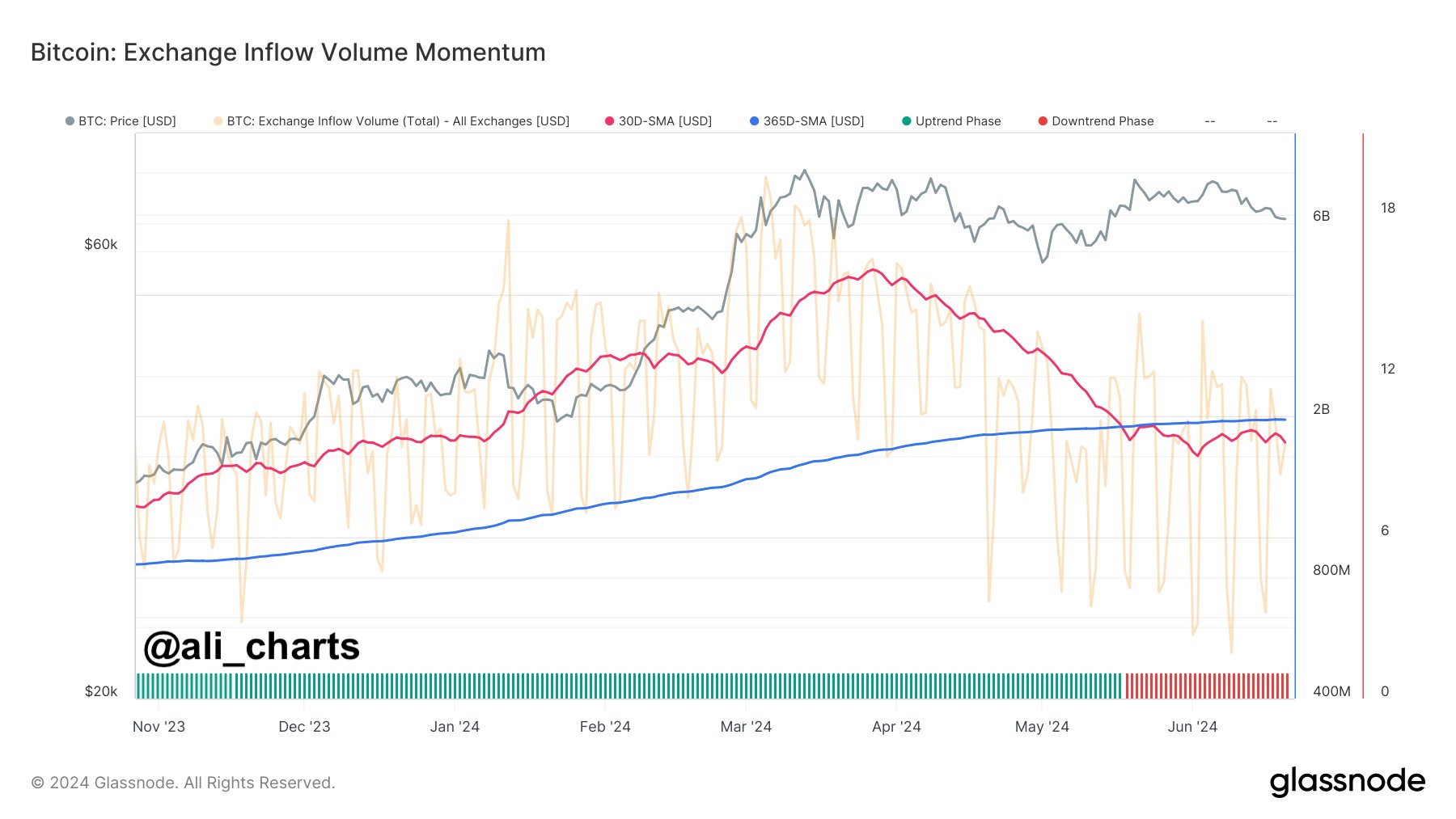

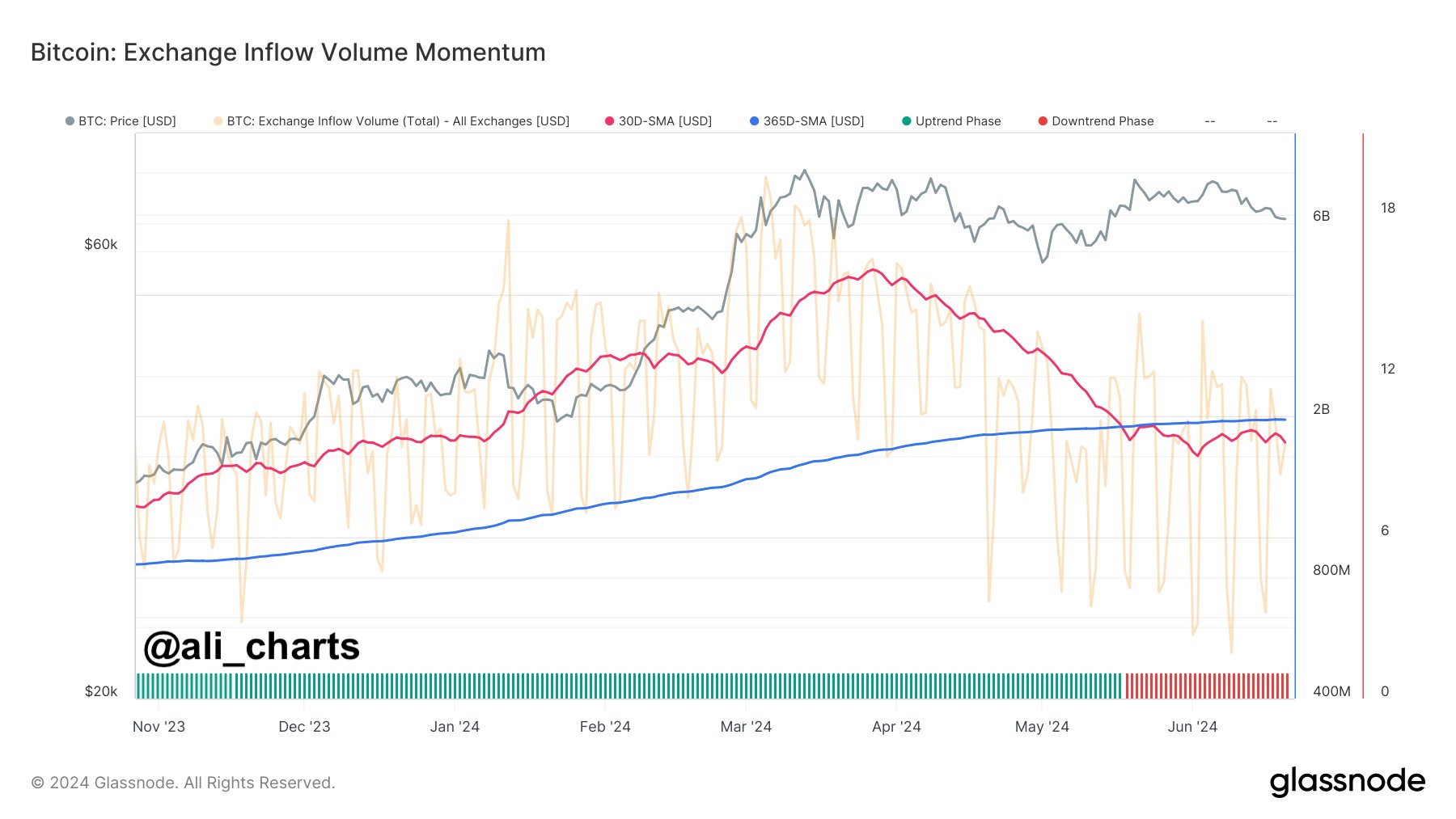

Similarly, analyst Ali Martinez noticed a downturn in exchange-related on-chain exercise, highlighting decreased investor curiosity and community utilization. This decline in exercise additional alerts that Bitcoin would possibly stay subdued till market sentiment shifts and exercise picks up once more.

Both analysts recommend monitoring these resistance ranges and on-chain metrics intently for indicators of a development reversal within the close to future. Besides, Ali Martinez has beforehand stated that if Bitcoin fails to remain above $66,254, BTC may see a possible correction to $61,000.

As of writing, Bitcoin price fell practically 3.6% and traded at $63,5887.92, whereas its buying and selling quantity rose 31.74% from yesterday. Besides, the Bitcoin Futures Open Interest plummeted 1.95% over the past 24 hours and 0.75% within the four-hour timeframe to 532.30K BTC or $34.05 billion.

Also Read: Binance Enables USDT Integration on TON Network, TON Price Rally Ahead

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.