The cryptocurrency market is at the moment experiencing important turbulence, prompting a shift in investor habits in the direction of Bitcoin, which has historically been seen because the most secure asset inside the digital foreign money ecosystem.

Related Reading

Flight To Safety: Bitcoin’s Rising Dominance

In instances of market uncertainty, traders usually gravitate in the direction of what they understand as safer property. This habits is clear within the current crypto market dynamics, the place Bitcoin has change into the popular selection for traders seeking to climate the storm.

The broader market sell-off, which noticed a staggering $110 billion in market worth vanish in only one week, has notably impacted altcoins. Projects akin to Akash Network, Floki, and Chiliz have skilled important declines, every plummeting over 30%.

The Appeal Of Bitcoin

Bitcoin’s enchantment lies in its established monitor file and perceived stability in comparison with newer, extra unstable altcoins. This notion has pushed many traders to hunt refuge in Bitcoin, whereas altcoins are left uncovered to harsh market situations. This shift in choice underscores a broader perception that Bitcoin provides a safer haven in periods of market misery.

Long-Term Perspective On Bitcoin’s Dominance

Despite Bitcoin’s present dominance, some analysts advise warning. Jelle, a seasoned crypto dealer, means that Bitcoin’s dominance may not be sustainable in the long term.

#Bitcoin dominance continues to lose steam as worth consolidates proper under all-time highs.

Almost as if #Altcoins will outperform as quickly as BTC breaks out.

Almost. pic.twitter.com/tjVOaUHskm

— Jelle (@CryptoJelleNL) June 17, 2024

He argues that altcoins, with their modern options and potential for important progress, might reclaim their misplaced floor as soon as Bitcoin surpasses its earlier all-time excessive of $74,000. This perspective highlights the cyclical nature of the crypto market, the place completely different property can outperform at completely different instances.

Market Sentiment And Future Prospects

The broader market’s present downturn has led to a bearish sentiment, with Bitcoin struggling to keep up its footing inside an important help zone round $64,500. The prevailing sentiment is one in every of warning, because the market grapples with uncertainty.

However, there are glimmers of hope on the horizon. Interestingly, whereas the crypto market has been experiencing a decline, tech shares have been performing nicely, marking their seventh consecutive day of beneficial properties. This divergence means that the present downturn is likely to be particular to the crypto market slightly than indicative of a broader financial malaise.

Volatility And Potential Reversals

The infamous volatility of the crypto market signifies that swift reversals are all the time a risk. Historically, digital property have been susceptible to dramatic swings, and what goes down can simply as rapidly return up.

Related Reading

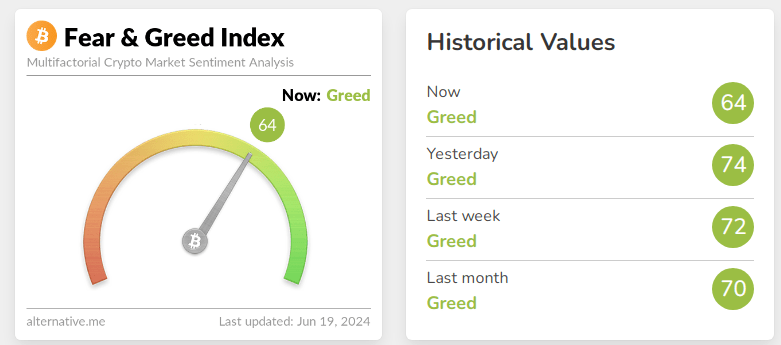

This inherent volatility is each a threat and a possibility for traders. The current uptick within the Fear & Greed Index to 64 signifies that regardless of the sell-off, some traders stay optimistic, exhibiting a level of irrational exuberance.

Featured picture from Photlurg, chart from TradingView