On-chain information exhibits that the Bitcoin taker buy/sell ratio has skilled a major surge on a selected crypto alternate. Here’s the way it might affect the worth of the premier cryptocurrency.

Bitcoin Investors Buying The Dip On This Exchange

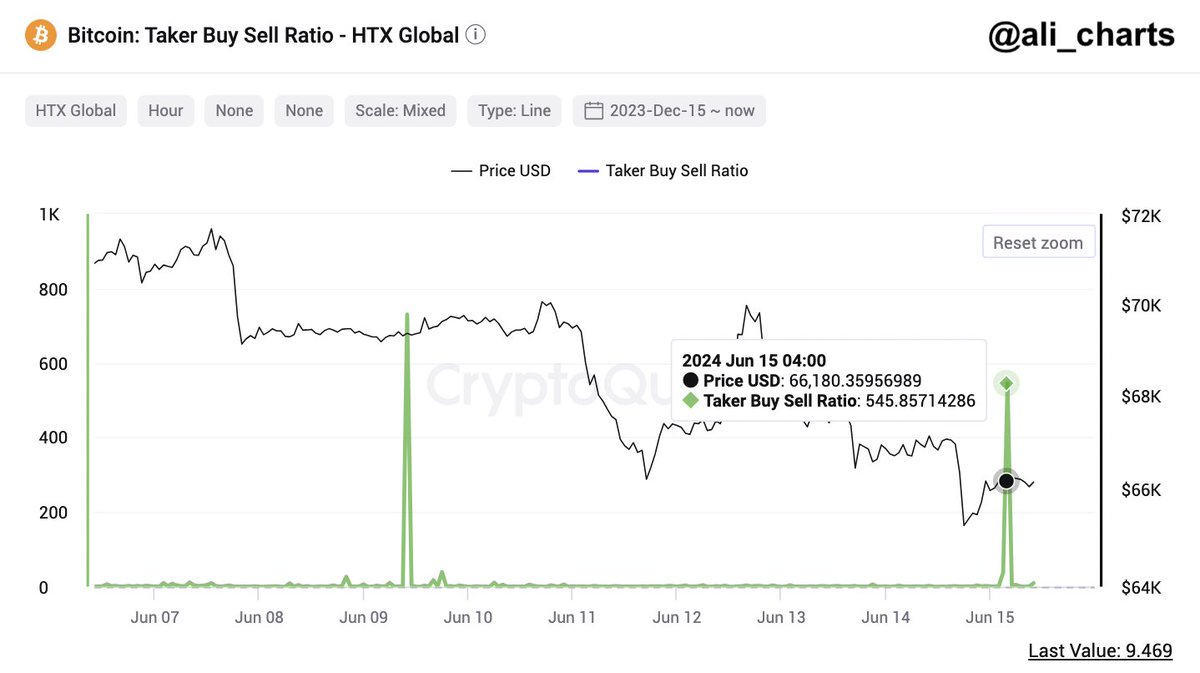

Prominent crypto pundit Ali Martinez took to the X platform to reveal that traders on a selected alternate have been benefiting from the latest fall in Bitcoin value. The related indicator right here is the taker purchase/promote ratio, which measures the ratio between the taker purchase volumes and the taker promote volumes.

Typically, when the worth of this metric is bigger than 1, it implies that the taker purchase quantity is larger than the taker promote quantity on the alternate in query. In this case, extra merchants are willing to buy coins at the next value on the buying and selling platform.

Conversely, when the taker purchase/promote ratio is under 1, it implies that extra sellers are keen to promote cash at a cheaper price, indicating that the promote quantity is bigger than the purchase quantity.

Bitcoin taker purchase/promote ratio | Source: Ali_charts/X

According to information from CryptoQuant, the Bitcoin taker purchase/promote ratio on the HTX Exchange (previously often known as Huobi) just lately skyrocketed to above 545 on Saturday. This suggests a major improve in shopping for strain and a shift in investor sentiment.

Martinez famous in his submit on X that this spike in bullish strain could possibly be a sign of impending upward value motion for Bitcoin. These excessive purchase volumes on the HTX alternate come on the again of BTC’s latest fall to $65,000.

However, it’s value noting that the common Bitcoin taker buy/sell ratio throughout all exchanges continues to be under 1. At the time of writing, the worth of this metric stands round 0.8.

BTC’s Average Mining Cost Surges Above $86,500

The newest information exhibits Bitcoin’s common mining price has soared to $86,668. This determine displays the cumulative bills related to producing one BTC, together with electrical energy, {hardware}, and operational prices.

As highlighted by Ali Martinez in a post on X, each vital improve in BTC’s common mining price is often adopted by a corresponding improve within the coin’s market worth. With this historic context, the most recent improve within the common mining price suggests {that a} value improve could possibly be on the horizon for Bitcoin.

#Bitcoin‘s common mining price is at the moment at $86,668.

And guess what? Historically, $BTC all the time surges above its common mining price! pic.twitter.com/S3UkwgvS3N

— Ali (@ali_charts) June 15, 2024

As of this writing, the worth of Bitcoin continues to hover across the $66,000 mark, with no vital change previously day. According to CoinGecko information, the premier cryptocurrency is down by practically 5% previously week.

The value of BTC on the every day timeframe | Source: BTCUSDT chart on TradingView

Featured picture from Barron’s, chart from TradingView