The cryptocurrency market has seen important adjustments, main many analysts to warning towards investing in altcoins.

Historically, bull markets have seen Bitcoin and Ethereum rise first, adopted by altcoins. However, present circumstances recommend a shift on this sample.

Why Buying Altcoins Now Is Risky

Quinn Thompson, founder of the crypto hedge fund Lekker Capital, advised towards investing in altcoins right now. He pointed to a number of indicators of market instability, together with excessive leverage and open curiosity, an absence of panic-driven shopping for, and stagnant stablecoin provide.

He believes the market is experiencing elevated promoting strain, significantly from enterprise capital funds needing to lift capital, which results in extra promoting than shopping for. This state of affairs, mixed with low summer trading volumes, makes it troublesome for altcoins to achieve traction.

“I think there is serious cascade risk in crypto, and in particular, expect most altcoins to be taken out back. The market seems to have lost any ability to bounce, even in majors, while at the same time, leverage and open interest remains high,” Thompson mentioned.

Thompson recognized two main causes for his stance. First, the influence of Bitcoin and Ethereum exchange-traded funds (ETFs) and the difficulty of altcoin provide inflation.

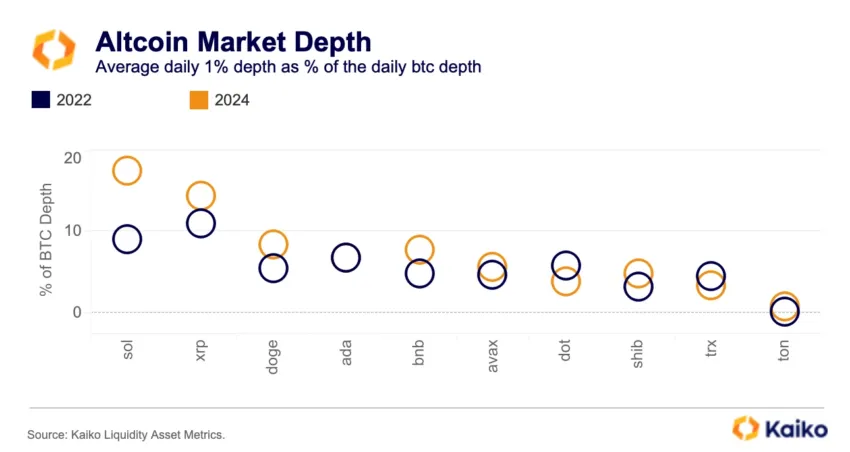

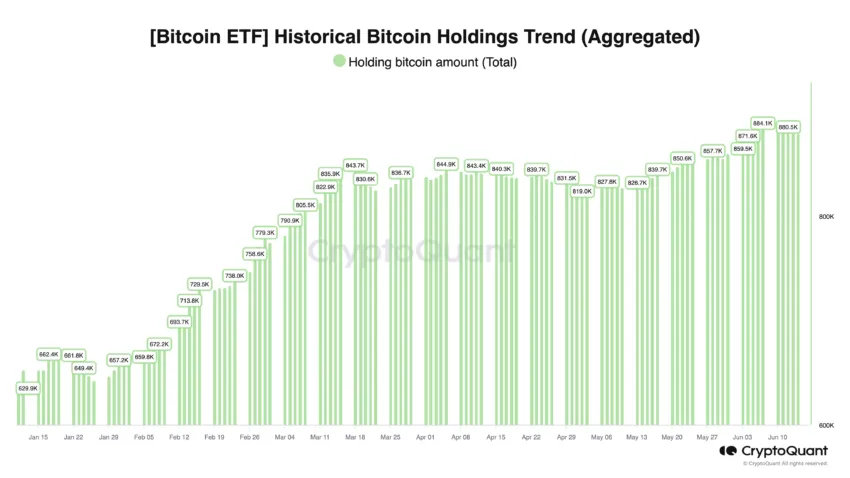

The introduction of Bitcoin and Ethereum ETFs has modified the market construction. In the previous, capital would circulate from main cryptocurrencies like Bitcoin and Ethereum into altcoins during bull markets. However, with over $50 billion now invested in Bitcoin ETFs, these funds would not have related mechanisms for investing in altcoins.

This shift has restricted the capital obtainable to altcoins, making it tougher for them to rise in worth. According to Samara Epstein Cohen, Chief Investment Officer of ETF at BlackRock, conventional market contributors more and more focus on Ethereum for tokenization, which additional sidelines altcoins.

Read extra: How To Invest in Real-World Crypto Assets (RWA)?

The fast launch of new altcoins has additionally flooded the market, creating important inflationary strain. Many tasks release large amounts of tokens aggressively, leading to a provide that far exceeds demand.

Thompson identified that there’s a lack of demand to help the roughly $3 billion of month-to-month altcoin provide inflation anticipated over the subsequent one to 2 years. While some altcoins should still carry out properly, figuring out these profitable tokens can be more difficult than in earlier years.

“Altcoins have a constant stream of sell pressure. As we enter an already low-volume summer period, the combination of significant token supply unlocks and venture capitalists’ sell pressure will likely be too strong of an uphill battle for most tokens,” Thompson concluded.

Meanwhile, Will Clemente, co-founder of Reflexivity Research, mirrored on how the market has matured. In 2020, investing in high-beta altcoins was a profitable technique as these property outperformed Bitcoin. However, this method is now not efficient.

Many altcoins have underperformed Bitcoin in current months, indicating that the market dynamics have modified.

“In 2020, you go out on the risk spectrum, those things are going to have higher beta to Bitcoin and you just get long all the vaporware and all that stuff goes up. We have not seen that this time. A lot of the altcoin to Bitcoin pairs have just been bleeding out for several months now and it hasn’t really been as simple as just buy whatever vaporware altcoin and you’ll outperform Bitcoin,” Clemente emphasised.

Technical analyst Michaël van de Poppe highlighted that Bitcoin is close to or at an all-time excessive, whereas most altcoins haven’t reached their earlier peaks. This discrepancy signifies an absence of confidence in altcoins, which proceed to battle in the present market setting, suggesting that the days of simple beneficial properties from altcoins could also be coated.

Read extra: 10 Best Altcoin Exchanges In 2024

Investors needs to be conscious of the heightened dangers and contemplate new circumstances earlier than making choices in the cryptocurrency market.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. However, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.