The cryptocurrency market has skilled important turbulence not too long ago, elevating questions on the longevity of the present bull market in Bitcoin and altcoins.

Analysts and business insiders provide diversified views on the future of Bitcoin and altcoins, reflecting on market tendencies, macroeconomic elements, and investor habits.

Analysts’ Predictions on Bitcoin, Altcoins

Bitcoin investor Murad Mahmudov highlighted two potential situations for Bitcoin’s future. He urged that if the worth stays above $60,000, the bull market would possibly proceed following the typical four-year cycle.

However, relying on macroeconomic circumstances, a world recession might drive Bitcoin’s worth right down to $30,000.

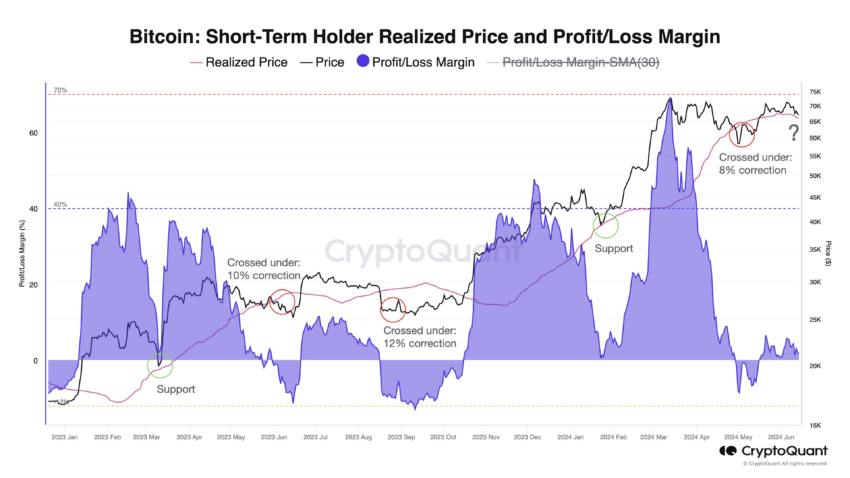

Likewise, Julio Moreno, Head of Research at CryptoQuant, pointed out the excessive likelihood of Bitcoin reaching $60,000. He mentioned that Bitcoin is at a vital worth stage, round the short-term holders’ realized worth of $62,800.

This metric might both present assist or result in an 8% to 12% correction if the worth drops beneath this stage, probably bringing Bitcoin right down to about $60,000.

From a technical perspective, buying and selling veteran Peter Brandt warned that breaking by the $60,000 assist ranges might result in additional declines. He famous {that a} drop beneath $60,000 would possibly see Bitcoin reaching $48,000.

Read extra: Bitcoin (BTC) Price Prediction 2024 / 2025 / 2030

Meanwhile, market analyst Bob Loukas took a extra average stance, predicting a interval of consolidation much like what was noticed final summer time. He emphasizes the chance of a repeated sample, suggesting that persistence could be required as the market stabilizes.

“Last summer’s consolidation, visualized this summer. Not saying it’s going to repeat, but serves as a reminder of what’s possible and the patience that might be needed,” Loukas mentioned.

Will Clemente, co-founder of Reflexivity Research, additionally anticipates a consolidation part. He has adjusted his funding technique, retaining solely core Bitcoin holdings and some different positions.

Clemente believes that whereas Bitcoin would possibly expertise a sideways motion throughout the summer time, there may be potential for larger costs in the fourth quarter, influenced by financial information and Federal Reserve actions.

Regarding altcoins, Andrew Kang, co-founder of Mechanism Capital, expressed warning. He stays not sure if the momentum generated by Bitcoin exchange-traded fund (ETF) approval will prolong to altcoins, notably Ethereum. While Bitcoin would possibly see elevated curiosity, he doubts the identical for Ethereum ETFs.

Read extra: What Is Altcoin Season? A Comprehensive Guide

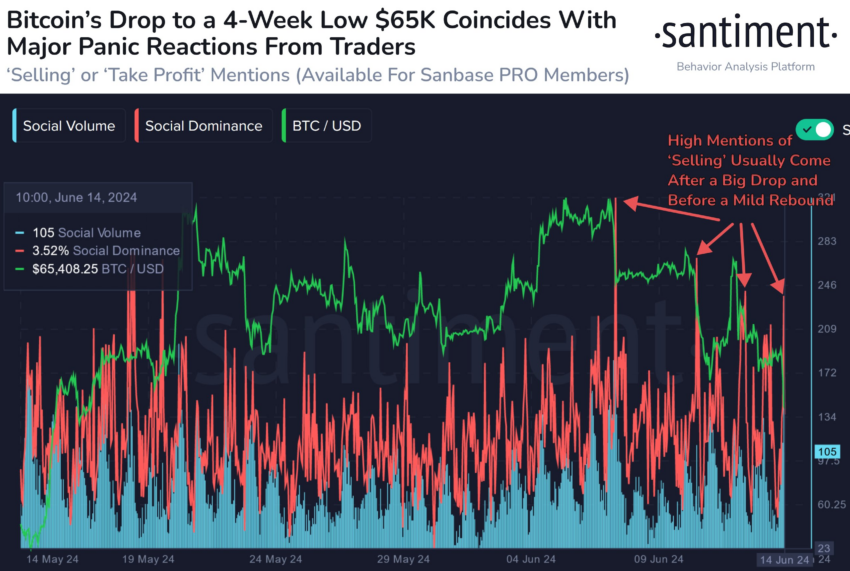

Despite the pessimistic outlook, analysts at blockchain analytics agency Santiment noted the present market sentiment. They observe heightened concern amongst traders as Bitcoin’s worth drops to $65,000. If panic promoting continues, this concern might result in a short lived bounce and a shopping for alternative.

“Spikes in mentions of selling or taking profit are common after a drop, and a temporary bounce and buy opportunity may form if we see continued FUD and panic from small traders,” Santiment defined.

In abstract, the future of the Bitcoin and altcoin bull market is unsure. Potential outcomes vary from important corrections to intervals of consolidation. The route will largely rely on macroeconomic elements and shifts in investor sentiment.

Disclaimer

In line with the Trust Project pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. Always conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.