Bitcoin value latest plunge under $67,000 has sparked discussions amongst buyers, with fears of additional declines looming. Notably, famend analyst and veteran dealer Peter Brandt, who precisely forecasted Bitcoin’s drop to $16,000 in 2022, now cautions that the cryptocurrency may plummet to $48,000.

However, he cited the dip may occur if it fails to maintain crucial assist ranges. Meanwhile, amid the daring forecast and vital choices expiry, all eyes are on Bitcoin’s subsequent transfer.

Analyst Predicts Bitcoin Price Dip To $48K

The latest Bitcoin drop has despatched ripples by the crypto neighborhood. The flagship crypto’s failure to maintain above the $67,000 mark has sparked intense hypothesis about its future trajectory.

Amid this, crypto market professional Peter Brandt, who can be a seasoned dealer with a historical past of correct predictions, has issued a stark warning. In a latest submit on the X platform, he outlined a possible path for Bitcoin’s decline.

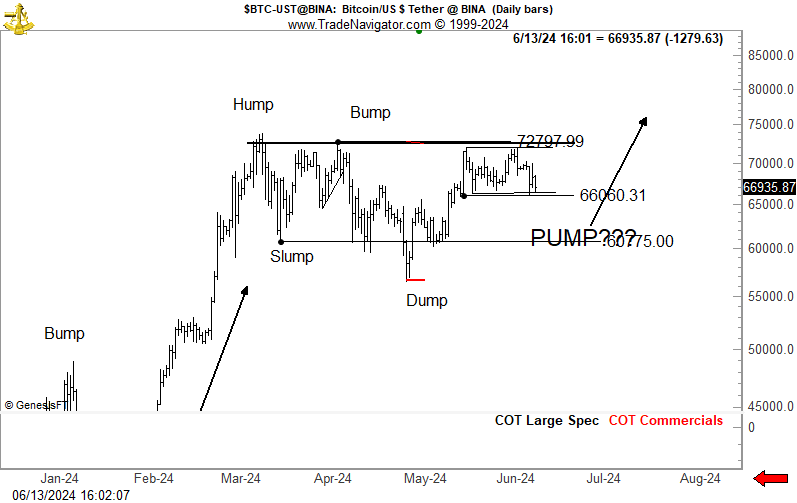

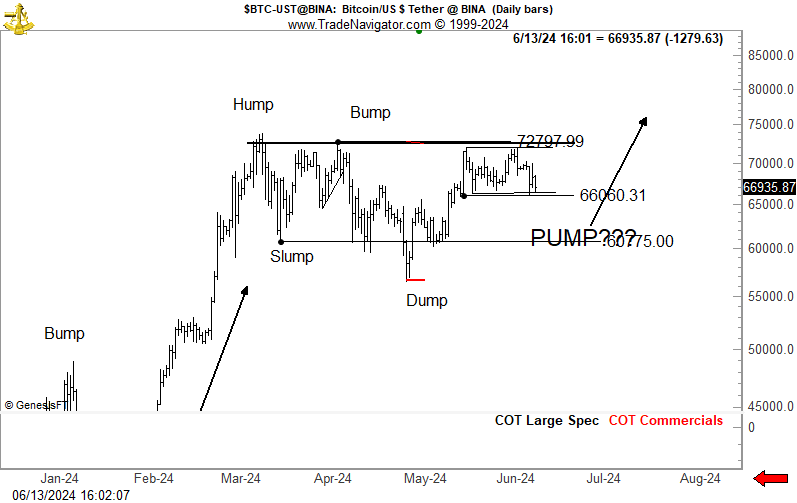

In a latest X submit, Peter Brandt shared a value chart of Bitcoin, whereas noting $65,000 and $60,000 as essential ranges for Bitcoin’s close to future. According to Brandt, a drop under $65,000 may pull the worth in the direction of $60,000. Conversely, a plunge under the $60,000 degree may see Bitcoin fall to $48,000.

However, Brandt says that whereas these are essentially the most simple interpretations, the market might be unpredictable. In this context, he said:

Sometimes the obvious interpretations of a chart work out, more often than not the charts morph.

Also Read: Bitcoin ETF Outflows Hit $228 Million Amid BTC Price Dip, What’s Happening?

Macroeconomic Factors & Options Expiry In Focus

The newest inflation knowledge from the U.S. Labor Department has proven indicators of cooling. For context, May’s Consumer Price Index (CPI) and Producer Price Index (PPI) experiences counsel cooling inflationary pressures in the nation.

Notably, this growth may affect the U.S. Federal Reserve’s method to rates of interest. Having mentioned that, if the Fed adopts a extra dovish stance, it’d supply some reduction to the crypto market. A possible coverage shift may mitigate additional declines in Bitcoin’s value, offering a potential lifeline for buyers.

Meanwhile, one other crucial issue affecting Bitcoin’s value is the latest expiry of 20,000 Bitcoin options on June 14, 2024. Options expiry occasions typically introduce vital volatility as merchants modify their positions. Notably, the utmost ache level for this expiry was set at $68,500, indicating the worth degree at which most choices would expire.

As of writing, Bitcoin price stayed in the purple whereas crossing the transient $67,000 mark. Over the final 24 hours, its value noticed a excessive of $68,337.23 and a low of $66,304.57, reflecting the risky situation in the market.

Furthermore, its buying and selling quantity additionally fell 24.55% to $27.17 billion. However, regardless of a drop in its value, Bitcoin Futures Open Interest rose 0.98% in the final 4 hours to 522.67K BTC or $35.14 billion.

Also Read:

The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.