Spot Bitcoin ETFs within the U.S. witnessed over $100 million influx on Wednesday, June 12, making a reversal from two-day consecutive outflows. It follows as each headline and month-to-month CPI inflation within the United States dropped and traders instantly introduced a rebound in Bitcoin worth, recording a broader crypto market restoration. However, the Federal Open Market Committee (FOMC) signaled a single charge minimize this yr after it held rates of interest unchanged.

Spot Bitcoin ETFs Record Inflow After Two Outflows

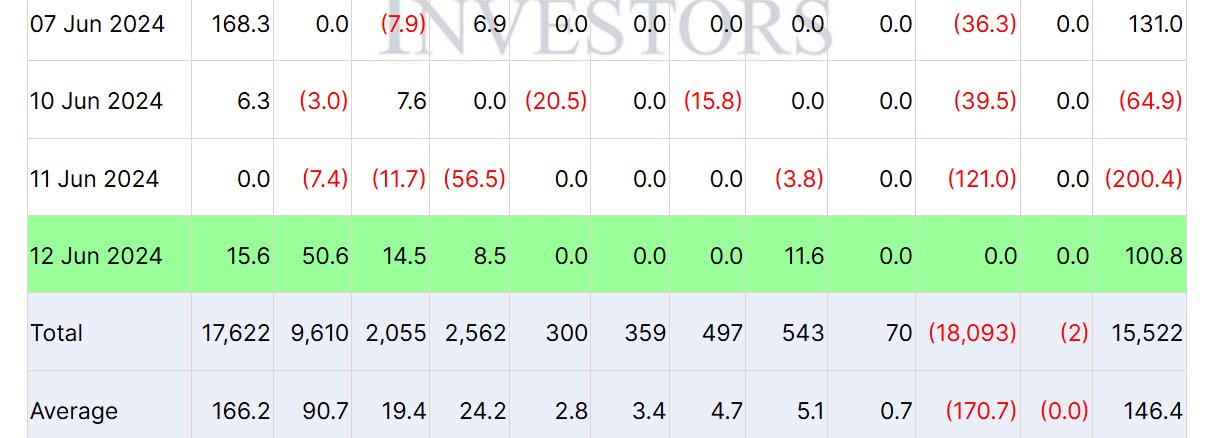

The U.S.-based spot Bitcoin exchange-traded funds (ETFs) recorded a web influx of $100.8 million, as per Bloomberg and Farside Investors information on June 13. The reversal from two consecutive days of outflows to an influx is vital for market sentiment as merchants await key U.S. PPI inflation information on Thursday and Bank of Japan rate of interest resolution on Friday.

BlackRock’s iShares Bitcoin ETF (IBIT) noticed $15.6 million in influx and raised hopes of witnessing enormous inflows within the subsequent few weeks. Following the newest influx, BlackRock’s web influx hit over $17.6 billion and BTC holding climbed to $20.86 billion.

Fidelity Bitcoin ETF (FBTC) led the spot Bitcoin ETF shopping for on Wednesday, recording an influx of $50.6 million. Followed by Bitwise Bitcoin ETF (BITB), VanEck Bitcoin ETF (HODL), and Ark 21Shares (ARKB) Bitcoin ETF with $14.5 million, $11.6 million, and $8.5 million, respectively. Other spot Bitcoin ETFs noticed zero web inflows.

Grayscale Bitcoin Trust (GBTC) additionally recorded zero influx after a web outflow of $237 million within the earlier 4 days. GBTC bought 3434 BTC over the earlier 4 buying and selling days and 335K BTCs since launch.

Also Read: BTC ETF To Impact Price Stability In Long Run

BTC Price To Stay Under $70,000 This Month

Wall Street giants anticipate a Fed charge minimize in September regardless of the FOMC hinting at just one charge minimize, which helped in bringing again shopping for in spot Bitcoin ETFs. In addition, choices merchants even have room to promote BTC forward the month-to-month crypto expiry on June 28. The max ache level for Bitcoin is at $55,000.

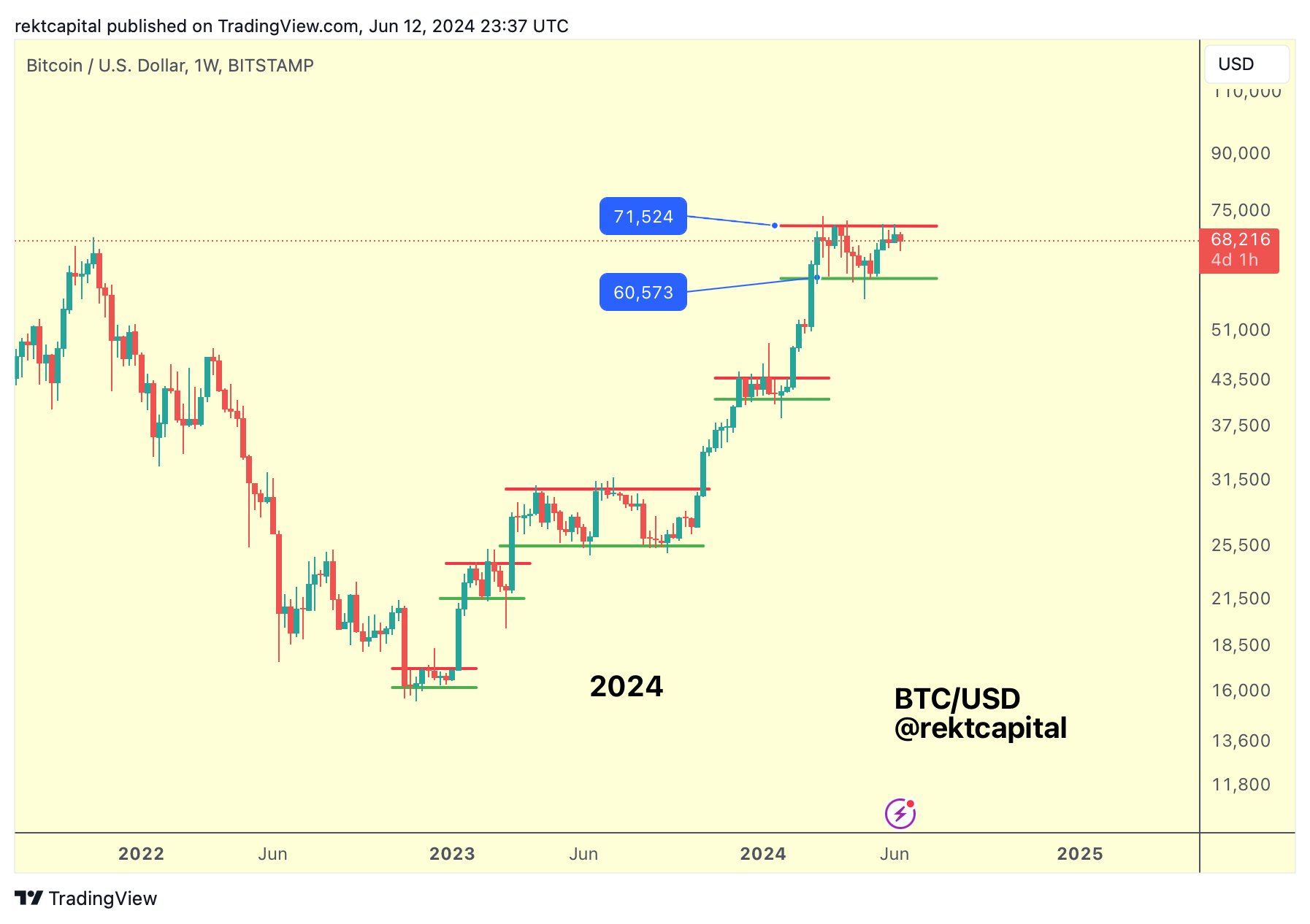

Rekt Capital stated “This cycle has been a cycle filled with Re-Accumulation ranges which inevitably break to the upside over time,” hinting at buy-the-dip alternatives. Whales will not be holding, however buying and selling BTC after the value continues to maneuver in a variety.

BTC price fell once more under $67,500 as merchants adjusted positions based mostly on the Fed’s dovish outlook on charge cuts. The worth is at present buying and selling at $67,559, with a 24-hour high and low of $67,028 and $69,977, respectively. Furthermore, the buying and selling quantity has elevated by 18% within the final 24 hours, indicating an increase in curiosity amongst merchants.

Also Read:

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.