Crypto merchants await cues from the newest US Consumer Price Index (CPI) and core CPI information to find out whether or not it’s time for Bitcoin to hit a brand new all-time excessive or considerations nonetheless prevail. The U.S. Bureau of Labor Statistics will launch CPI inflation information for May hours earlier than the US Federal Reserve’s rate of interest choice on Wednesday, June 12. The information is essential after a higher-than-expected US jobs data final week that scaled again bets on Fed fee cuts.

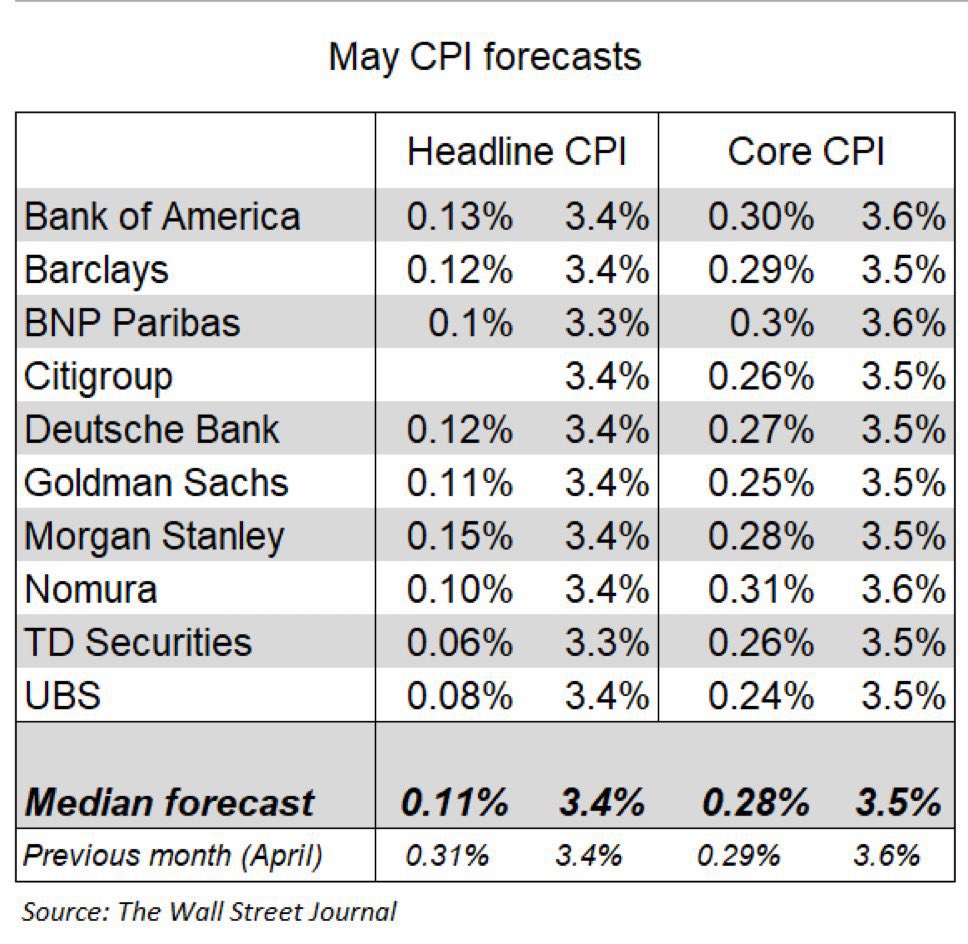

Wall Street giants together with JPMorgan, Bank of America, Goldman Sachs, Morgan Stanley, Citigroup, UBS, Nomura, RBC, and Barclays estimate CPI to come back in line at 3.4%. Meanwhile, BNP Paribas, TD Bank, and Wells Fargo forecast CPI inflation cooling to 3.3%.

As per economists, the annual CPI inflation to come back in line at 3.4%, much like final month. The month-to-month fee seen slowing to 0.1% from 0.3% final month. Also, the annual Core CPI is predicted to fall to three.5% from 3.6% final month and month-on-month core inflation to carry regular at 0.3%, after a significant drop final month.

Both inflation information estimates by Wall Street and economists sign an general optimistic numbers and sentiment for an uptick available in the market. US inventory futures steadied at present as traders braced for double macro occasion of CPI and FOMC. Meanwhile, China introduced its inflation fee falling under estimates.

Bitcoin Traders Eyes Fed Rate Cuts in September

Banks have predicted Fed rate cuts beginning in September. A cooling CPI inflation and PCE inflation to verify September as an official pivot by the Fed. Meanwhile, Fed Chair Jerome Powell stays bullish on the state of the US economic system, nonetheless anticipating three fee cuts, regardless of two indicated by Fed swaps.

The US greenback index (DXY) dropped forward of CPI and Fed fee choice. It’s shifting round 105.22, more likely to drop under 105 after the important thing macro occasions. CPI in keeping with market estimates might elevate bets for a fee minimize in September, doubtlessly lifting Bitcoin worth.

Moreover, US 10-Year Treasury yields (US10Y) pared beneficial properties this week amid optimistic sentiment for market restoration, fading considerations raised after final week’s jobs information. Bitcoin worth strikes in the other way to the US treasury yields and merchants eyeing an additional drop with slowing financial coverage tightening.

Also Read: Why The World’s Largest Bank Called Ethereum (ETH) Digital Oil

Bitcoin Price Rebound Post CPI To Bring Crypto Market Recovery

Bitcoin tends to dump into FOMC and CPI because the crypto market overreacts, which ought to reverse after these occasions. BTC worth is making a wholesome market construction on the larger timeframe and a buy-the-dip alternative, stated analysts. It has fashioned an inverse head and shoulders sample within the decrease timeframe, which might deliver a restoration within the broader crypto market as BTC rises.

Open pursuits are growing as soon as once more to hit all-time highs, however met a tough patch as a result of macro occasions. Total BTC futures open curiosity is at $35.47 billion, with recent hints of shopping for from the underside, as per Coinglass information.

Options market information point out a rebound above $67,500 at present and to surpass $69,000 on expiry day on Friday. Options merchants have wager Bitcoin to hit highs of $75K and even $80K by the tip of June. Traders are bullish after this heavy macro week, as per Deribit.

Meanwhile, spot Bitcoin ETFs noticed a $200 million outflow amid macro considerations. Fidelity, Bitwise, ARK 21Shares, VanEck, and GBTC Bitcoin ETFs recorded outflows on Tuesday.

BTC price is buying and selling at $67,265, down 0.57% within the final 24 hours. The help stage is at $66K, a drop under this may negate the bullish situation within the quick time period. Furthermore, the buying and selling quantity has elevated barely within the final 24 hours, indicating an increase in curiosity amongst merchants.

Also Read:

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.