Bitcoin bulls took the worth to rally over the $71,500 stage after sentiment improved attributable to cooling inflation and bullish technical chart patterns. Bitcoin worth eyes breaking above $72,000, with $1.5 billion in shorts going through liquidation on the stage for a transfer to a brand new all-time excessive of $75,000.

Traders say Bitcoin is at a serious inflection level as indicated by a decline in buying and selling volumes earlier than a $2.2 billion in Bitcoin and Ethereum choices expiry and US nonfarm payrolls and unemployment charge information at the moment.

$2.2 Billion in Bitcoin and Ethereum Options Expiry

The crypto market stays calm on account of $2.2 billion Bitcoin and Ethereum choices expiry, consultants level to a potential selloff or gleam outlook for weeks.

Over 17,493 BTC choices of notional worth $1.24 billion are set to run out, with a put-call ratio of 0.69. The max ache level is $70,000, indicating Bitcoin merchants have room to liquidate positions as promoting strain stay. Implied volatility (IV) witnessing declines throughout all main phrases to 50%, which implies volatility would drag worth down.

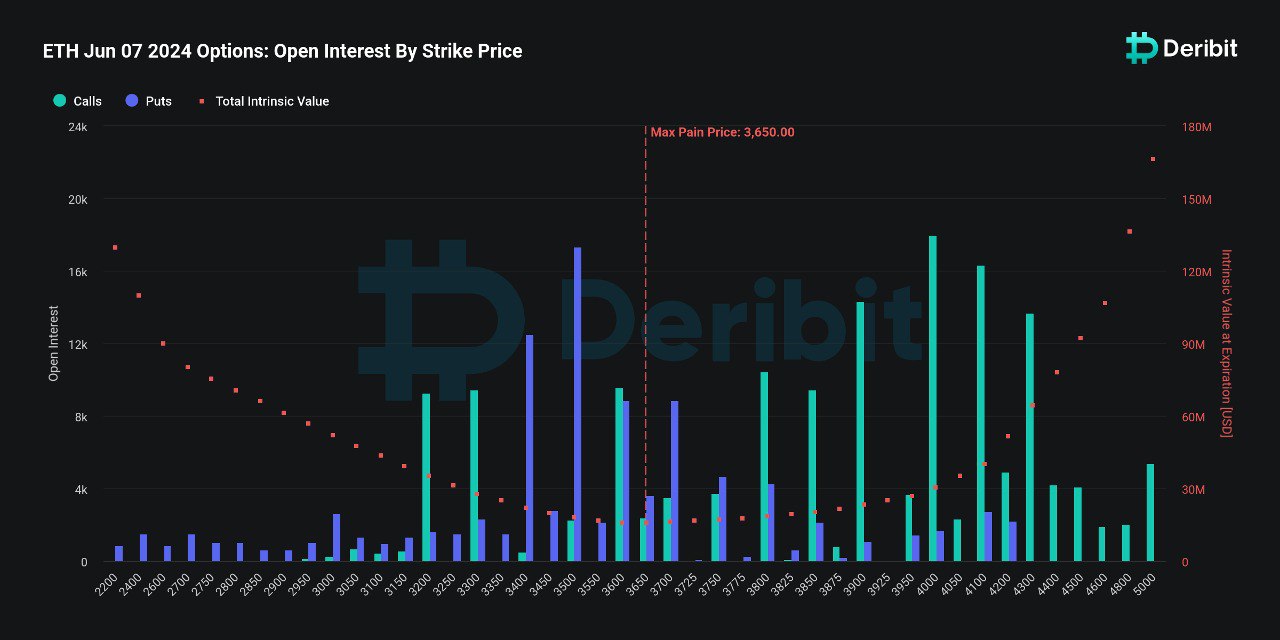

Meanwhile, 260,000 ETH choices of notional worth of just about $1 billion are set to run out, with a put-call ratio of 0.65. The max ache level is $3,650, which can also be decrease than the present worth of $3,813. This signifies merchants nonetheless have room to liquidate and decrease the worth. Keeping an eye fixed on buying and selling volumes is required for additional steerage on ETH worth instructions.

Also Read: Whales Shuffle 318M XRP as Price Holds $0.52 Support

Nonfarm Payrolls and Unemployment Rate

The US Bureau of Labor Statistics to launch nonfarm payrolls and unemployment information at the moment. The US financial system is about so as to add 185K jobs in May 2024, barely greater than 175K in April.

The unemployment charge is predicted to stay regular at 3.9%, holding at two-year highs. Also, wages seemingly rose 0.3% month over month, a small uptick from 0.2% seen in April, however the yearly achieve is seen unchanged at 3.9%.

May jobs data are anticipated to return in robust, regardless of cooling labor market. An improve in unemployment charge above 3.9% will deliver a constructive transfer out there.

Bitcoin Price to Rally to $83,000

BTC price has been shifting sideways for the final 2 days close to $71K as merchants awaited key financial information. The worth at the moment trades at $71,047, with a 24-hour high and low of $70,119 and $71,625, respectively. Furthermore, the buying and selling quantity continues to remain low, indicating a decline in curiosity amongst merchants.

According to 10x Research, the top and shoulders sample formation signifies that Bitcoin will quickly rise to $83,000, and the resistance line could also be damaged within the subsequent few days. “The ideal time for this resistance to break is either today, Friday, June 7, or next week, Wednesday, June 12.”

Meanwhile, Bitcoin futures open curiosity has began to fall forward of CME Bitcoin futures market buying and selling shut at the moment. The whole BTC futures OI rises to $38.04 billion.

Also Read: Bitcoin Whales Buying $1 Billion Worth BTC on Daily Basis, $80,000 Coming Soon

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.