In the wake of Ethereum exchange-traded funds (ETFs) approval, high analyst Michaël van de Poppe is bullish on 5 particular altcoins and predicts substantial returns.

This landmark occasion has spurred curiosity throughout the Ethereum ecosystem, setting the stage for an altcoin season. Here is a have a look at the altcoins van de Poppe is eyeing to purchase, every chosen for his or her potential to yield vital positive factors.

1. Optimism (OP)

Optimism, a Layer-2 scaling solution for Ethereum, is the primary altcoin on the record. With Ethereum’s value surge, platforms enhancing its effectivity are anticipated to thrive.

This Layer-2 community makes use of roll-up know-how to batch transactions, lowering prices and growing pace. Michaël van de Poppe highlighted its spectacular complete worth locked (TVL) ratio, indicating sturdy ecosystem development. Optimism’s low circulating provide additional enhances its bullish outlook.

“I think that a coin like Optimism can do between, I would say, 300% to 800% in BTC value in the coming six months. I think that’s very likely and that’s probably the first run,” van de Poppe mentioned.

2. Arbitrum (ARB)

Next is Arbitrum, one other Layer-2 resolution competing carefully with Optimism. It leverages zero-knowledge rollups, a know-how offering sooner and safer transaction processing.

Despite its value struggles, Arbitrum’s ecosystem exhibits robust growth momentum. Van de Poppe believes its substantial TVL and ongoing developments make it a strong funding, poised for a big rebound.

“If you look at the TVL of this Arbitrum, it’s almost the exact same amount as the market capitalization. So that is super bullish as the ecosystem is also growing. But once we look at the price action, it is garbage,” van de Poppe added.

Read extra: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

3. Woo Network (WOO)

Woo Network, a decentralized trade (DEX) recognized for its excessive liquidity and low charges, is one other altcoin van de Poppe plans to purchase.

In the decentralized finance (DeFi) sector, DEXs are gaining traction attributable to growing regulatory pressures on centralized exchanges. Woo Network’s technological benefits and rising person base place it effectively for development, notably as buying and selling volumes on Ethereum proceed to rise.

“Once Ethereum starts to do well and the volumes are already waking up, this is where WOO comes in. There’s also a revenue being made so that is why I think it’s a great one to have. I think when the whole cycle starts for WOO, it can actually yield between 500% to 1,500%,” van de Poppe defined.

4. Wormhole (W)

Wormhole, a bridge protocol for interoperability between blockchains, ranks fourth. As the DeFi panorama expands, seamless asset transfers throughout totally different blockchains are essential.

Its progressive options facilitate this cross-chain communication, making it a sexy funding. Although comparatively new, its potential for widespread adoption and integration into varied blockchain ecosystems is excessive.

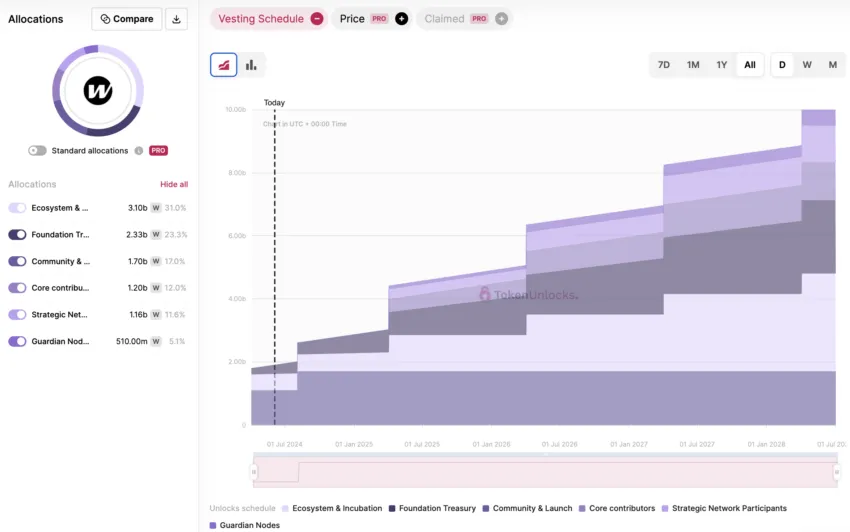

“I want to bet on safe Solana (SOL) solutions. The only tricky part with Wormhole is the fact that there are still unlocks, but these unlocks are going to take some time so that’s why I think that this one is going to do really well,” van de Poppe added.

5. Dogecoin (DOGE)

Finally, Dogecoin, a well known meme coin, stays a favourite. Despite its volatility, Dogecoin’s group assist and up to date value efficiency make it a viable short-term play.

Michaël van de Poppe sees it as a high-risk, high-reward asset, particularly amid a broader crypto market upswing.

“Whether you like it or not, you see all the meme coins doing well. Floki, Book of Meme, Bonk. All of those meme coins are doing well. This is the time when you want to get yourself into a position of Dogecoin. It’s the easiest one. It will do a 4x to 5x or maybe even more,” van de Poppe concluded.

Read extra: 7 Hot Meme Coins and Altcoins that are Trending in 2024

These altcoins are chosen primarily based on their technological strengths, market positioning, and potential for top returns. However, it’s important to method these investments with warning, given the inherent volatility of the cryptocurrency market.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. However, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.