The crypto market noticed a slight restoration, however costs stay beneath stress as market individuals brace for inflation knowledge and crypto choices expiry on Friday, May 31. Altcoins are primarily dealing with the warmth as they weaken in opposition to Bitcoin value, with Bitcoin dominance rising once more above 53%.

Markets Focus on Fed’s Preferred Gauge PCE Inflation

Traders at the moment are specializing in the PCE and core PCE inflation figures, the U.S. Federal Reserve’s most well-liked gauge to measure inflation. The U.S. Bureau of Economic Analysis to launch key inflation knowledge as that might decide market route for weeks.

Wall Street expects PCE inflation to return in decrease than anticipated figures. The market estimates annual PCE inflation to return on the identical stage of two.7% as final month. Meanwhile, the month-over-month PCE inflation can also be anticipated at 0.3%, just like the earlier month.

On the opposite hand, annual and month-to-month core PCE inflation to stay on the identical stage of two.8% and 0.3%, as per market estimates. While stagnant precise PCE inflation figures might be optimistic for the markets, hinting at cooling inflation, Wall Street banks predict an inflation pivot for market rally.

Also Read: FIT21 Unlikely to Pass Senate Before November Election — Report

Bitcoin and Ethereum 8.2 Billion Options Expiry

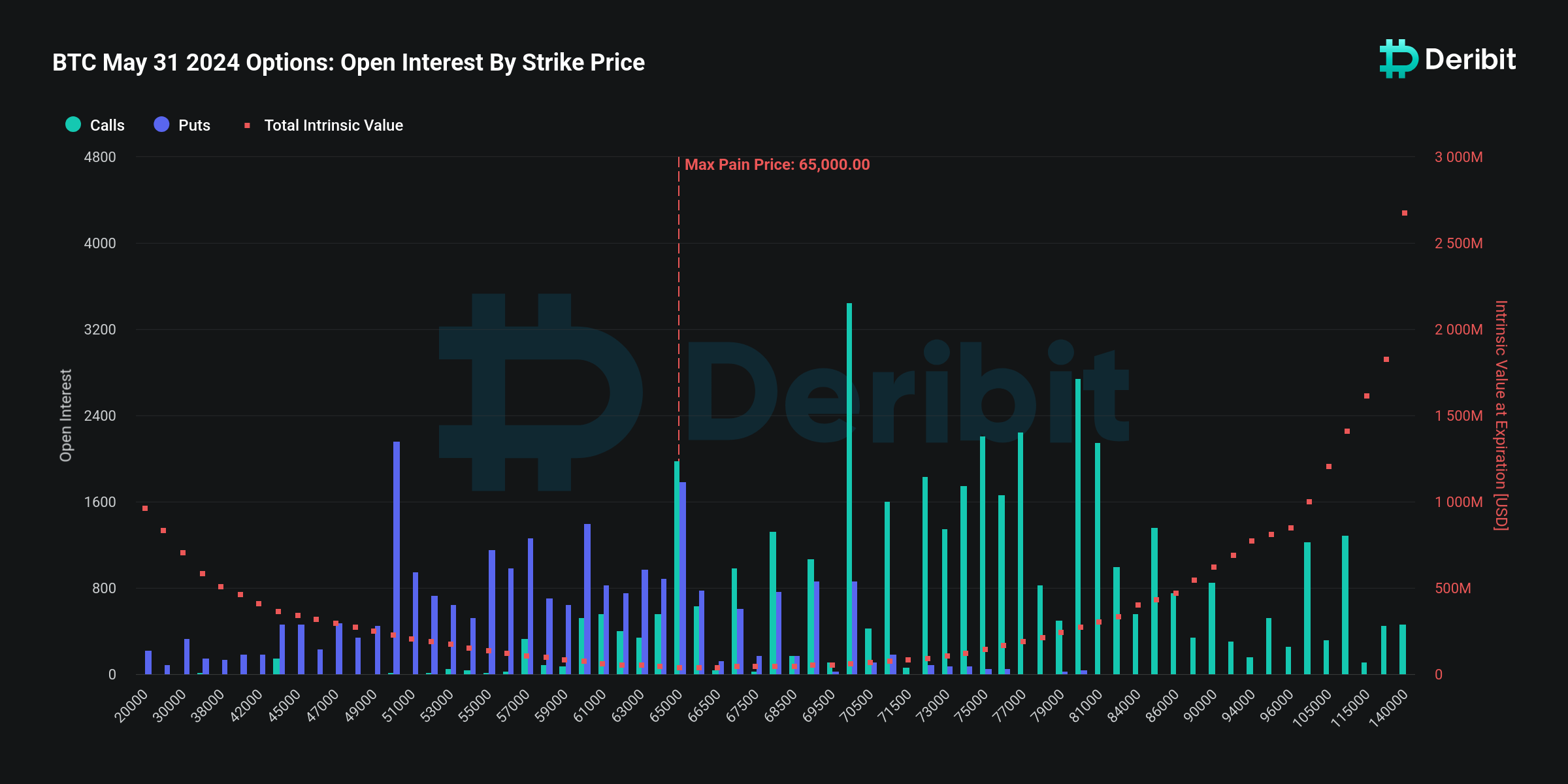

Over 69k Bitcoin choices of $4.7 billion in notional worth are set to run out on Deribit on May 31. The put-call ratio is 0.61, indicating an increase in name open curiosity not too long ago as month-to-month expiry approaches. The max ache level is $66,000, which is beneath the present value. Thus, the market can anticipate large volatility with a pullback in value on the expiry day.

Moreover, 909k Ethereum choices of notional worth $3.4 billion are set to run out, with a put-call ratio of 0.60. The max ache level is $3,300. ETH price is at the moment buying and selling above the max ache level and provides extra room for merchants to e-book earnings.

Adam from Greekslive revealed that the volatility attributable to the value surge fell again rapidly. BTC’s short-term possibility IV fell to 40%, whereas ETH’s decline is barely smaller and is comparatively steady at round 60%. Market consideration is on spot Ethereum ETFs as any announcement can convey upside transfer within the markets.

Also Read: Will Ripple XRP Secrets Get Revealed? SEC’s Win in Remedies Imminent?

BTC Price Eyes New ATH

The US greenback index (DXY) fell close to 104.70 after consecutive rises in the previous few days. The GDP progress for the US was revised decrease to 1.3% in Q1, consistent with expectations, primarily resulting from slower shopper spending.

Meanwhile, the US 10-year Treasury yield fell towards 4.55%, easing from the four-week excessive of 4.61% touched yesterday as markets continued to evaluate the newest knowledge for hints on the Federal Reserve’s coverage outlook. Notably, Minneapolis Federal Reserve President Neel Kashkari said that the present coverage stance is restrictive however emphasised that officers haven’t totally dominated out extra charge hikes.

Any additional drop in DXY and treasury yields might convey a restoration in BTC value as inflationary pressures ease. The CPI reported offered much-need bullish momentum for Bitcoin and the general market, with merchants anticipating comparable outcomes after PCE knowledge.

BTC price jumped 2% previously 24 hours, with the value at the moment buying and selling close to $68,500. The 24-hour low and excessive are $67,118 and $69,500, respectively. Furthermore, the buying and selling quantity has elevated by 10% within the final 24 hours, indicating curiosity amongst merchants.

Also Read: LUNC & USTC Open Interest Soars Over 20%, Terra Luna Classic Price Set For 60% Rally

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.