Crypto Market Selloff: The digital asset area witnessed a pointy decline in the present day, with the vast majority of altcoins failing to keep up a constructive momentum. While Bitcoin worth stayed close to the bay, main altcoins and meme cash like Ethereum, Solana, XRP, Dogecoin, Pepe Coin, and others, have witnessed a selloff in the present day. So, let’s check out the current market developments and see the potential causes behind the current selloff.

Crypto Market Selloff: Why Are Altcoins Witnessing A Slump Today?

A flurry of causes could possibly be behind the current plunge within the crypto market, particularly among the many altcoins. Here we discover a number of the prime causes behind the current selloff.

Whales Booking Profit

The crypto market has witnessed strong positive aspects over the previous few days, with hovering anticipation over the Spot Ethereum ETF and different regulatory developments within the area. In addition, the pro-crypto sentiment amid the U.S. Presidential election buzz has additionally bolstered the sentiment of the market watchers.

Considering that, a number of traders appear to be shifting their focus in the direction of the profit-booking technique as a result of current surge. For context, a notable Ethereum whale transaction has raised eyebrows in the present day.

According to the report, whale deal with 0xAeb…AED31 moved 4062 Ethereum from Lido to Binance, signaling a possible revenue of $3.12 million upon sale. This transfer follows a pattern the place the whale beforehand shifted 18,446 ETH from Binance, in the end promoting a portion for a big revenue two months prior.

The transaction highlights whales probably cashing out on substantial positive aspects, contributing to market volatility. Such profit-taking actions by giant holders usually set off selloffs amongst retail traders, underscoring the influence of whale actions on crypto markets.

Distinct Views Over Ethereum ETF

The Spot Ethereum ETF hype, particularly after the regulatory nod by the SEC, has despatched the Ethereum worth greater over the previous few weeks. However, regardless of the hovering optimism, a number of crypto market analysts have offered completely different outlook over the potential efficiency of the funding instrument.

While a number of market watchers are bullish on the Ethereum worth following the beginning of the Ethereum ETF trading, some have argued a special image. For context, some market pundits anticipate that the U.S. Spot Ethereum ETF is not going to get as a lot traction because the U.S. Bitcoin ETFs.

In addition, a current report from the outstanding analysis agency, Kaiko means that upon the Ether ETF launch, Ethereum might witness a $110 million outflow. Kaiko has instructed the state of affairs evaluating it with the Bitcoin ETF buying and selling, and as a consequence of vital outflow from GrayScale.

Also Read: Vanguard Receives Backlash Over Ethereum ETF Ban But There’s A Catch

Cautions In The Meme Coin Sector

According to current reviews, Ark Invest CEO Cathie Wood has offered a combined outlook on the SEC’s stance on the ETF approval course of. Cathie Wood means that the regulatory nod for the Ethereum ETF could possibly be solely as a result of U.S. election concern.

In addition, she additionally mentioned that though an ETF for Solana may get authorised by the SEC, however meme cash ETF are unlikely to observe the identical path. Amid this meme coins like Dogecoin, Shiba Inu, Pepe Coin, and others, have famous sharp declines in the present day.

On the opposite hand, the current surge in meme cash has additionally offered a profit-booking alternative for the crypto market individuals. According to a current report by Lookonchain knowledge, a whale has deposited 660.7 billion of Pepe Coin, price $9.52 million, to Binance in the present day.

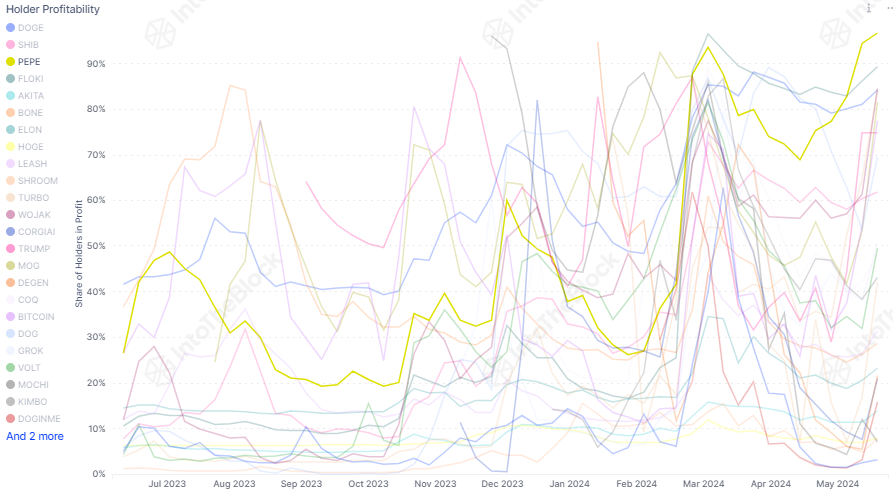

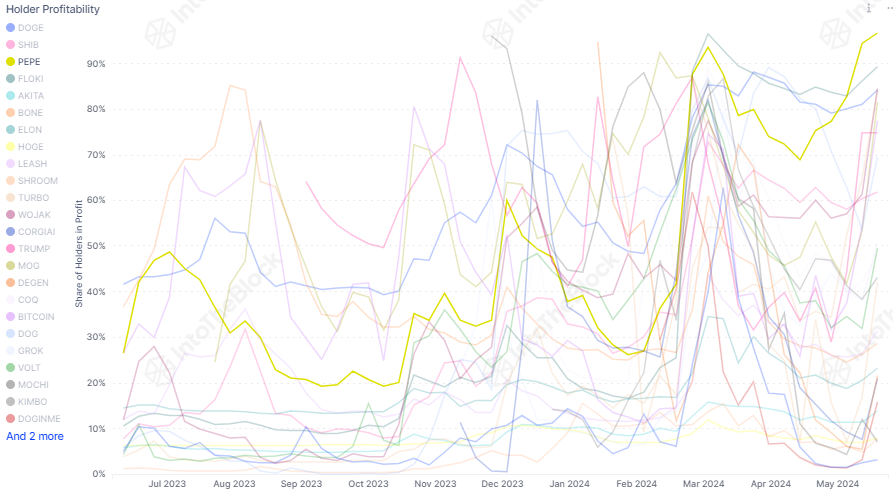

Notably, Pepe Coin has reached a brand new excessive lately, and it allowed the whale to e book a revenue of $4.95 million together with his current promoting, with an ROI of 52%. According to IntoTheBlock knowledge, 90% of the PEPE holders are actually in revenue, making it one of the “profitable among major meme coins”.

Crypto Market Performance

The crypto market has been risky currently, with traders in search of extra readability on the sector. In addition, the current surge in crypto costs, particularly meme cash, has offered a possibility to liquidate the holdings to e book substantial revenue for the traders.

As of writing, the worldwide crypto market cap was down about 2% to $2.51 trillion, after reaching $2.57 trillion over the past 24 hours. Talking concerning the particular person cryptos, Ethereum price was down 2.51% to $3,716.64, whereas Solana price witnessed a droop of two.37% to $165.12.

According to CoinGlass knowledge, 72,546 merchants had been liquidated within the final 24 hours, with the entire liquidation quantity totaling $155.26 million. Over the final 24 hours, Ethereum has famous a liquidation of $26.82 million, with long-liquidation at $18.60 million, and brief liquidation at $8.22 million.

Also Read: XRP Is Primed For A Breakout, Ex-Ripple Director Predicts

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.