The enigmatic world of Bitcoin continues to captivate buyers with its worth fluctuations. However, a latest evaluation by Cryptorphic, a outstanding crypto analyst, suggests the longer term may be brighter than latest dips would possibly point out.

Their prediction? Bitcoin hitting a staggering $156,000 by May twenty seventh, 2025.

Related Reading

The Halving Effect: A Historical Catalyst

Cryptorphic’s prediction hinges on a historic phenomenon often known as the halving. Every 4 years, the variety of Bitcoins rewarded for mining new blocks is lower in half. This, in principle, reduces the provision of latest cash getting into the market, doubtlessly driving up the value of present ones.

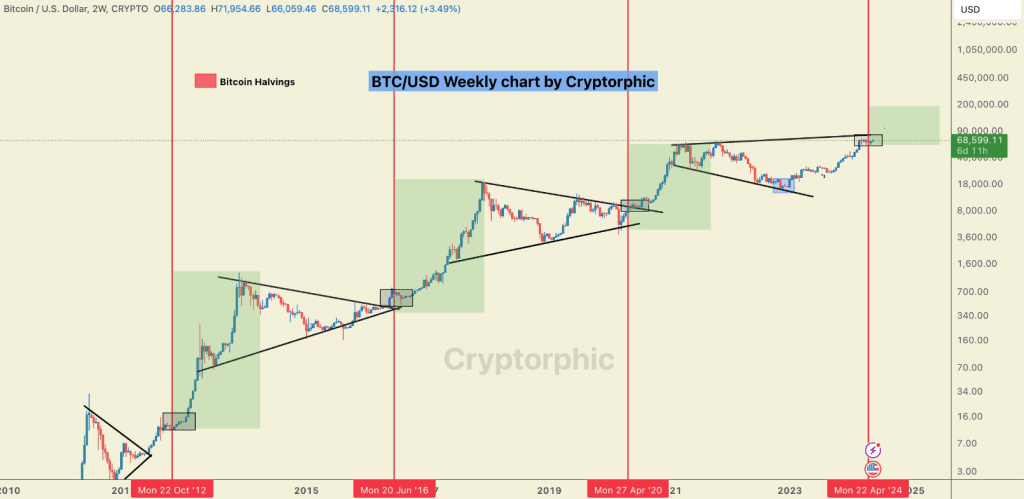

His evaluation examines previous halvings, showcasing an enchanting pattern. Following the primary halving in 2012, Bitcoin’s price skyrocketed a mind-blowing 8,300%. The second halving in 2016 noticed a extra modest however nonetheless spectacular improve of 288%. The most up-to-date halving in 2020 sparked a 540% surge inside a yr.

#Bitcoin might hit $156,000 by May 27 2025!

These inexperienced packing containers signify the value motion after #BTC halvings. We’ve by no means seen a pink yr after a halving.

Bitcoin halvings are vital occasions, listed below are the odds of Bitcoin’s worth improve one yr after every halving… pic.twitter.com/QEmNN8OuP2— Cryptorphic (@Cryptorphic1) May 27, 2024

A Golden Ticket Or Fool’s Gold?

Following the fourth halving final April, Cryptorphic predicts a possible worth surge of practically 130% by the next yr. This interprets to a price ticket of wherever between $115,000 and $156,000.

Despite the bullish outlook, the evaluation acknowledges the present short-term volatility. Bitcoin is at the moment buying and selling beneath its peak, reflecting a latest 5% dip. However, Cryptorphic identifies a technical indicator, the “inverse head and shoulders” sample, suggesting a possible breakout for the value.

A Broader Market View

The analyst’s perspective doesn’t shrink back from presenting contrasting viewpoints. Others take a extra nuanced strategy, expressing cautious optimism for the short-term trajectory. They acknowledge the diminishing bearish situations and consider the market may be in an earlier bullish section in comparison with Cryptorphic’s prediction.

This suggests the potential for additional positive factors even earlier than 2025, though each analysts emphasize the significance of a measured strategy to threat administration.

Related Reading

Over the previous yr, Bitcoin has surged by 144%, demonstrating vital upward momentum. This spectacular efficiency has allowed it to outperform 58% of the highest 100 crypto property, in addition to surpass Ethereum in positive factors. Such a sturdy improve underscores the asset’s robust market place and investor confidence.

Currently, the asset is buying and selling above its 200-day easy shifting common, indicating a sustained bullish pattern. Additionally, its excessive liquidity, supported by a considerable market cap, additional enhances its attractiveness to buyers.

Featured picture from Revolutionized, chart from Buying and sellingView