Ethereum exchange-traded funds (ETF) have been the speak of the city – and rightly so – after the United States Securities and Exchange Commission (SEC) authorised the itemizing of the funding merchandise in the course of the week. Meanwhile, the Bitcoin spot ETF market continued its resurgence on one facet, marked by a second consecutive week of optimistic inflows.

This streak of optimistic inflows represents an entire shift from earlier weeks when funding exercise was dangerously low. However, this latest turnaround displays an increase in investor confidence over the previous two weeks.

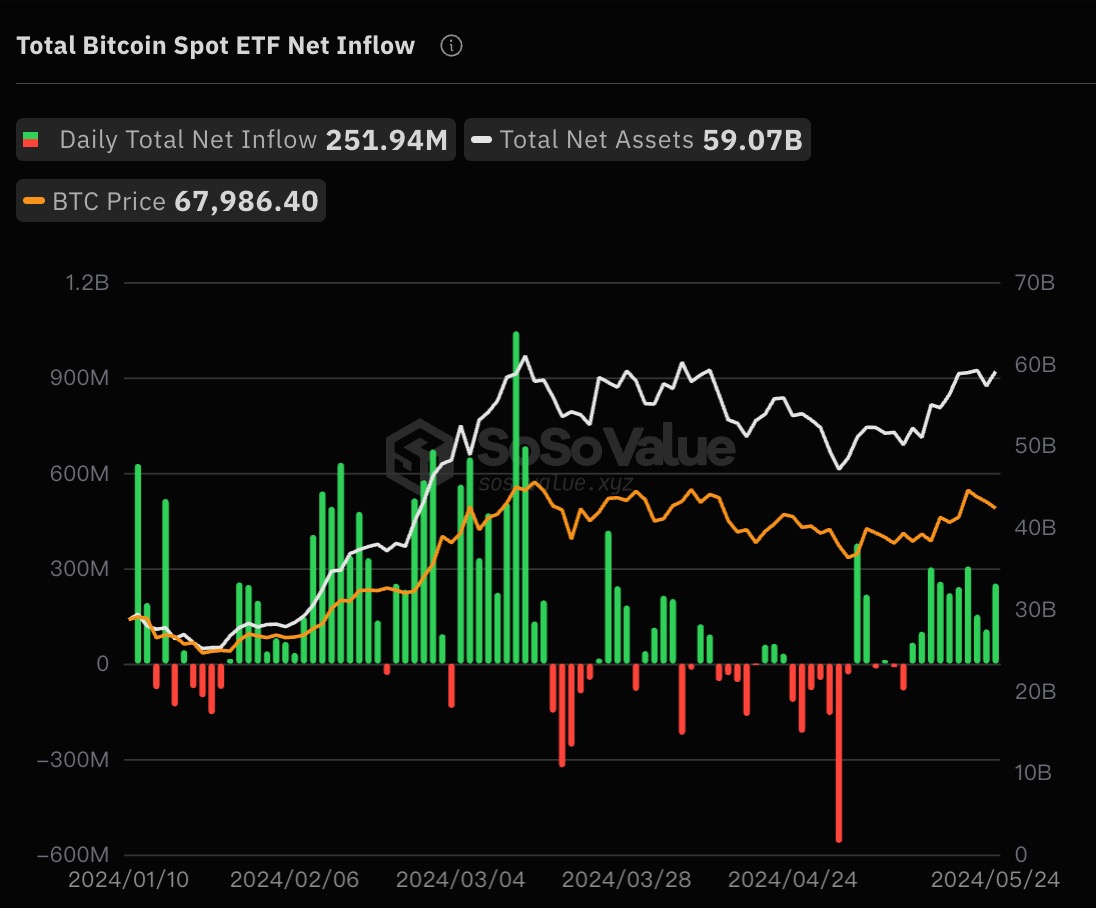

Bitcoin Spot ETF: $252 Million In Net Inflows In One Day

On Friday, May 24, the US Bitcoin spot ETF market noticed one other day of optimistic inflows, marking the tenth consecutive day of serious funding into these funds. According to data from SoSoValue, the market recorded a complete web influx of roughly $252 million to shut the week.

Related Reading

Breaking this down, BlackRock amassed a considerable proportion of the entire each day funding, with the IBIT ETF posting an influx of $182 million. Grayscale Bitcoin Trust (GBTC), then again, didn’t appeal to any capital on Friday, ending the week with zero each day outflows and influx.

Other ETF issuers, similar to Fidelity, Bitwise, and ARK Investment, additionally witnessed spectacular inflows on Friday. Most notably, Fidelity’s FBTC got here second to BlackRock’s fund after attracting about $43.7 million on the final day of the week.

More importantly, this optimistic influx day implies that the Bitcoin spot ETF market has amassed vital funding on daily basis for the second week in a row. And after the shut of Friday’s buying and selling session, the web influx prior to now week stood at a formidable $1.06 billion.

This sustained optimistic pattern when it comes to capital inflow means that investor confidence in Bitcoin ETFs is perhaps again at an all-time excessive. The final time there was a constant optimistic capital influx into these merchandise, the Bitcoin worth rose to a brand new all-time excessive.

With Ethereum spot ETFs on the point of buying and selling within the US, crypto exchange-trade merchandise appear to be in vogue in the meanwhile. And they may simply be the catalyst that the crypto market – notably Bitcoin – must resume what is left of the bull cycle.

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at $68,868, reflecting a 2.5% worth enhance within the final 24 hours. According to knowledge from CoinGecko, the premier cryptocurrency is up by 3% on the weekly timeframe.

Related Reading

Featured picture from iStock, chart from TradingView