Bitcoin (BTC) has skilled a major drop, falling under the $68,000 mark, a stark distinction to its earlier worth of round $70,000. This decline in Bitcoin’s worth may be attributed to a number of key components which have influenced the broader cryptocurrency market.

Source: CoinMarketCap

Factors Influencing Bitcoin’s Price Drop

Today’s pullback within the Bitcoin price can primarily be attributed to the S&P Global Purchasing Managers’ Index (PMI) report suggesting a sizzling US financial system. This has led to a surge within the greenback which has in flip put strain on threat property akin to cryptocurrencies.

In the PMI report, the financial system was reported to be rising at its quickest tempo in two years, which induced merchants to shift their expectation of rate of interest cuts, thus exerting extra strain on Bitcoin and different digital currencies.

At the identical time, there’s expectation concerning the resolution of the U. S. Securities and Exchange Commission (SEC) on spot ether (ETH) exchange-traded funds (ETFs). This might be resulting from the truth that market individuals are looking out for choices which will have an effect on the market considerably. Crypto analyst Kaleo mentioned that the market response might be drastic relying on the choice that has been made. He mentioned

“If the ETH ETF could be denied today, I wouldn’t be surprised to see prices nuke as violently as they ripped the other day.”

Crypto Market Sentiment and Regulatory Landscape

The cryptocurrency market can also be influenced by regulatory information and normal market sentiment. The SEC has been pretty conservative in its response to the crypto invoice that has just lately been accredited by the House of Representatives.

SEC Chair Gary Gensler identified that the company is prepared for dialogue however will proceed to implement the regulation to make sure that token operators present disclosures that are useful to buyers and legally required.

ETH’s temporary and sudden dip under $3800 was doubtless pushed by MEV buying and selling agency Symbolic Capital Partners. The establishment offered 6,968 ETH in a single minute, price $27.38 million, with a median promoting worth of $3,930, based on @ai_9684xtpa. One of the transactions offered 3,497 ETH…

— Wu Blockchain (@WuBlockchain) May 23, 2024

Apart from the regulatory points, different components which were seen to have led to the drop embody massive promoting orders available in the market. For occasion, buying and selling agency Symbolic Capital Partner offered 6,968 ETH price $27 million in a single minute, which has led to elevated promoting strain available in the market.

ETH Price Performance and Market Speculation

The anticipation surrounding the SEC’s resolution can also be seen within the context of the “buy the rumor, sell the news” phenomenon noticed in monetary markets. This conduct, the place costs improve in anticipation of an occasion and drop after the occasion happens, is prevalent within the crypto market.

Concurrently, this week, the Ethereum market has been fairly excessive risky, and ETH costs elevated greater than 22% in expectation of an ETF approval. This was marked by a brief squeeze and intense shopping for which was instrumental in inflicting massive worth swings available in the market.

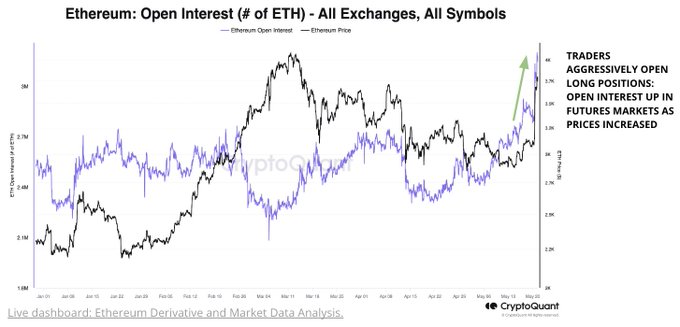

Source: CryptoQuant

CryptoQuant additionally reviews that the ETH futures market has been fairly energetic with complete open curiosity reaching 3.2 million ETH- valued at $11 billion, the best since January 2023. This rise is principally as a result of robust purchase orders that push the value up which led to one of many greatest hourly liquidations of the 12 months with 9.3K ETH.

Further, the ETH-BTC Open Interest ratio has additionally risen from 0.54 to 0.67 suggesting extra buyers are leaning in direction of Ethereum than Bitcoin. Moreover, the low cost on the ETHE fund has additional decreased to 17%, its lowest in two months, pointing to elevated curiosity in Ethereum in comparison with Bitcoin amongst buyers.

Read Also: XRP Price Prediction: Monumental Bull Run Likely As Coinbase Initiates XRP Trading In New York

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.