The current surge within the cryptocurrency market, propelled by notable rallies in main cash like Bitcoin and Ethereum, has instilled optimism amongst buyers. With vital occasions such because the approval of the U.S. Spot Bitcoin ETF and the Bitcoin Halving shaping the panorama, buyers at the moment are considering the potential period of the continuing bull cycle.

Meanwhile, CryptoQuant founder Ki Young Ju has just lately shared insights based mostly on on-chain knowledge, hinting at a potential timeline for the present bull cycle to finish.

Analyzing On-Chain Data for Bitcoin’s Bull Cycle End

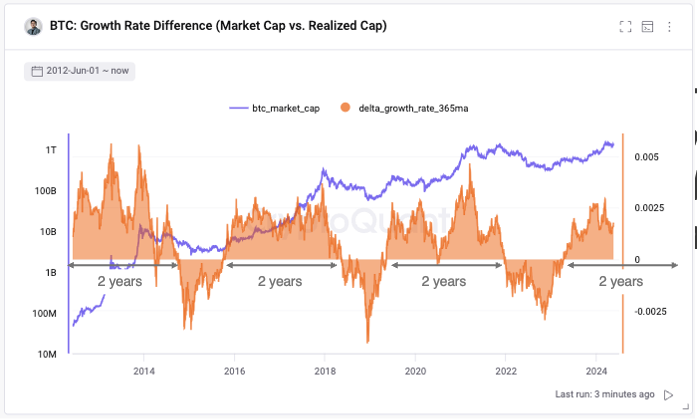

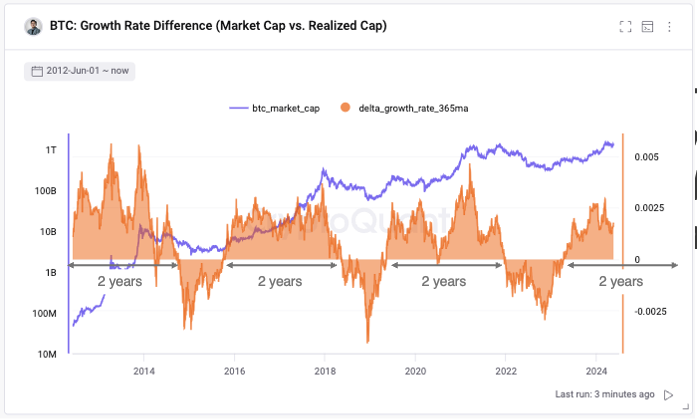

CryptoQuant CEO Ki Young Ju has drawn consideration to on-chain knowledge to supply insights into the trajectory of Bitcoin’s bull cycle. Sharing a Bitcoin value chart on the X platform, Ju highlighted that the cryptocurrency is at the moment amid its bull cycle, with its market capitalization outpacing its realized cap.

Meanwhile, he stated that based mostly on historic developments, such cycles sometimes final for about two years. So, contemplating the present sample, he hinted that the present Bitcoin bull cycle may conclude by April 2025.

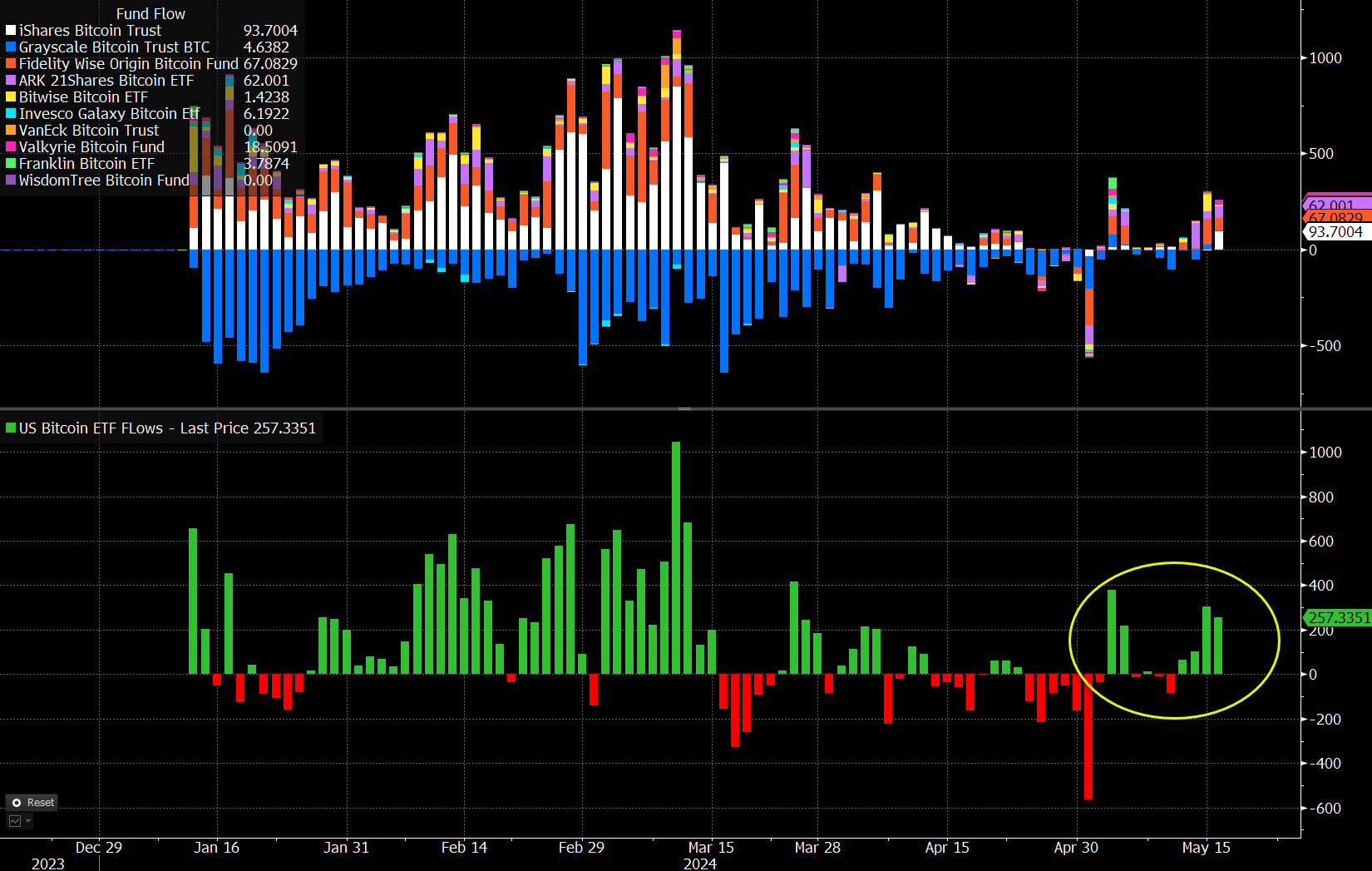

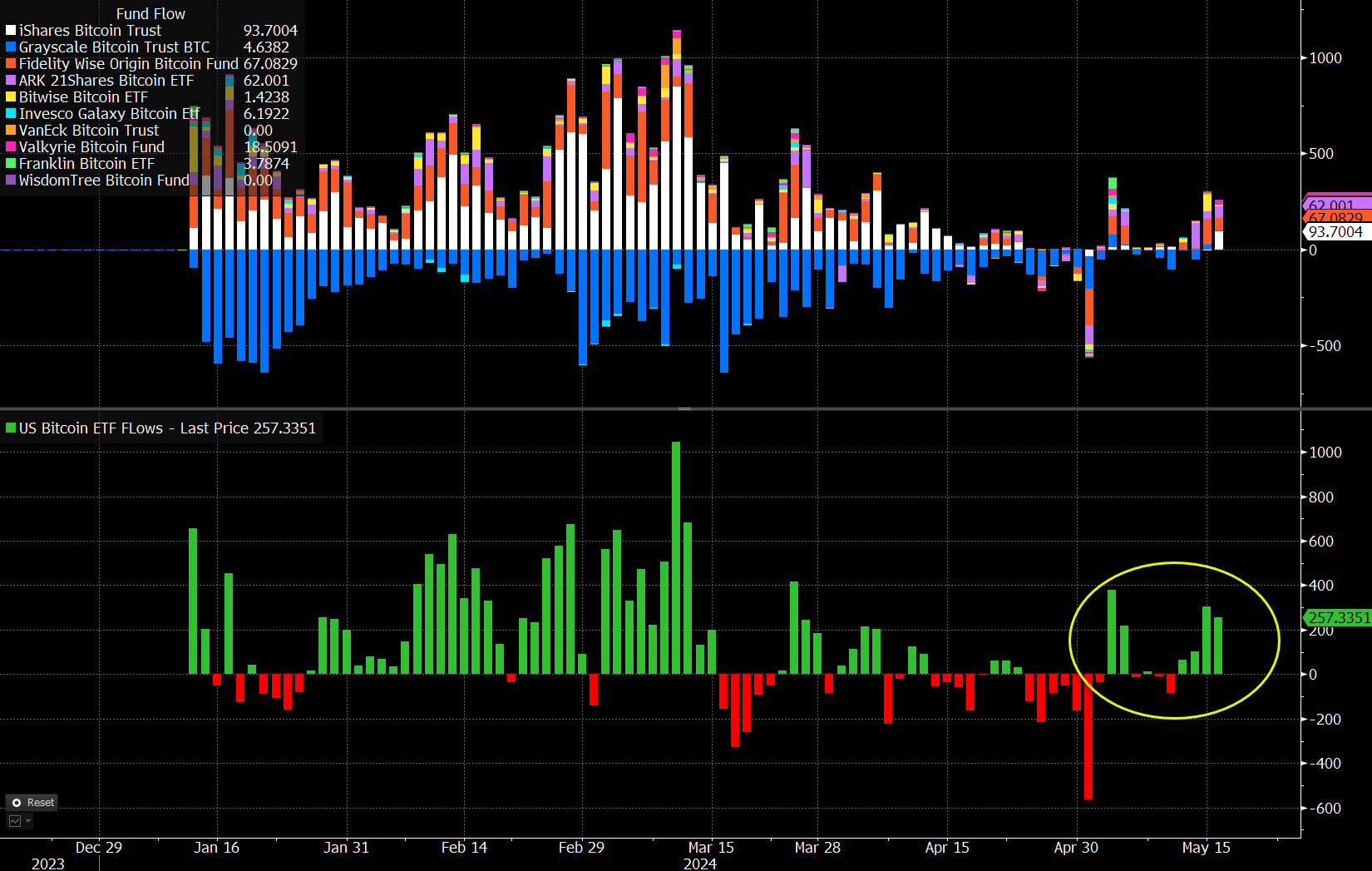

Notably, Ju’s evaluation comes at a time of optimistic sentiment within the crypto market, with the U.S. Spot Bitcoin ETF witnessing vital inflows this week. According to Farside Investors knowledge, the ETF recorded inflows exceeding $726 million over the previous 4 days, reflecting renewed investor curiosity.

Commenting on the event, Bloomberg Senior ETF analyst Eric Balchunas famous the ETF’s sturdy efficiency, with inflows totaling $1.3 billion over the previous two weeks. He stated that the vital influx this week has helped offset earlier outflows and reinstating confidence amongst buyers.

Also Read: Tether Pumps Liquidity With $1 Billion USDT Mints in 12 Hours, Crypto Market Rally Soon?

Market Sentiment Amid Regaining Momentum

The crypto market fanatics appear to be regaining confidence within the digital asset house, as evidenced by the current performances of cryptos like Bitcoin, Solana, and others. Notably, the current U.S. Consumer Price Index (CPI) knowledge has contributed to bolstering investor confidence.

The knowledge revealed a cooling of inflation in April in comparison with the earlier month, indicating a possible shift within the Federal Reserve’s hawkish stance on coverage charges. If inflation continues to say no, it might immediate the Fed to reassess its financial coverage, doubtlessly influencing market dynamics and investor sentiment within the coming months.

However, regardless of the optimistic developments, the volatility, though declined, appears to be dominating the market at the moment. According to CoinGlass knowledge, the Bitcoin Futures Open Interest fell 1.36% during the last 24 hours whereas rising about 1.26% within the final 4 hours to 490.28K BTC or $32.65 billion.

Meanwhile, the Bitcoin price famous slight positive aspects and traded at $66,440.54, up 0.53% from yesterday. On the opposite hand, the buying and selling quantity fell 23.31% to $30.20 billion, with the BTC touching a 24-hour excessive of $66,545.81. Over the final 30 days, the flagship crypto has gained practically 7%, whereas noting a weekly surge of over 5%.

Also Read: Here’s How This Solana Trader Made $200K with $1.5K In 5 Mins

The offered content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.