Crypto analyst Javon Marks has highlighted a number of metrics which have turned bullish for Ethereum (ETH). The analyst famous that one in every of these metrics suggests an all-time excessive (ATH) for the second-largest crypto token.

Bullish Metrics For Ethereum

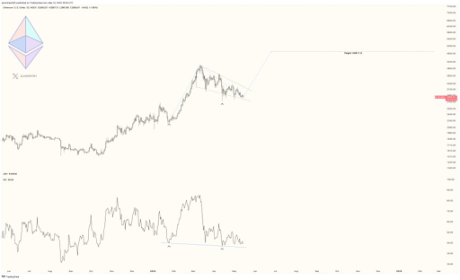

Marks remarked in an X (previously Twitter) post that the bull flag-like value construction has fashioned on the Ethereum chart. He added that increased lows are forming in Ethereum’s value motion, which can also be a bullish signal because it suggests a robust resistance to downward developments. Meanwhile, the analyst claims decrease lows within the Relative Strength Index (RSI) point out a hidden bullish divergence with Ethereum’s value.

Related Reading

Marks then raised the opportunity of Ethereum hitting a new ATH, stating that the “bull flag breakout might lead into new all-time highs and be of major service in many Altcoin progressions.” Before then, he claimed that Ethereum might quickly expertise a bigger value breakout, making the crypto token expertise a 63% upside to $4,811.

Crypto analyst Michaël van de Poppe additionally recently suggested that Ethereum might make a serious transfer quickly sufficient and lead altcoins to make new highs. According to him, this shall be triggered by the information surrounding the Ethereum ETF, as he expects that to be the “rotation for the Altcoins.”

However, Ethereum additionally dangers experiencing a big decline, contemplating reports that the Securities and Exchange Commission (SEC) would possibly reject the Ethereum ETF functions. Crypto analyst James Van Straten stated {that a} rejection of the Spot ETF “sends the ETHBTC ratio lower 0.047 to 0.03 as a long-term projection.”

This was one of many the explanation why the analyst said that “Ethereum looks like it’s going to the grave.” He additionally alluded to the truth that ETH has develop into inflationary with the Decun improve decreasing transaction charges, which has finally diminished ETH’s burn charge.

Things Aren’t Looking Good For ETH

Crypto analyst Derek just lately talked about that “Ethereum dominance and recent performance are heading toward their worst ever.” He famous that spotlight has turned to Bitcoin because of the stories a few potential rejection of the Ethereum ETF and securities status, which has put stress on funding sentiment. According to him, this has brought on the “imbalance in dominance” to achieve its worst level.

Related Reading

Derek additional famous that Ethereum’s unimpressive price action is affecting different altcoins, as their costs are “depressed.” He additionally claimed that the costs of layer two cash “continued to be under pressure.” The analyst steered that issues might worsen, because the ETH/BTC chart exhibits a downward wedge sample in progress. He claims that altcoins can solely “breathe” if Ethereum can escape this sample shortly.

At the time of writing, Ethereum is buying and selling at round $2906, down within the final 24 hours in line with data from CoinMarketCap.

Featured picture from Metaverse Post, chart from Tradingview.com