The U.S. Spot Bitcoin ETF sector experiences a resurgence with a notable $66 million influx, reversing the earlier week’s outflow development for the final two days. Notably, the latest information reveals that Fidelity’s FBTC leads the inflow, signaling renewed investor curiosity in cryptocurrency-backed exchange-traded funds. Besides, the influx additionally comes amid a restoration within the Bitcoin worth.

Fidelity’s FBTC Leads Bitcoin Inflow Surge

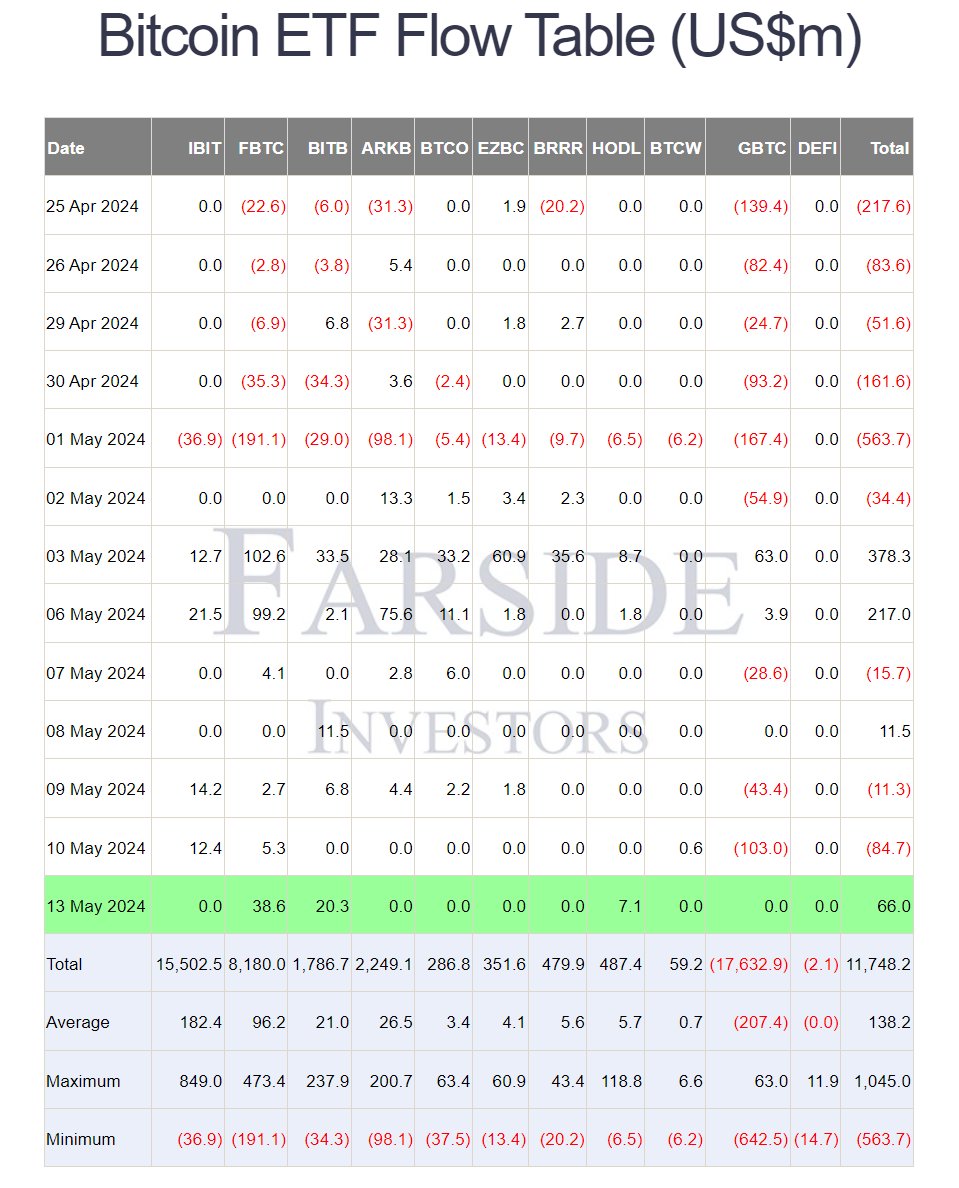

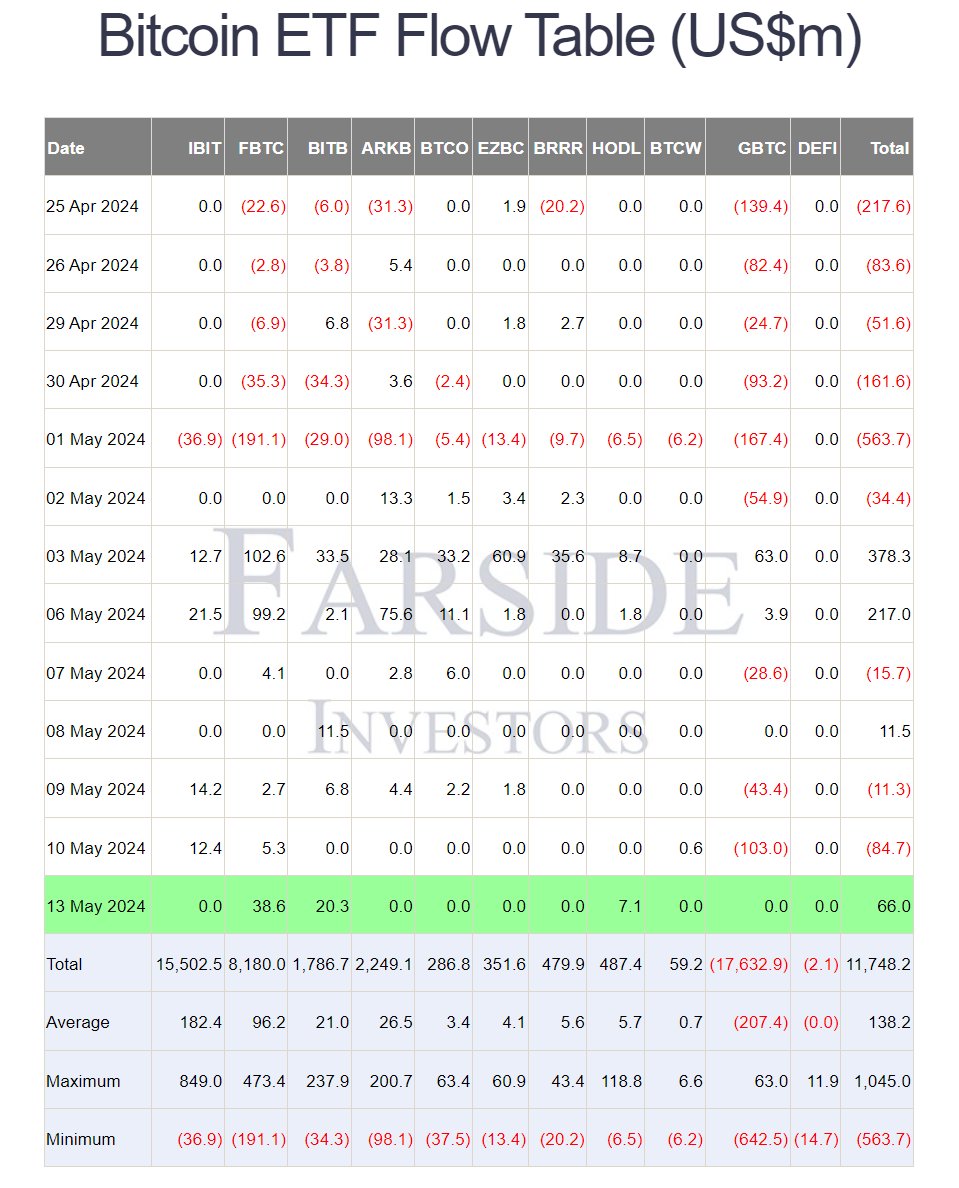

Following two consecutive days of outflow, the Bitcoin ETF market witnessed a turnaround with a major $66 million internet influx, as reported by Farside Investors. Notably, Fidelity’s FBTC emerges because the frontrunner, attracting $38.6 million in inflows, adopted by Bitwise Bitcoin ETF BITB with $20.3 million.

Meanwhile, the latest inflow additionally displays the renewed confidence of the merchants in Bitcoin ETFs. Besides, it additionally coincides with a restoration in Bitcoin’s performance, which surged previous the $63,000 mark just lately. Notably, this resurgence in investor curiosity comes amid heightened volatility within the general market, indicating a renewed urge for food for cryptocurrency investments.

It’s price noting that the web influx of $66 million on May 13 marks a constructive shift after two days of destructive flows. However, whereas no ETF skilled outflows, seven out of ten US Bitcoin ETFs, together with Grayscale and BlackRock choices, reported zero flows.

Meanwhile, over the past 30 buying and selling days, the ten Bitcoin ETFs noticed a internet outflow of $297 million, with outflows recorded on 17 of these days.

Also Read: Meme Coin Party Begins After GameStop Rally, Adds $5 Billion To Index

Crypto Market Performance

The inflow of $66 million into Bitcoin ETFs alerts a renewed bullish sentiment amongst buyers, bolstered by Fidelity’s FBTC garnering the lion’s share of inflows. Notably, with Bitcoin’s worth rebounding and analysts offering optimistic forecasts, the cryptocurrency market seems poised for additional development and stability within the coming days.

As of writing, the crypto market famous a surge of 0.37% to $2.27 trillion, whereas its general buying and selling quantity rose 50% to $71.79 billion. Meanwhile, the Bitcoin price famous slight positive aspects of 0.33% over the past 24 hours, buying and selling at $61,876.45 on the similar time.

Meanwhile, the BTC worth has touched a excessive of $63,422.66 and a low of $61,400.88 over the past 24 hours, reflecting the still-volatile state of affairs hovering over the market.

Also Read: Coinbase Investigates System-Wide Outage, Here’s All

The offered content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.