Bitcoin worth began falling and paring earlier positive factors after new macroeconomic knowledge, signaled that macro elements are key drivers of the Bitcoin worth at the moment. And as PPI, CPI, and Fed Chair Jerome Powell’s speech are due this week, BTC worth is more likely to stay below strain and unstable.

The newest pullback in BTC worth was a results of US client inflation expectations knowledge. The inflation expectations for the yr forward got here at 3.3%, the best since November, from 3% in every of the earlier 4 months. Moreover, the inflation expectations for five-year horizon elevated to 2.8% from 2.6%.

Meanwhile, the warmer inflation stays a priority for the FOMC members, with Federal Reserve Vice Chairman Phillip Jefferson and Fed’s Loretta Mester expressed blended outlook on inflation and fee cuts.

CoinGape lately reported University of Michigan consumer sentiment knowledge brought on BTC worth to tumble beneath $61,000 as inflation expectations for the yr forward rose to three.5% and the five-year inflation outlook hit 3.1% from 3.0%.

Crypto Market Saw Over $210 Million Liquidation

Coinglass knowledge reveals greater than $212 million had been liquidated throughout the crypto market within the final 24 hours. Among this, $132 million lengthy positions had been liquidated and practically $80 million brief positions had been liquidated. Most of the liquidation occurred within the final hour, which was recorded at over $50 million.

Over 90K merchants had been liquidated and the biggest single liquidation order occurred on crypto change Binance as somebody offered ETH for BTC valued at $3.98 million. This was an fascinating transfer by an investor or a whale.

BTC price fell greater than 1% in a number of hours to $62,566. The 24-hour high and low are $60,769 and $63,422, respectively. The costs are more likely to preserve the weak momentum and fall to assist at $62,000.

Popular analyst Ali Martinez predicts a retrace towards $62,000 as Bitcoin is going through rejection by the 200-EMA on the 4-hour chart. The TD Sequential indicator additionally presents a promote sign. However, BTC will proceed its upward trajectory if the candlestick closes above $64,000.

Also Read: Solo Miner Scoops Entire $3.125 BTC From Single Block, Here’s How

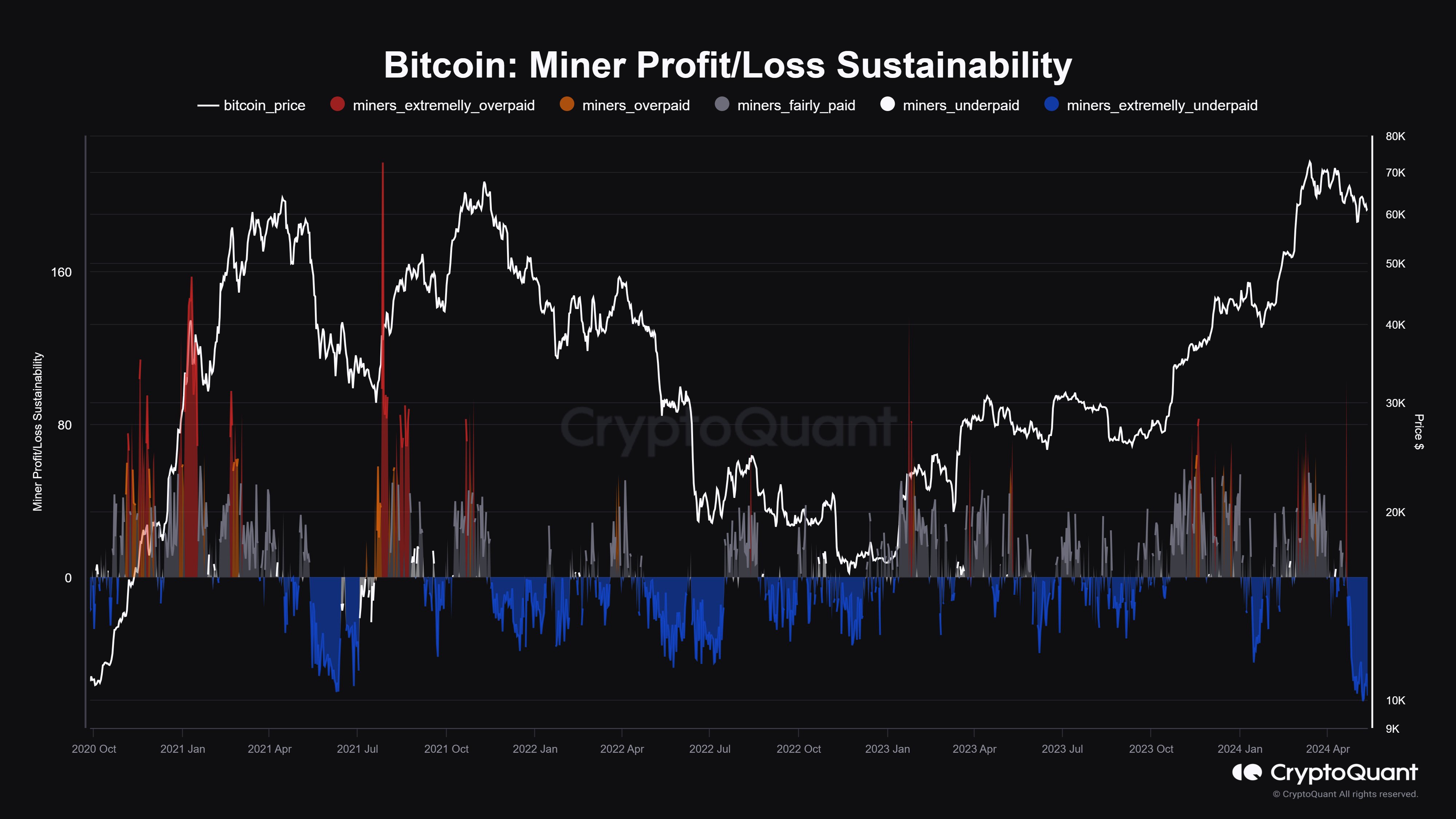

Miners Face Capitulation Risk

Bitcoin miners are going through vital capitulation threat after the current Bitcoin halving of block subsidies and comparatively low transaction charges. The buying and selling volumes have additionally plummeted and brought on an extra enhance in dangers. On-chain analyst Maartunn mentioned, “This is likely to cause substantial strain, especially for less efficient miners.”

According to crypto researcher agency Kaiko, the crypto market to see extra promoting strain as Bitcoin miners with massive holdings of the digital asset face a pointy drop in income. “Higher transaction fees offset lower miner rewards for firms in April, but this has since reversed,” it added.

Also Read:

The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.