Early-stage funding agency Metaplanet introduced on Monday that it’s adopting Bitcoin (BTC) as its sole “strategic treasury reserve asset.”

This audacious determination indicators a rising confidence within the controversial cryptocurrency as a authentic retailer of worth and hedge in opposition to conventional financial woes.

Related Reading

Yen Under Pressure, Bitcoin On The Rise

Metaplanet’s determination comes amidst a backdrop of sustained financial pressures in Japan. A weakening yen, coupled with excessive authorities debt ranges and persistently low-interest charges, appears to have pushed the agency to hunt different havens for its reserves.

Bitcoin, with its finite provide and decentralized nature, seems to be their reply.

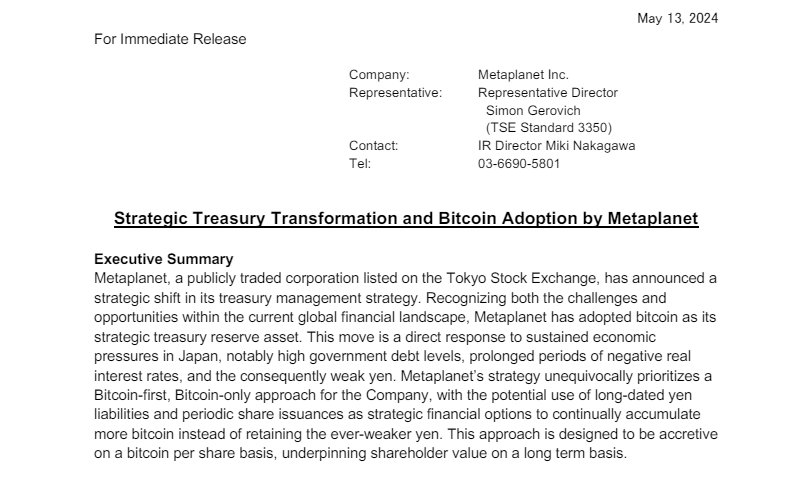

‘Bitcoin-First, Bitcoin-Only’ Approach

In a transparent assertion of intent, Metaplanet outlined its new “Bitcoin-first, Bitcoin-only approach” to treasury administration. The firm plans to strategically convert its current yen liabilities and future share issuances into BTC, successfully accumulating extra of the digital asset over time.

This technique echoes the current strikes of US-based MicroStrategy, which has develop into a significant institutional holder of Bitcoin.

A screenshot of Metaplanet's press launch.

Believing In The ‘Absolutely Scarce’ Asset

Metaplanet’s press launch paints a glowing image of the highest crypto asset’s potential. They view it as “fundamentally superior” to conventional currencies and different funding choices, highlighting its shortage and lack of a central issuer.

They are impressed by Bitcoin’s proof-of-work (PoW) consensus mechanism, emphasizing the way it creates a progressively increased value of manufacturing for the remaining cash but to be mined. This, they argue, stands in stark distinction to conventional commodities whose provide will be readily elevated.

Bitcoin is now buying and selling at $62.896. Chart: TradingView

Following The Footsteps Of A Corporate Bitcoin Believer

There are clear parallels between Metaplanet’s technique and that of MicroStrategy. The US agency has aggressively amassed Bitcoin, at the moment holding over 1% of your complete circulating provide. Metaplanet, although smaller, has reportedly acquired over 117 BTC since April, signaling their dedication to replicating this technique.

While Metaplanet’s determination displays a rising institutional curiosity in Bitcoin, it additionally carries important dangers. Bitcoin’s value stays extremely risky, with the potential for substantial losses if the market takes a downturn.

Additionally, the regulatory panorama surrounding cryptocurrencies continues to be evolving, and future rules may negatively impression Bitcoin’s viability as a reserve asset.

Related Reading

A Digital Canary In The Coal Mine?

Metaplanet’s daring transfer serves as an enchanting case research. Their all-in guess on Bitcoin raises questions on the way forward for conventional reserve property and the potential for wider adoption of cryptocurrencies by institutional buyers.

Impact On Bitcoin Price

The firm’s funding, whereas important for a single agency, represents a comparatively small portion of the full Bitcoin market capitalization. However, the information itself may generate optimistic sentiment and short-term value will increase, particularly if it entices different institutional buyers to observe swimsuit.

Conversely, if Metaplanet’s technique backfires and they’re compelled to promote their Bitcoin holdings at a loss, it may set off a broader sell-off and value decline.

Ultimately, the long-term impression will depend upon how this daring transfer by Metaplanet performs out, alongside broader market forces and evolving rules.

Featured picture from Pexels, chart from TradingView