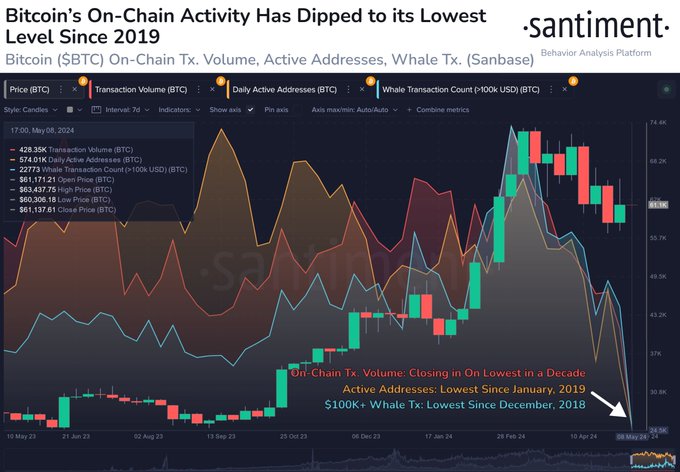

Over the final two months, Bitcoin’s on-chain exercise has neared historic lows as transaction volumes have lowered noticeably.

This cooling off comes after the all-time excessive of Bitcoin earlier within the yr and is a interval headline by crowd concern and indecision fairly than being a predictor of additional worth dips.

Bitcoin’s On-Chain Activity Declines

According to Santiment knowledge, Bitcoin’s on-chain transaction quantity has dropped, hitting figures that have been final seen years in the past (since 2019). This sample signifies that merchants are reluctant to switch their positions, presumably due to the market’s volatility.

The sharp decline in exercise adopted Bitcoin’s all-time high in March 2024, a milestone that was one yr forward of the anticipated schedule in response to historic halving cycles.

Market Reaction and Analysis

The sharp decline within the transaction quantity has not escaped the eye of market analysts. As reported by Coingape, Bitcoin examined the $60,000 assist on May 10 after a really temporary journey as much as $63,500.

In addition, on platforms like X (previously Twitter), merchants counsel that institutional gamers could also be manipulating the market to forestall vital breakouts throughout weekends when the ETF market is closed.

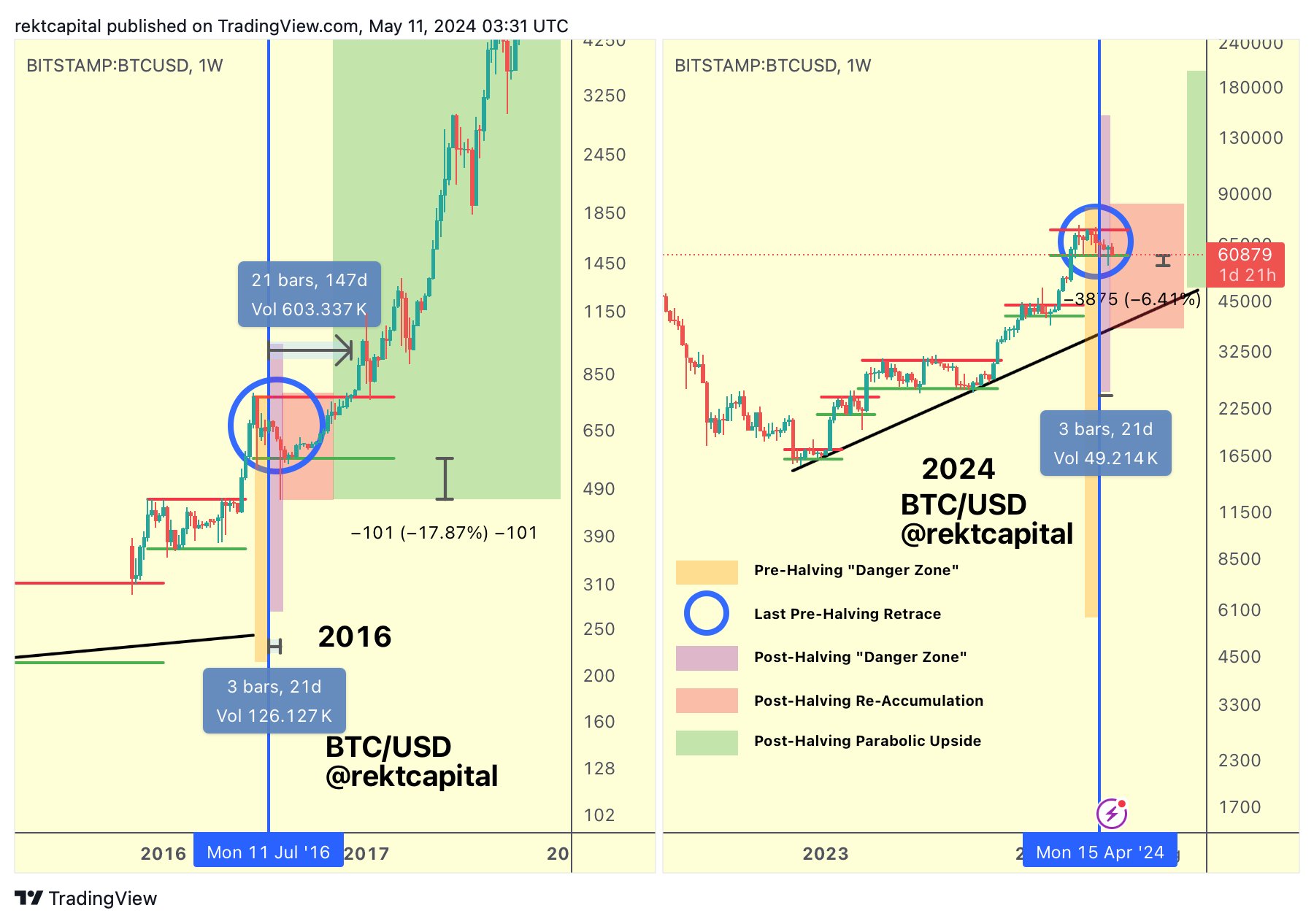

Trader and analyst Rekt Capital highlighted that Bitcoin normally takes successful weeks after a halving occasion, an interval he dubs the “danger zone.” ” This section of worth dip, which is coming to an finish now, confirmed a hunch within the worth of Bitcoin to $56,500. Nevertheless, long-term holders (LTH) should not promoting their holdings, which could signify a attainable restoration.

Price Performance and Economic Influences

Bitcoin’s worth efficiency has been risky, as the cryptocurrency has been unable to maintain its movement above $63,000. Bearish indications from stagflationary US financial knowledge and hawkish remarks by Federal Reserve officers have additionally weakened the bullish sentiment.

Specifically, the University of Michigan Consumer Sentiment Survey revealed a major drop from 77.2 in April to 67.4 in May, whereas inflation expectations rose, including to the market’s considerations.

The worth volatility shares the identical Bitcoin historical past sample the place post-halving intervals normally see massive corrections. But the value trajectory this yr in too removed from the same old four-year cycle, which means that the brand new excessive will be reached comparatively rapidly.

Long-Term Holders Maintain Confidence

Although the value of Bitcoin has fallen in current months, the long-term Bitcoin holders are nonetheless constructive. According to the info from CryptoQuant, these holders nonetheless didn’t promote their holdings after the highest at $73,000. Meanwhile, at press time. Bitcoin(BTC) bulls have been nonetheless combating for market management regardless of a broader market sell-off that dipped the value to an intra-day low of $60,492.63. Trading at $60,908.99, BTC was 0.10% from the intra-day excessive.

On the opposite, in response to Coingape, the long-term holders appear to be ready for a attainable revival. Axel Adler Jr, an on-chain analyst, famous that long-term holders had beforehand offered 1.3 million BTC on the peak however are presently retaining their property, anticipating an area backside.

Such an act exhibits a powerful religion in Bitcoin’s long-term worth as against the actions of short-term holders, who’ve been seen to take part in numerous profit-taking occasions. Now, the market is taking a look at main financial knowledge and upcoming occasions that embody PPI and CPI stories, as nicely as a speech from Fex chair Jerome Powell, which can have an effect on Bitcoin’s trajectory within the following weeks.

Also Read:

The offered content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.