The price of Bitcoin has continued to maneuver inside a consolidation vary since hitting a brand new all-time excessive in mid-March. This sluggish worth motion has been a supply of fear to most buyers, particularly when the premier cryptocurrency lately misplaced its assist on the $60,000 degree.

Interestingly, worth will not be the one Bitcoin metric that has cooled off for the reason that first quarter of the yr. Data analytics agency Santiment has revealed that on-chain exercise on the Bitcoin community has additionally slowed down over the previous few months.

How Historically Low On-Chain Activity Affects BTC Price

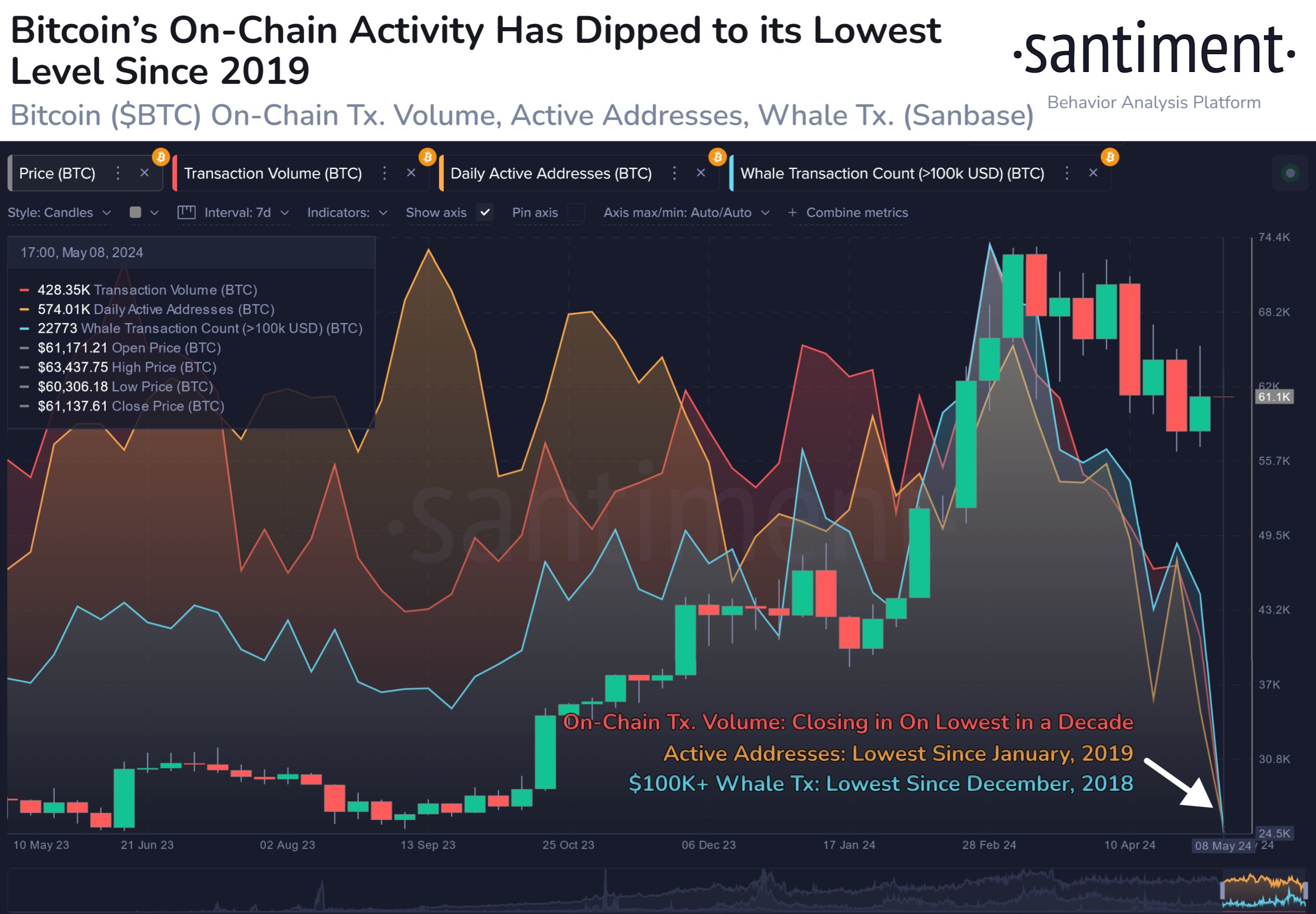

In a new post on the X platform, Santiment revealed that on-chain exercise on the Bitcoin community is approaching historic lows. This revelation is predicated on the noticeable downtrend in varied metrics, notably transaction quantity, every day lively addresses, and whale transaction rely.

Related Reading

According to the blockchain intelligence platform, buyers have been transacting much less with BTC for the reason that premier cryptocurrency hit a new all-time high price. As a consequence, Bitcoin’s on-chain exercise has dropped to its lowest degree since 2019.

Breaking down the metrics, Santiment discovered that transaction quantity on the pioneer blockchain is falling to its lowest previously decade. The information analytics agency defines transaction quantity as a metric that tracks the entire quantity of cash transacted for a given asset inside a timeframe.

What’s extra, Santiment talked about in its report that the variety of every day lively addresses, which measures the variety of distinct addresses that participated in a BTC transaction on any given day, has reached its lowest level since January 2019.

Source: Santiment/X

The blockchain intelligence platform additionally revealed that whale exercise has slowed down on the Bitcoin community. The variety of whale transactions (larger than $100,000) has fallen to the bottom level for the reason that finish of 2018, in response to Santiment’s information.

On the floor, the decline in on-chain activity looks like a worrying development and a symptom of an unstable market well being. Santiment, nonetheless, famous that this dip won’t essentially be related to imminent BTC worth dips – as seen previously weeks.

The analytics firm stated that the decline in on-chain exercise is extra indicative of “crowd fear and indecision” amongst merchants. Ultimately, this underscores the connection between the on-chain exercise and sentiment within the Bitcoin market.

Bitcoin Price At A Glance

According to data from CoinGecko, the value of Bitcoin sits simply above $60,770, with a mere 0.2% worth dip previously day.

Related Reading

Bitcoin worth continues to maneuver inside a variety | Source: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView