The crypto market has witnessed risky buying and selling these days, with all the main cryptos like Bitcoin, ETH, SOL, XRP, DOGE, SHIB, and others costs slipping over the previous few days. Meanwhile, the current market crash displays the continued bearish sentiment hovering over the market, whereas dampening the buyers’ confidence.

Although there’s a flurry of macroeconomic and different associated considerations, let’s discover a number of the potential causes behind crypto costs’ dip as we speak.

Why Is The Crypto Market Falling Today?

The broader crypto market has gone by means of tumultuous buying and selling to this point over the previous few weeks, over the hovering considerations of inflation, the Fed’s stance with their coverage charges, and different associated considerations. So, right here we discover the potential the reason why the crypto market is witnessing a downturn momentum as we speak.

Bitcoin ETF Outflows Trigger Crypto Market Dip

The cryptocurrency market witnessed a downturn as we speak, pushed by ongoing outflows from the U.S. Spot Bitcoin ETF. According to Farside Investors information, Bitcoin ETFs have skilled outflows for 3 days this week, contrasting with two days of inflows.

Over the final two days, the U.S. Spot Bitcoin ETFs registered a major outflow of $96 million, heightening investor apprehensions. However, this comes after a promising begin to the week, with a considerable influx of $217 million into the funding instrument, which has additionally fueled optimism within the crypto market.

Meanwhile, the predominant issue behind the outflow strain seems to be the persistent exodus from Grayscale GBTC, with over $146 million exiting previously two days alone. These consecutive outflows from Bitcoin ETFs and the continued Grayscale exodus have contributed to the prevailing detrimental sentiment within the crypto sector.

Inflation Concerns

Today’s crypto market dip is attributed to heightened inflation considerations following current financial information. For context, the University of Michigan’s shopper sentiment index plummeted from 77.2 in April to 67.4 in May, marking a six-month low and lacking expectations.

In addition, inflation expectations for the 12 months forward surged to three.5%, reaching a six-month excessive, whereas the five-year outlook rose to three.1%. Meanwhile, Federal Reserve officials’ cautious remarks additional fueled investor anxiousness.

As CoinGape Media reported earlier, Fed’s Lorie Logan highlighted vital upward inflation dangers, advocating for coverage flexibility and ruling out quick fee cuts. Simultaneously, Fed Governor Bowman emphasised the necessity for sustained coverage stability.

These developments have left buyers apprehensive in regards to the financial outlook, prompting a downturn within the crypto market as they search readability amid unsure monetary situations.

Also Read: Dogecoin (DOGE) Price Eyes ‘Golden Cross’, A Mega Rally ahead?

Anticipation of Next Week’s Economic Data

Investors are bracing for subsequent week’s financial information launch, inflicting a pause within the crypto market as we speak. With current bleak financial indicators impacting sentiments, anticipation looms over the U.S. Producer Price Index (PPI) and Core PPI information set to be unveiled on Tuesday, May 14, alongside Fed Chair Jerome Powell’s deal with.

Following this, the focus shifts to the U.S. Consumer Price Index (CPI) information and Core CPI information, in addition to U.S. retail gross sales information, scheduled for launch on Wednesday, May 15. Notably, these pivotal financial figures maintain vital weight for crypto market buyers, providing insights into the present financial panorama and inflationary pressures.

Meanwhile, as anticipation builds, market members are exercising warning, resulting in a short lived downturn within the crypto market as they await essential indicators to navigate future funding methods.

A Closer Look Into The Market Trends

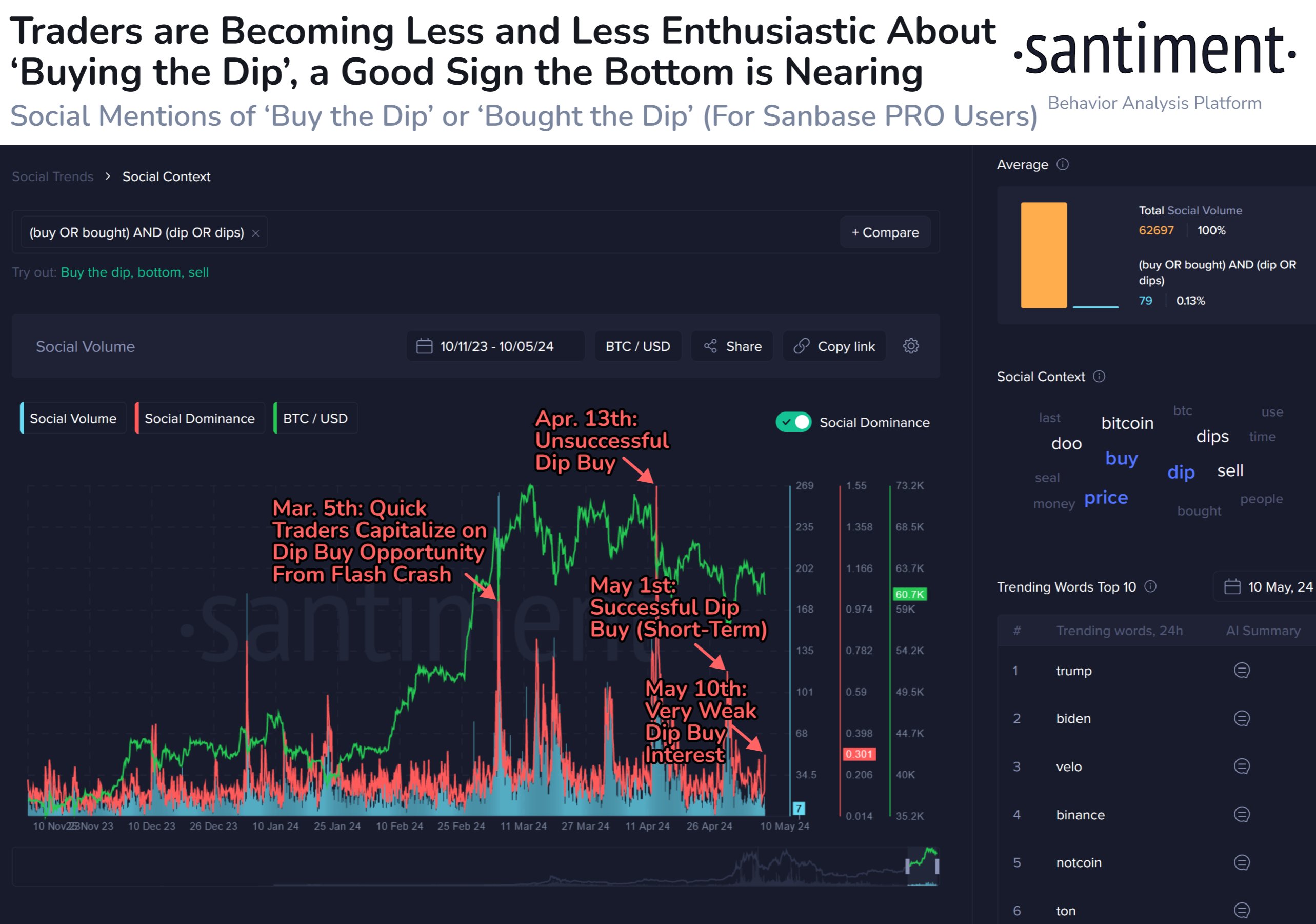

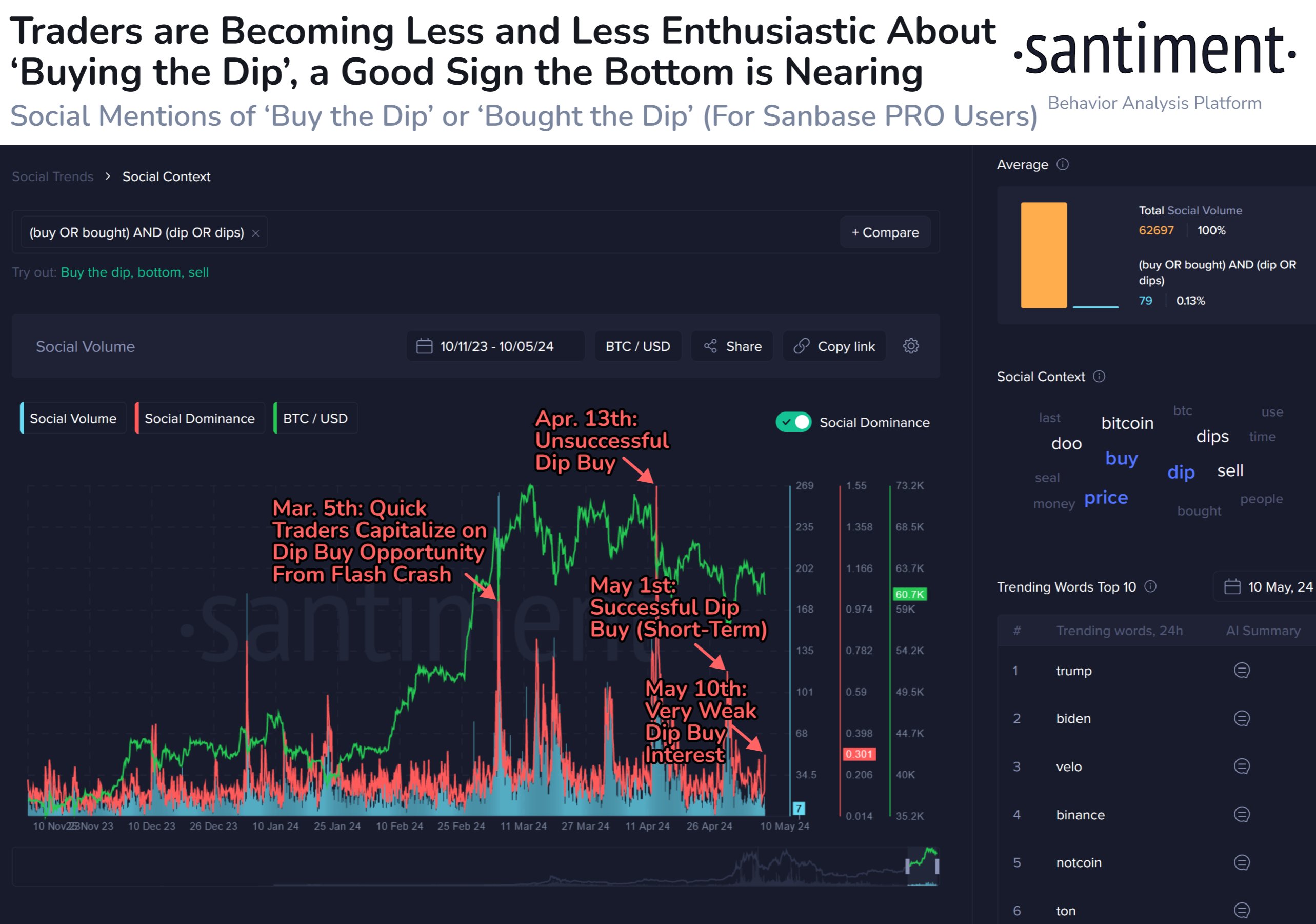

The current discussions over the crypto market dip have been additional intensified by the most recent report of Santiment. In a current X publish, Santiment stated that this downward pattern coincided with a regarding lack of enthusiasm amongst merchants to capitalize on the dip by means of the “buy the dip” technique.

Meanwhile, the report means that the prevailing sentiment amongst merchants signifies a insecurity, signaling that the cryptocurrency’s worth could also be nearing a backside. This hesitancy to purchase throughout the dip displays a broader sentiment of uncertainty amongst buyers, contributing to the downward strain on costs throughout the market.

On the opposite hand, CoinGlass reported a major surge in crypto liquidations, with 58,000 merchants going through liquidation, totaling $156.53 million within the final 24 hours. Notably, the biggest single liquidation occurred on Binance, involving the BTCUSDT pair, with a worth of $3.56 million.

Crypto Prices & Performance

The world crypto market fell 3.42% to $2.26 trillion as of writing, indicating the bearish sentiment hovering available in the market. At the identical time, the Bitcoin price slipped 3.26% and traded at $61,033.64, whereas the Ethereum price plunged 4.00% to $2,922.99.

Similarly, the Solana price famous a stoop of 5.65% to $145.72, whereas the XRP price plummeted 2.31% to $0.5058. The situation within the meme coin sector was additionally bearish amid the broader market retreat. The main meme coin, Dogecoin price fell 5.15% to $0.1445, whereas the Shiba Inu price decreased by 3.80% to $0.00002262.

Also Read: PEPE Investors Accumulate 650 Bln Pepe Coin, More Steam Left?

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.