The Bitcoin (BTC) value has skilled a major uptick, marking an almost 3% surge right this moment following a interval of sluggish buying and selling. Meanwhile, the current rally, after a protracted unstable market sentiment, precedes a main occasion: the expiry of 18,000 Bitcoin choices. Notably, the market individuals are intently watching the implications of this expiry on BTC’s value trajectory and the broader cryptocurrency market.

Market Analysis Ahead of Options Expiry

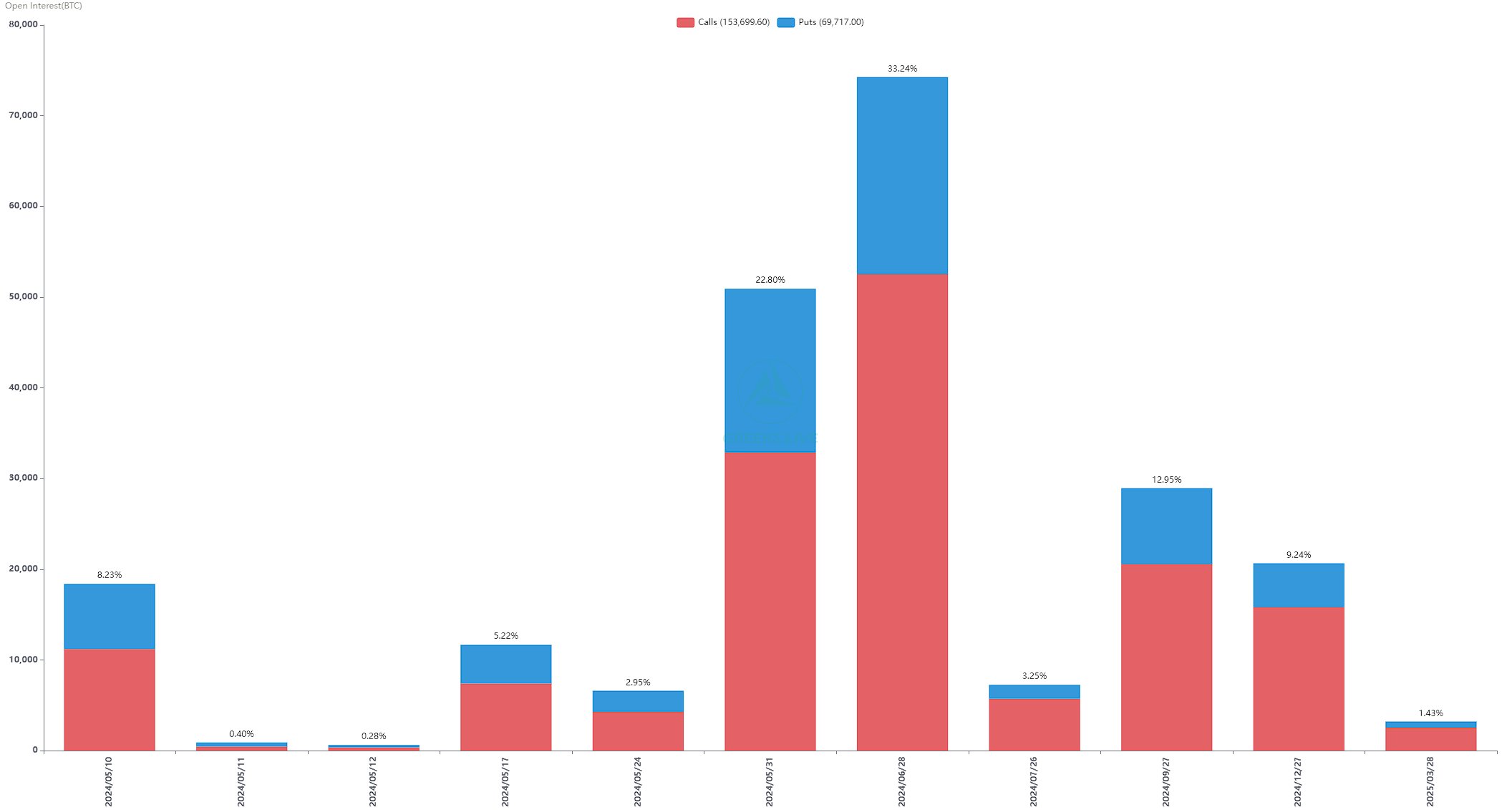

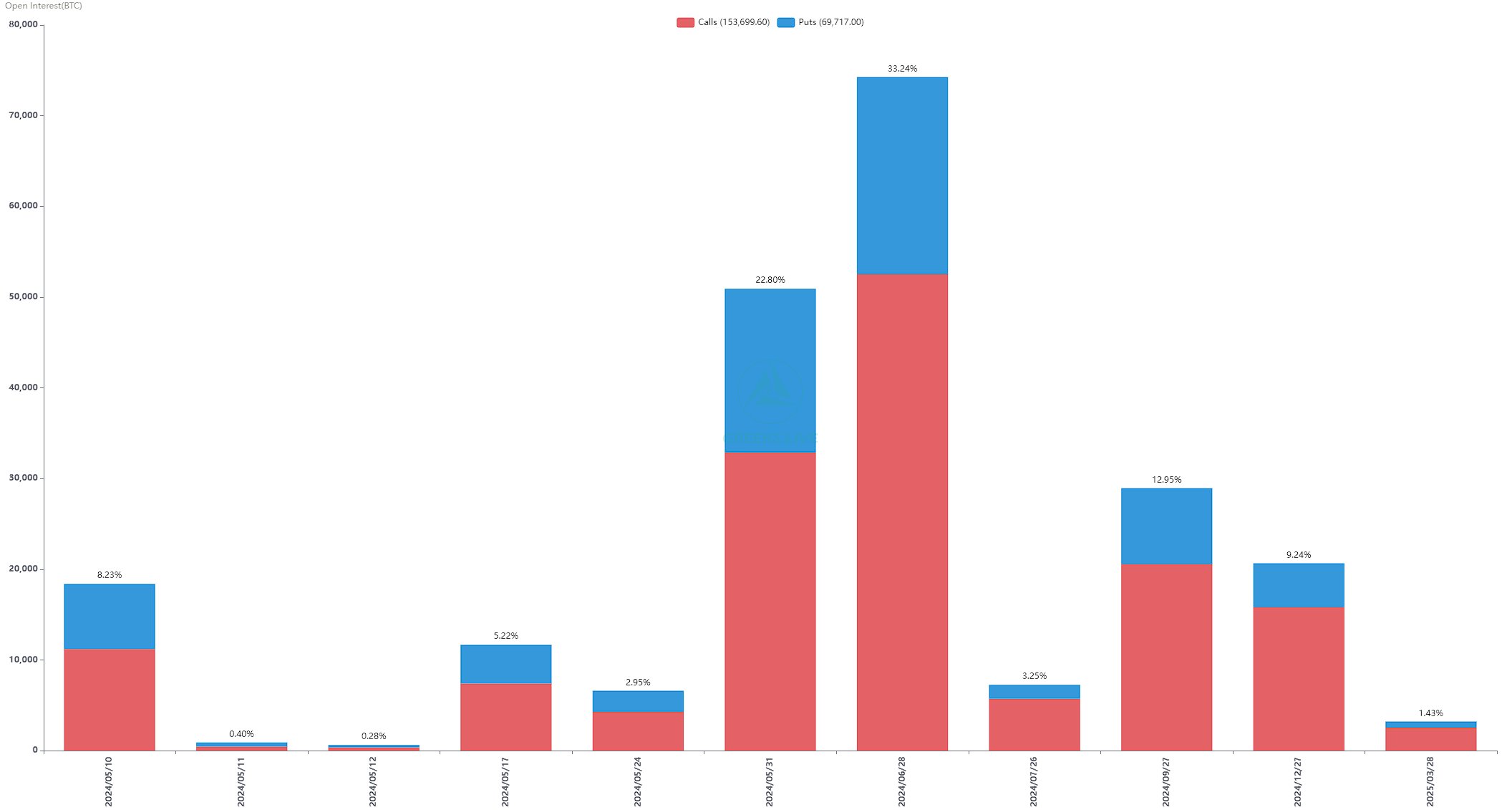

The current surge in Bitcoin costs has buyers’ consideration, following unstable buying and selling and forward of right this moment’s options expiry. Notably, As the market braces for the expiry of 18,000 Bitcoin choices, analysts at Greeks. stay to present insights into the present choices knowledge. With a Put Call Ratio of 0.64, a Maxpain level at $62,000, and a notional worth of $1.2 billion, anticipation is excessive concerning potential market actions post-expiry.

Meanwhile, the current weak spot in crypto markets, compounded by falling volumes and outflows from US BTC ETFs, has raised considerations. Despite a slight restoration in investor confidence due to lowering implied volatility (IV), uncertainties linger, significantly contemplating historic market traits in May.

While Bitcoin garners consideration, Ethereum (ETH) can also be in focus as 280,000 ETH choices are set to expire right this moment. With a Put Call Ratio of 0.74, a Maxpain level of $3,050, and a notional worth of $800 million, market individuals are intently monitoring ETH’s value dynamics alongside BTC.

Also Read: Dogwifhat (WIF) Price Shoots 13% Amid Whale Accumulation, More Steam Left?

Implications Amid Fund Outflows

Despite the upcoming choices expiry, each Bitcoin and Ethereum costs have rallied. In addition, this surge within the Bitcoin value comes regardless of stories of an $11.3 million outflow from US Spot Bitcoin ETFs on May 9. Notably, Grayscale’s ongoing exodus continues to weigh on the Bitcoin ETF flows.

However, as market individuals navigate these developments, the approaching hours post-options expiry will probably present readability on BTC and ETH’s short-term value trajectory. Traders stay vigilant, and ready to react to any vital market actions ensuing from this occasion.

According to CoinGlass knowledge, the Bitcoin Futures Open Interest (OI) soared 1.84% to 480.25K BTC or $30.28 billion right this moment. Simultaneously, the Ethereum OI famous an development of 0.58% to $10.76 billion on the similar time.

Meanwhile, the Bitcoin price soared 2.74% and traded at $62,946.19, whereas its buying and selling quantity from yesterday rose 8.08% to $26.04 billion. On the opposite hand, the Ethereum price rose 1.80% to $3,034.26 forward of the choices expiry.

Also Read: Kraken Fires Back At SEC Over Unregistered Securities Trading Claims

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.