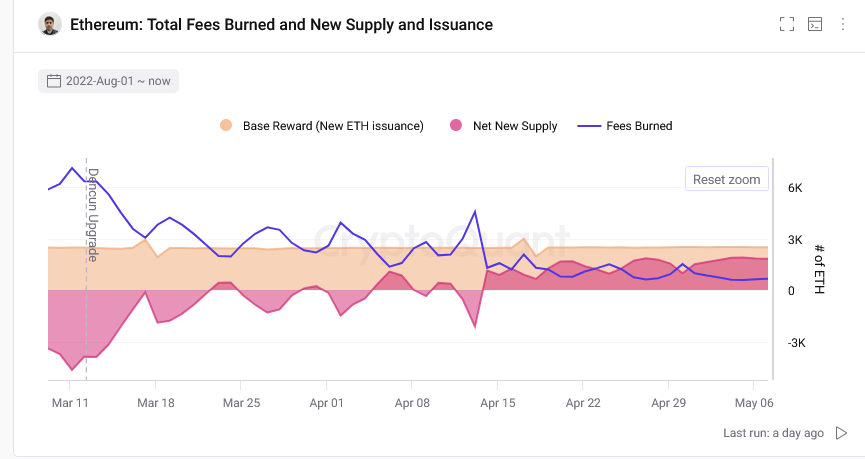

Researchers at CryptoQuant, a crypto analytics platform, are actually disproving the concept that Ethereum is “ultra-sound money,” particularly after activating the extremely anticipated Dencun Upgrade in mid-March.

Analysts observe that the arduous fork has slowed the variety of cash going to the “furnace.” Accordingly, ETH is now extra deflationary, contemplating the rising day by day provide over the previous weeks.

The Impact Of Dencun On Gas Fees

Analysts say the Dencun Upgrade was one of many main updates after The Merge. With Dencun, Ethereum builders launched proto-danksharding for extra environment friendly and low cost transaction processing, particularly by layer-2 platforms like Arbitrum.

Besides serving to scale back fuel charges for layer-2 options, the replace enhanced the mainnet scalability. Accordingly, the first layer might deal with extra transactions with out congestion or fuel charges spiking.

Though layer-2 fuel charges have drastically fallen, exercise on Arbitrum, Optimism, and Base have registered extra exercise. However, the issue with decrease fuel charges from layer-2 transactions, that are bundled and confirmed mainnet, means Ethereum is now growing fewer cash.

As such, ETH steadily turns into inflation after months of provide discount, reflecting the adoption of the mainnet and off-chain options.

The fee at which ETH turned deflationary pre-Dencun meant the “ultra-sound money” narrative was legitimate. Due to the quickly falling provide, ETH, like BTC or gold, might turn into a retailer of worth.

Ethereum Is Becoming Inflationary: Study

However, CryptoQuant information now paints a regarding image. A report discovered that shrinking fuel charges from layer-2 platforms interprets to decrease ETH being taken from provide.

This “structural shift” researchers found, signifies that ETH provide is now not lowering as quickly as earlier than. In their evaluation, they noted that in current days, the ETH provide has been rising on the quickest day by day fee for the reason that Merge.

At this tempo, if the speed of ETH burning continues to drop, Ethereum might now not be on monitor to turn into deflationary. It will probably be particularly so if exercise shifts, as has been the case, to competitors low-fee and scalable networks like Solana and Avalanche.

Falling Ethereum and Bitcoin costs will additional exacerbate the burn fee. Whenever costs crumble, on-chain exercise tends to contract sharply over time.

Feature picture from Canva, chart from TradingView