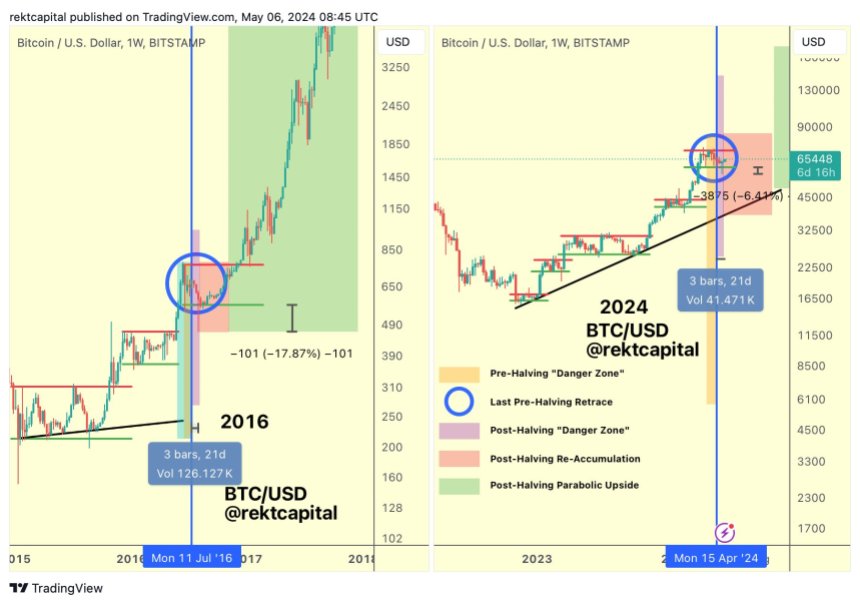

Well-known cryptocurrency analyst and dealer Rekt Capital has revealed an intriguing discovering relating to Bitcoin’s value development in a latest evaluation. His ground-breaking prognosis reveals that the crypto asset is mirroring historic value motion that happened throughout a bull cycle eight years in the past.

Similar Historical Price Tendency In Bitcoin

Rekt Capital asserted that the best way Bitcoin is reiterating a previous value development from a cycle 8 years in the past is superb. Given the magnitude of the 2016 bull cycle, BTC could possibly be poised for vital development within the upcoming months. During the 2016 bull cycle, BTC witnessed a notable development of practically 3,000%, following the conclusion of the Bitcoin Halving event.

Moving on, Rekt Capital drew consideration to his earlier put up relating to Bitcoin’s post-Halving motion, which he dubbed the Post-Halving Danger Zone. According to the analyst, the digital asset is at present caught up on this zone.

(*8*)

He additional famous that Bitcoin has veered to the damaging beneath the present Re-Accumulation Range Low, repeating the sample that started in 2016. In 2016, the transfer beneath the re-accumulation vary was about 17%. However, this divergence in 2024 is down by 6%.

Rekt Capital beforehand affirms in 2016, about 21 days after the Halving, Bitcoin noticed a prolonged -11% decline earlier than transitioning towards the upside.

Thus, if there needs to be draw back volatility on this cycle across the Re-Accumulation Range Low, 2016 knowledge signifies that BTC might flip to the upside within the subsequent 10 days, contemplating the put up time.

Even although the Post-Halving “Danger Zone” ends within the upcoming days, significantly 4 days from now, Rekt Capital said that 2016 knowledge proves that there could also be some damaging volatility on the $60,600 Range Low within the interim.

Pre-Halving Danger Zone For BTC

Notably, the skilled additionally recognized a Danger Zone earlier than the occasion, the place earlier Pre-Halving retraces have at all times began. According to Rekt Capital, pre-Halving retracements have traditionally been seen in Bitcoin between 14 and 28 days earlier than the occasion, and this cycle hasn’t been any totally different to date.

He said that Bitcoin noticed its first pre-Halving retrace of -18% about 30 days earlier than the Halving, whereas in 2016, the pre-Halving retrace began 28 days earlier than the occasion, suggesting BTC might transfer in the identical course as that of 2016. Due to this, Rekt Capital is assured {that a} potential hazard zone might happen after Halving.

However, the retracement from the present all-time excessive has now confirmed to be deeper and longer than previous retracements, spanning a number of weeks. Consequently, the skilled predicted a excessive likelihood that Bitcoin costs could have reached a backside.

At the time of writing, the worth of Bitcoin was seeing a optimistic sentiment, rising by 0.43% to $64,126 prior to now day. Both its market cap and buying and selling quantity have elevated by 0.50% and 24.43%, respectively, within the final 24 hours.

Featured picture from iStock, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site solely at your personal danger.