Crypto alternate Kraken’s subsidiary is a serious beneficiary of the spot Bitcoin exchange-traded funds (ETF) within the United States and Hong Kong, as per a modern report by Bloomberg. The firm predicts $1 billion of belongings below administration (AUM) in spot Bitcoin and Ether ETFs in Hong Kong, in addition to different markets to see the itemizing of spot crypto ETFs.

Kraken’s CF Benchmarks Gains 50% of Crypto Benchmarking Market

CF Benchmarks, a subsidiary of crypto alternate Kraken, noticed a large improve in demand for its indices amid a boon in spot Bitcoin ETFs. The United States and Hong Kong are main monetary hubs bringing publicity of already established institutional buyers base to Bitcoin.

The firm stated it represents virtually 50% market share within the crypto benchmarking market on account of launch of spot Bitcoin ETFs within the U.S. in January and in Hong Kong final yr. It supplies knowledge for about $24 billion in crypto ETFs, primarily BlackRock’s iShares Bitcoin ETF with $16.2 billion AUM.

CF Benchmarks expects its income to virtually double this yr, as per the rising demand for spot Bitcoin ETF. The final obtainable income knowledge signifies it reached £6 million ($7.5 million) in 2022. In addition, the agency plans to increase headcount by round a 3rd to greater than 40. Kraken acquired CF Benchmarks in 2019.

South Korea and Israel Are Next in Crypto ETFs Race

CF Benchmarks chief govt officer Sui Chung sees them working with crypto ETFs issuers in South Korea and Israel subsequent. South Korea has one of many largest crypto customers, with excessive buying and selling volumes impacting crypto costs.

“South Korea is a market where ETFs have become the wrapper of choice for long-term savings. It is also a market where digital assets have gained a high degree of adoption,” stated Sui Chung.

The firm expects Hong Kong-based spot Bitcoin and Ether ETFs to witness $1 billion in funds below administration by year-end.

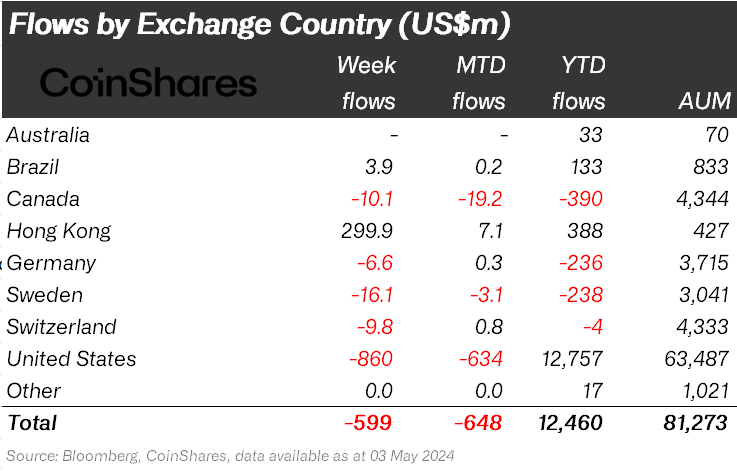

CoinShares head of analysis James Butterfill revealed Hong whereas different markets undergo outflows from digital asset merchandise, Hong Kong noticed $300 million in inflows to date this week.

Also Read:

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.