A bull flag just lately fashioned on the Bitcoin chart, elevating the potential for a development reversal quickly sufficient because the flagship crypto makes vital strikes to the upside. This crypto analyst means that the crypto may rise to as high as $100,000 when it makes that transfer.

Bitcoin’s Bull Flag Suggests More Upside

Denis Baca, Head of Product at Zivoe Finance, noted that the bull flag formation on Bitcoin’s day by day chart traditionally means that the crypto token is primed for extra upsides. He added that the bullish sample is “shaping up nicely” and that Bitcoin may doubtlessly shoot up towards $100,000 as soon as the declining quantity picks up.

However, Baca additional steered that Bitcoin could drop below $60,000 earlier than it makes such a parabolic transfer. He alluded to how the crypto token traditionally retests the assist degree of the 20-week SMA (small shifting common) in May. This may trigger Bitcoin to drop to $56,000, he claimed.

Total crypto market cap at the moment at $2.2 trillion. Chart: TradingView

Baca opined that such worth dips may very well be “healthy” for Bitcoin earlier than it experiences a reversal. He elaborated that these dips “offer solid buying opportunities,” which may assist spark Bitcoin’s move to record highs.

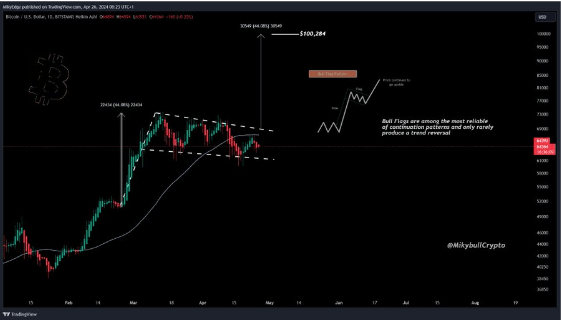

Crypto analyst Mikybull Crypto additionally shared his ideas on what this bullish sample may imply for Bitcoin. On his half, he steered that the formation additional proves the continuation of Bitcoin’s bull run and {that a} bearish reversal was unlikely.

#Bitcoin on a day by day chart forming a bull continuation sample.

According to Wyckoff’s regulation of trigger and impact “the longer the consolidation, the more explosive the markup will be” pic.twitter.com/ArH0lNnyc2

— Mikybull 🐂Crypto (@MikybullCrypto) April 26, 2024

He additionally hinted that the subsequent leg up may very well be huge as he alluded to Wyckoff’s regulation of trigger and impact, which states that “the longer the consolidation, the more explosive the markup will be.”

Bitcoin Needs A Catalyst To Spark This Upward Trend

Andrey Stoychev, Head of prime brokerage at Nexo, remarked that any potential worth rise for Bitcoin is unlikely to be realized without a catalyst. He famous that the flagship crypto token has managed to construct resilient assist at $64,000, however with none catalyst, it can merely proceed to commerce across the $67,000 vary.

It is value noting that the Spot Bitcoin ETFs, which beforehand served as a significant catalyst to Bitcoin’s worth surges, have just lately suffered from declining demand. They have additionally experienced significant net outflows this month, resulting in a wave of Bitcoin sell-offs from the fund issuers to satisfy redemptions.

Despite this, Stoychev is constructive that Bitcoin gained’t drop beneath $60,000. He predicts that the one factor that may trigger Bitcoin to retrace to such a degree is that if high interest rates are maintained longer than anticipated, as this will have an effect on sentiment towards crypto belongings.

At the time of writing, Bitcoin is buying and selling at round $62,900, down over 2% within the final 24 hours, in keeping with data from CoinMarketCap.

Featured picture from Pixabay, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual threat.