Almost $6.3 billion of BTC choices are set to run out on April 26, signaling potential draw back value volatility that might see Bitcoin fall to the $61,000 mark. Bitcoin and crypto market restoration is predicted by merchants after the crypto market expiry, probably stopping profit-taking on draw back hedges.

Bitcoin Price Recovery After Options Expiry?

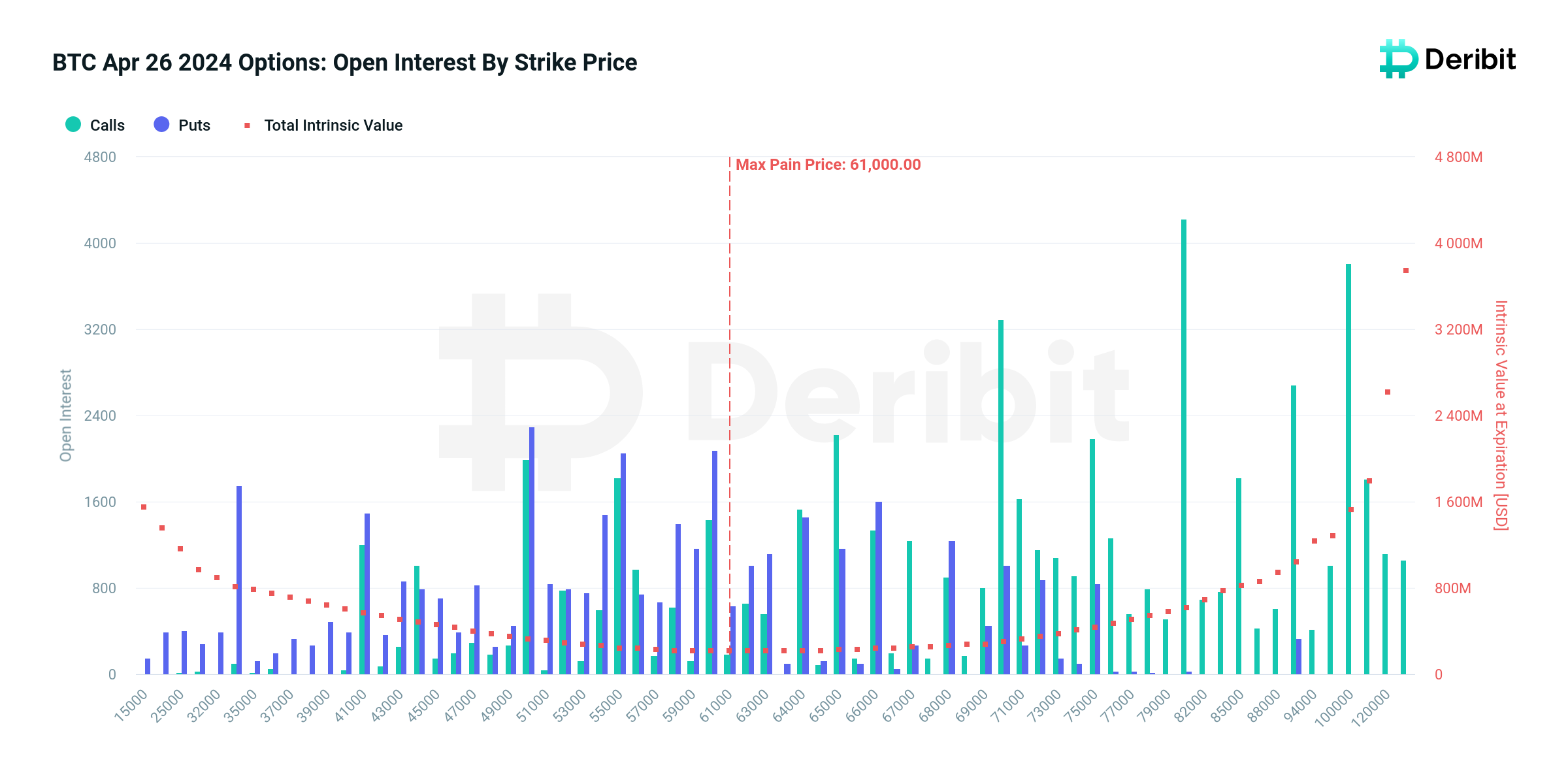

Over 96k Bitcoin choices of $6.2 billion in notional worth are set to run out on Deribit on April 26. The put-call ratio is 0.68, indicating an increase in put choices just lately as month-to-month expiry approaches. The max ache level is $61,000, under the present value. The market can anticipate enormous volatility with a pullback in value anticipated on the expiry day.

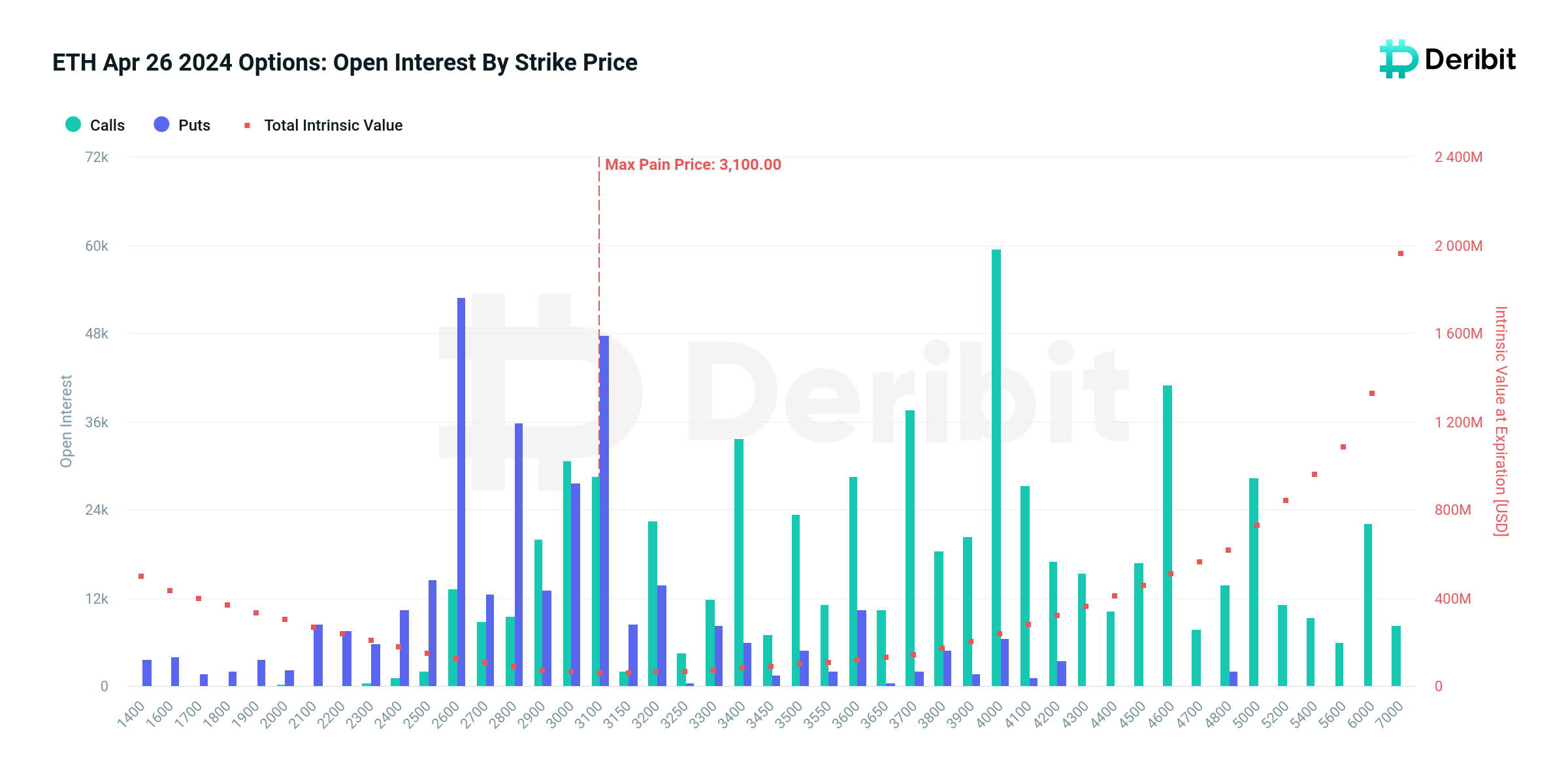

Moreover, 990k Ethereum choices of notional worth $3.1 billion are set to run out, with a put-call ratio of 0.51. The max ache level is $3,100, with the ETH price presently buying and selling above the max ache level at additionally larger than the present value of $3,141.

Deribit revealed that realised volatility has surged as BTC Volatility Index (DVOL) noticed a pointy enhance as crypto choices expiry comes close to.

Options professional Greekslive mentioned low crypto market quantity this week pushed Bitcoin and Ethereum costs to commerce close to help ranges. This weak point available in the market brought about important declines in implied volatility (IV) throughout all main phrases, with Dvol down as a lot as 15% for the reason that halving. The lack of volatility available in the market led to promoting of huge variety of choices.

Moreover, market sentiment stays subdued attributable to latest spot Bitcoin ETF outflow. The probability for BTC to return to its all-time highs is extraordinarily low because it might face extra resistance.

Also Read: 5 Reasons To Buy & Hold Pepe Coin Right Now

Arthur Hayes Predicts Crypto Market Recovery

BitMEX co-founder Arthur Hayes reveals a significant bullish sign for the crypto and inventory markets. As macro elements have been the first causes behind a drop in sentiment within the crypto market just lately, Hayes revealed tax receipts from US residents added $200 billion to the Treasury General Account (TGA) of the U.S. Treasury Dept and the subsequent steps can convey a restoration within the markets.

BTC price jumped 1% prior to now 24 hours, with the value presently buying and selling at $64,302. The 24-hour high and low are $62,783 and $65,275, respectively. Furthermore, the buying and selling quantity has elevated barely within the final 24 hours.

The markets are additionally eyeing the Fed’s most popular measure to gauge inflation PCE inflation launch at present for additional steering on value path within the subsequent few weeks. The annual PCE charge is estimated to elevated for a second straight month to 2.6% from 2.5% whereas the annual core PCE inflation probably fell to 2.6%, the bottom in three years, from 2.8%.

Also Read:

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.