In the crypto market, latest evaluation utilizing suggests {that a} vital majority of altcoins are in a purchase zone.

This presents a possible alternative for traders searching for favorable entry factors.

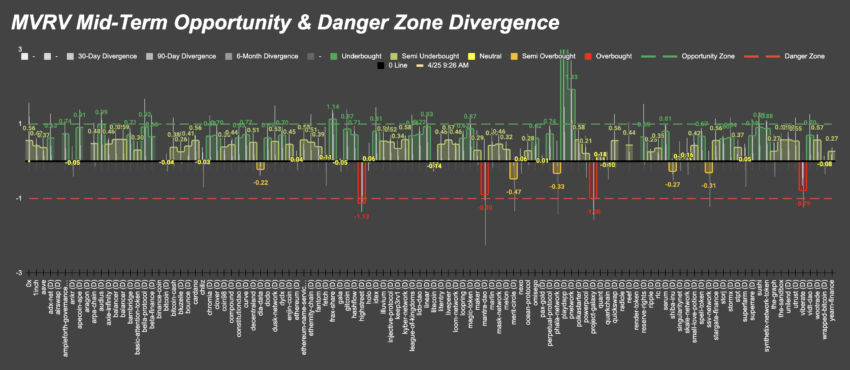

Most Altcoins Are in History Buy Zone

The Market Value to Realized Value (MVRV) ratio compares the market capitalization of a cryptocurrency to its realized capitalization.

Market capitalization refers back to the complete worth of all cash in circulation, calculated by multiplying the present worth of a crypto by the whole variety of cash. Realized capitalization, however, values every unit of crypto on the worth it was final transacted, offering a nuanced view of the cash invested over time.

This differentiation is important. While market capitalization will be inflated by speculative buying and selling, realized capitalization represents a grounded evaluation of an asset’s true worth. A low MVRV ratio signifies that the worth of a crypto could be undervalued relative to the precise quantity of capital invested in it. Therefore, it suggests a possible buy signal for savvy investors.

Read extra: 7 Hot Meme Coins and Altcoins that are Trending in 2024

According to blockchain analytics platform Santiment, over 85% of altcoins are at the moment positioned in a “historic opportunity zone.” This evaluation relies on the MVRV ratios calculated from collective returns of wallet holdings over various time frames.

“It may be justified to buy while there is growing fear seeping in from the crowd after all of these market cap dips,” Santiment noted.

These Are the Altcoins to Watch

Some of the most undervalued altcoins embody Dego Finance (DEGO), Bella Protocol (BEL), and 0x Protocol (ZRX). Here is the complete record of notable altcoins, all suggesting appreciable undervaluation in accordance with the most recent information.

| Asset | MVRV Ration (30D) |

| Dego Finance (DEGO) | -37.01% |

| Bella Protocol (BEL) | -31.69% |

| 0x Protocol (ZRX) | -29.60% |

| Reserve Rights (RSR) | -29.02% |

| Dusk (DUSK) | -28.18% |

| IDEX (IDEX) | -27.33% |

| Frax Share (FXS) | -26.37% |

| Gitcoin (GTC) | -26.36% |

| Audius (AUDIO) | -26.32% |

| ApeCoin (APE) | -26.10% |

| SushiSwap (SUSHI) | -24.77% |

| AdEx (ADX) | -24.31% |

| VIDT DAO (VIDT) | -23.94% |

| Ethernity (ERN) | -23.92% |

| QuickSwap (QUICK) | -23.80% |

| Beta Finance (BETA) | -23.72% |

| League of Kingdoms Arena (LOKA) | -23.60% |

| Linear Finance (LINA) | -23.43% |

| Chromia (CHR) | -23.24% |

| Treasure (MAGIC) | -23.21% |

| Bitcoin Cash (BCH) | -22.11% |

| StormX (STMX) | -22.06% |

| StaFi (FIS) | -21.56% |

| Synthetix (SNX) | -20.87% |

| SuperRare (RARE) | -21.44% |

| Ampleforth Governance Token (FORTH) | -20.46% |

For traders, this might signify a vital second to consider diversifying portfolios or coming into new positions at a decrease danger. However, it’s important to conduct thorough analysis. One should take into account different market components and private funding targets earlier than making any monetary selections.

Disclaimer

In line with the Trust Project pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. Always conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.